Ethereum (ETH) has grown greater than 10% over the previous seven days because the market exhibits indicators of latest exercise. Nevertheless, key technical indicators reveal a mixture of energy in tendencies from consumers and weakening of cautious optimism.

ETH is at the moment combating a crucial zone of resistance that may outline whether or not the rally will proceed or fade. With momentum nonetheless weak, it could possibly be a decisive month for Ethereum's subsequent main transfer.

Ethereum tendencies weaken sharply when bears are close by

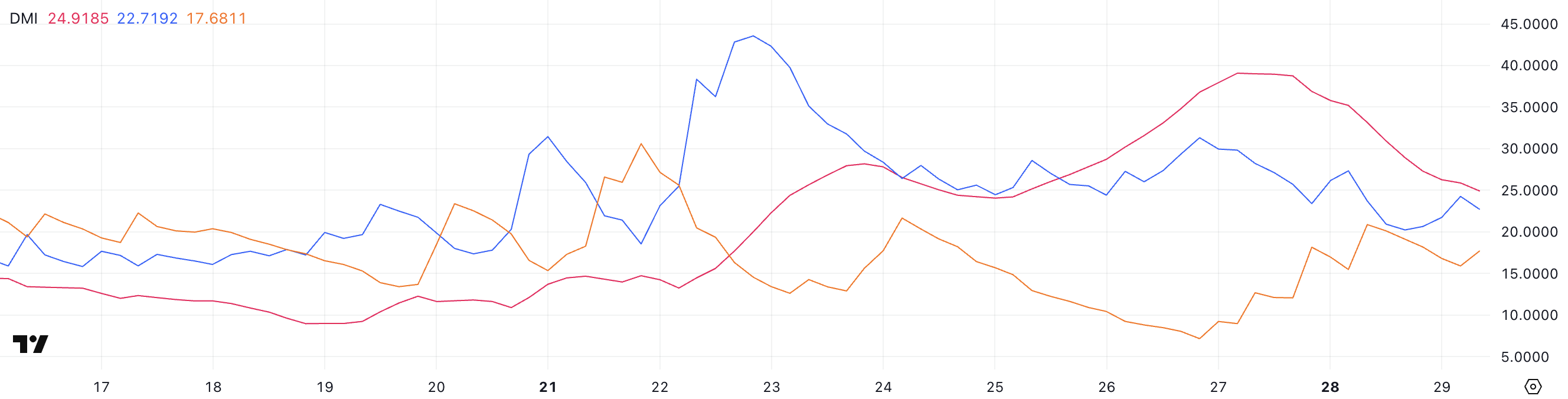

Ethereum's DMI chart exhibits ADX is at the moment at 24.91, a pointy drop from 39 two days in the past. ADX, or the typical directional index, measures the depth of a pattern, whether or not rising or falling.

Generally, ADX reads above 25 present a powerful pattern, whereas values beneath 20 counsel that the market is in a interval of buying and selling that’s sure to weak point or vary.

The sudden drop in ADX signifies that Ethereum's current momentum is shortly shedding its energy. With out new buying and selling pressures, ETH might stay caught in a extra unstable, horizontal sample within the quick time period.

ETH DMI. Supply: TradingView.

Then again, directional indicators present clear shifts. Monitoring bullish stress +DI fell to 22.71, down three days in the past and from 31.71 yesterday, from 27.3.3.

In distinction, -DI rose from simply 7.16 to 17.68 from 15.64 three days in the past and yesterday. Yesterday, the hole between consumers and sellers was nearly closed, suggesting that +DI is 20.91 and 20.1 at -DI, with sellers nearly regaining market management.

This weakened momentum and the energy of the pattern, which reduces the danger of decreasing Ethereum costs, if consumers can't adhere to crucial ranges. Nevertheless, if the Bulls can maintain the bottom and regain momentum, ETH might nonetheless make one other try at restoration.

ETH RSI climbs after a pointy drop: Will restoration be retained?

