Bitcoin (BTC) renewed momentum in Could 2025, surpassing 14% within the final 30 days, simply 6.3% under the important thing $100,000 mark. The plain demand for Bitcoin behind worth motion has been constructive for the primary time since late February, indicating a change in conduct on the chain.

Nevertheless, contemporary inflow, notably from US-based ETFs, means that institutional convictions haven’t but returned to full, as they’re suppressed in comparison with 2024 ranges. In accordance with MEXC COO Tracy Jin, if present circumstances apply, the summer season gathering for $150,000 is believable and feelings change into more and more bullish.

The obvious demand for Bitcoin is constructive, however a contemporary inflow remains to be missing

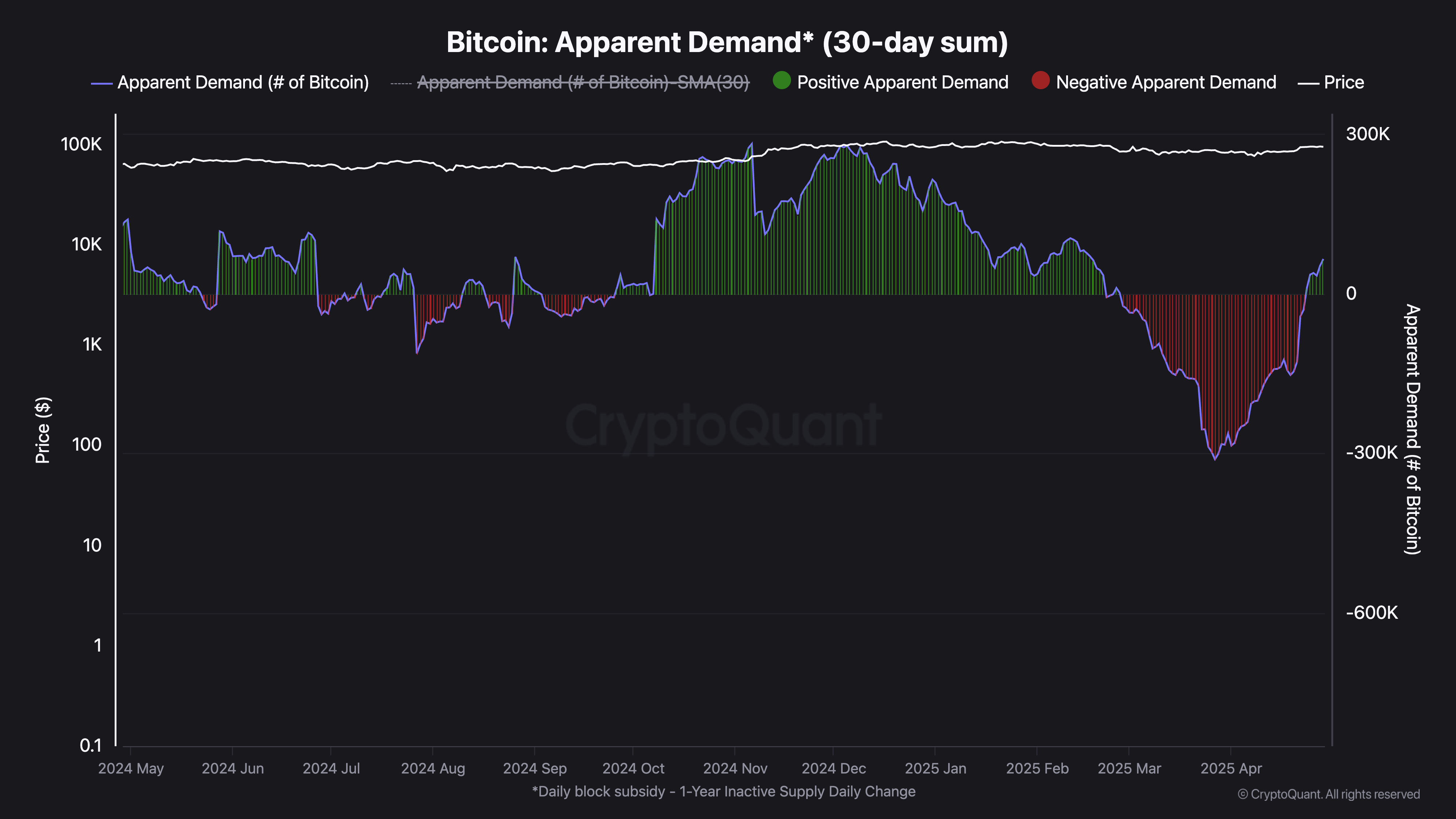

Clear demand for Bitcoin has proven clear indicators of a restoration just lately, rising to 65,000 BTC within the final 30 days. This marks a sudden rebound from the trough on March twenty seventh. This has outlined a transparent demand as a internet 30-day holding change throughout all investor cohorts, attaining a extremely adverse degree of -311,000 BTC.

Obvious demand displays an aggregated stability shift throughout the pockets, offering perception into whether or not capital is in or ending Bitcoin community.

Present demand ranges are properly under the earlier peak in 2024, however a significant inflection level occurred on April twenty fourth.

Obvious demand for Bitcoin. Supply: Cryptoquant.

Regardless of this enchancment, the broader demand momentum stays weak.

The dearth of steady new inflow suggests that almost all latest accumulation could also be pushed by present holders slightly than getting into the market.

For Bitcoin to launch a sustainable rally, each the plain demand and demand momentum should present constant and synchronized progress. Till that alignment happens, present stabilization might not help robust or long-term worth breakouts.