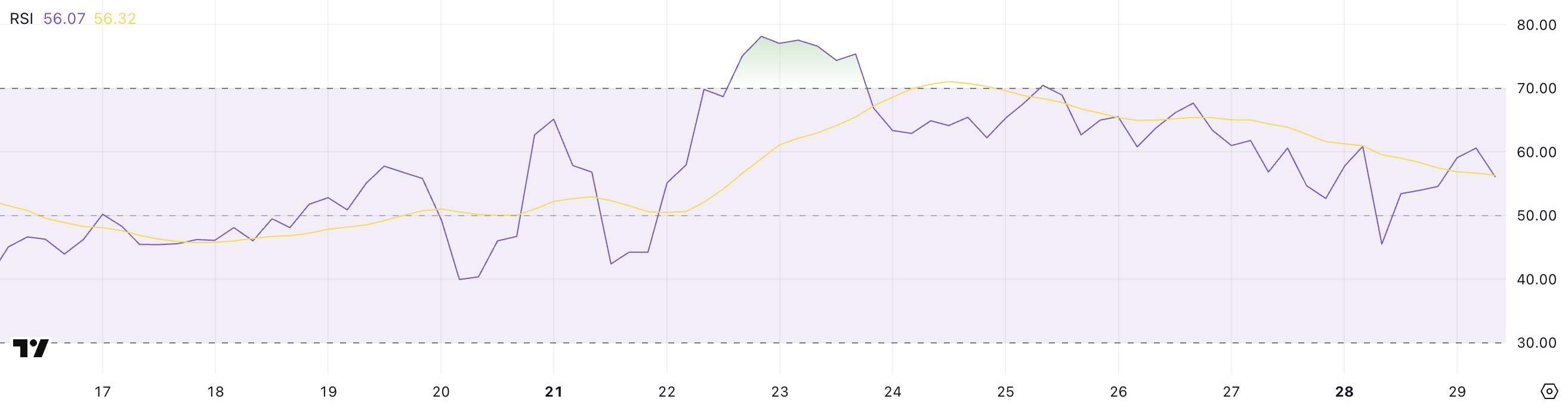

Ethereum's RSI at the moment sits at 45.5 to 56 a day in the past after reaching 70.46 4 days in the past. The relative energy index (RSI) is a momentum index that measures the pace and magnitude of worth motion.

Sometimes, RSIs above 70 counsel that belongings could also be over-acquired and pullbacks could also be required, whereas RSIs beneath 30 point out situations of over-selling and potential rebounds.

Measurements between 30 and 70 are thought of impartial, with a stage of about 50 usually informing the market at resolution factors. Ethereum's RSI's sharp swing over the previous few days displays current unsettling emotions about ETH.

eth rsi. Supply: TradingView.

As soon as the RSI returned to 56, Ethereum regained momentum after immersing itself in impartial territory. Readings over 50 are barely bullish, suggesting that consumers have begun to reaffirm some extent of management, though not overwhelming.

If RSI continues to rise in direction of 60 or later, it might probably present a brand new push to the highest of ETH costs.

Nevertheless, as soon as momentum stalls once more and the RSI retreats, the restoration will lose steam and counsel that Ethereum can return to a wider integration or correction stage.

Ethereum fights crucial resistance when breakouts and breakdowns are on the horizon

Ethereum Worth has tried a number of makes an attempt over the previous few days to interrupt resistance ranges for $1,828. If ETH can decisively break and maintain this stage, you possibly can open the door and improve your momentum.

The subsequent main objective is $1,954, and if bullish momentum stays robust, additional rally to $2,104 could possibly be rolled out. Ethereum was in a position to in the end take a look at $2,320 with an much more aggressive uptrend, marking a major bullish growth.

These ranges are key to watching as they will outline the energy and sustainability of breakouts over the subsequent few days.

ETH worth evaluation. Supply: TradingView.

On the draw back, if Ethereum fails to take care of its present stage and the pattern reverses, the primary vital help to look at is $1,749. A break beneath that might result in a transfer to $1,689.

As gross sales pressures intensify, ETH might additional lengthen the downtrend, with key help ranges coming at $1,537 and $1,385.

Shedding these ranges exhibits a deeper correction, suggesting that current restoration makes an attempt are short-term earlier than a longer-term bearish section enters.