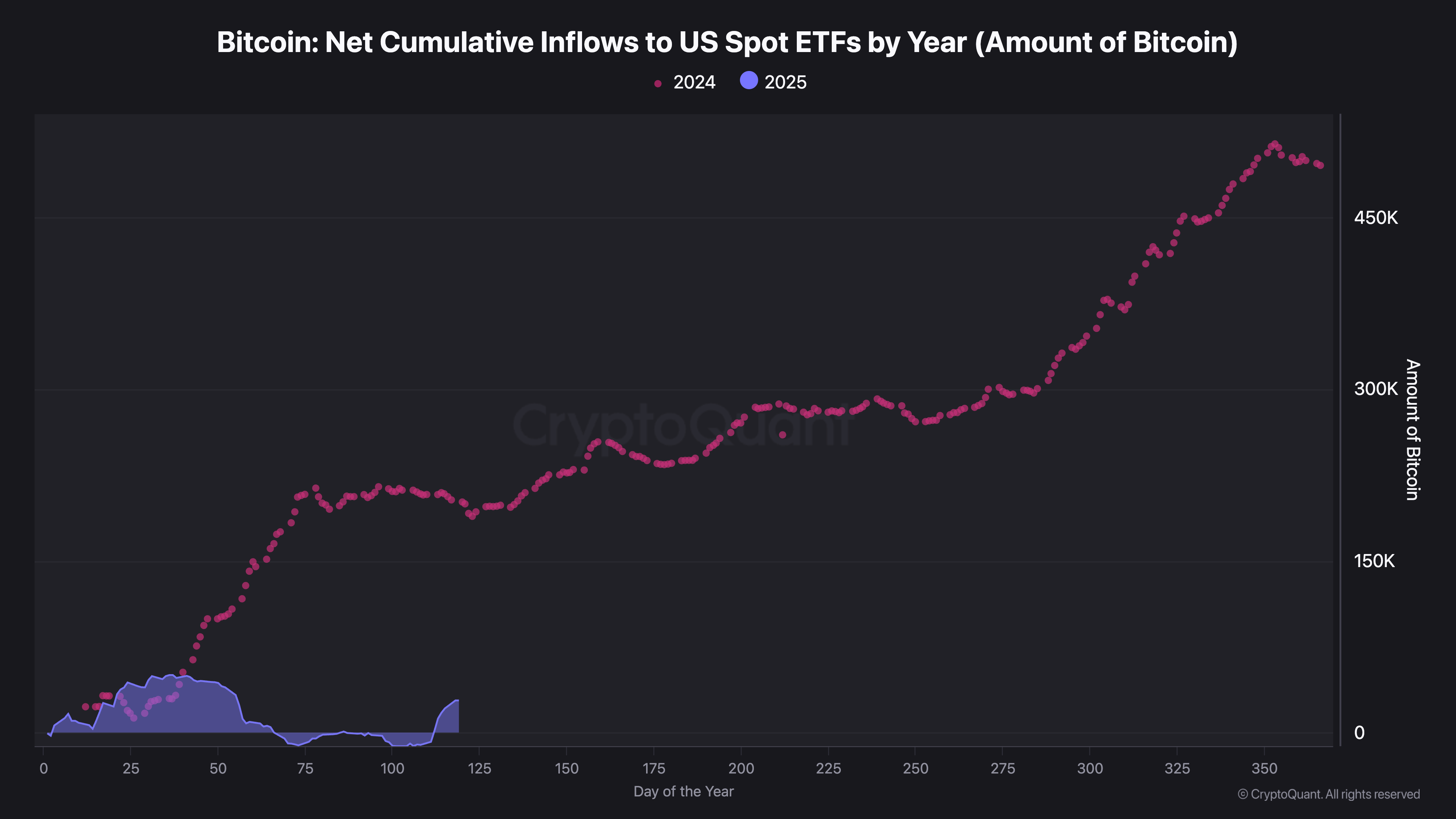

US Spot Bitcoin ETF Inflows are nonetheless properly under the 2024 degree

Bitcoin purchases from US-based ETFs have remained roughly flat since late March, fluctuating between each day internet flows from -5,000 to +3,000 BTC.

This exercise degree is in stark distinction to the highly effective inflow seen in late 2024, when each day purchases continuously exceeded 8,000 BTC and contributed $100,000 to the primary Bitcoin rally.

To date, in 2025, BTC ETFs collectively amassed a internet complete of 28,000 BTC final yr, properly under the over 200,000 BTC they bought at this level.

This decline marks a slowdown in institutional demand, which is traditionally vital in driving key worth actions.

Bitcoin: Web cumulative inflows to us discover ETFs annually. Supply: Cryptoquant.

There are early indicators of modest rebounding, and ETF inflow has been starting to rise just lately. Nevertheless, present ranges should not sufficient to gas sustained uptrends.

ETF actions are sometimes seen as representatives of institutional convictions, and a noticeable enhance in purchases may point out new confidence in Bitcoin's medium-term orbit.

Till these influxes come into impact, broader markets might battle to generate the momentum wanted for long-term gatherings.

With momentum positive aspects regardless of macro strain, Bitcoin is approaching $100,000

Bitcoin costs have risen by greater than 14% within the final 30 days, rebounding strongly after falling under $75,000 in April.

This new momentum is as BTC demonstrates relative resilience amid wider macroeconomic volatility and policy-driven strain, together with Trump's tariff measures that weighed dangerous property.

The crypto market as a complete feels an impression, however Bitcoin seems to be barely indifferent, indicating that it’s much less delicate to those exterior shocks than different digital property.

Bitcoin worth evaluation. Supply: TradingView.

BTC is at present solely 6.3% under the $100,000 mark, remaining under the $17% mark, leaving it at a possible transfer to $110,000. Sentiment is as soon as once more constructive, in line with Tracy Jin, COO of MEXC.

“Past quick worth motion, the rising institutional urge for food and decreased provide mechanisms illustrate the background of macroeconomic uncertainty and show the structural modifications within the position of Bitcoin in world monetary markets. BTC is used to hedge in opposition to inflation and Fiat-based monetary fashions.

In accordance with Gin, the summer season rally for $150,000 is believable. She harassed that the $95,000 vary is more likely to be the launch level for a definitive brewing breakout that exceeds $100,000 sooner or later.

” If world commerce tensions proceed to stabilize and institutional accumulation continues, summer season rallies to $150,000 may very well be believable, and by 2026 may attain $200,000. Total, we will see inventory index progress, notably on Friday.