The most important Altcoin ETH has been bucking the broader market droop over the previous 24 hours, recording a modest revenue of round 1%. At press time, the cash commerce for $1,842.

This comes as the principle momentum metric (relative to Taker's purchasing and gross sales) to the very best degree in 30 days.

Merchants look upwards at ETH as they purchase stress and builds

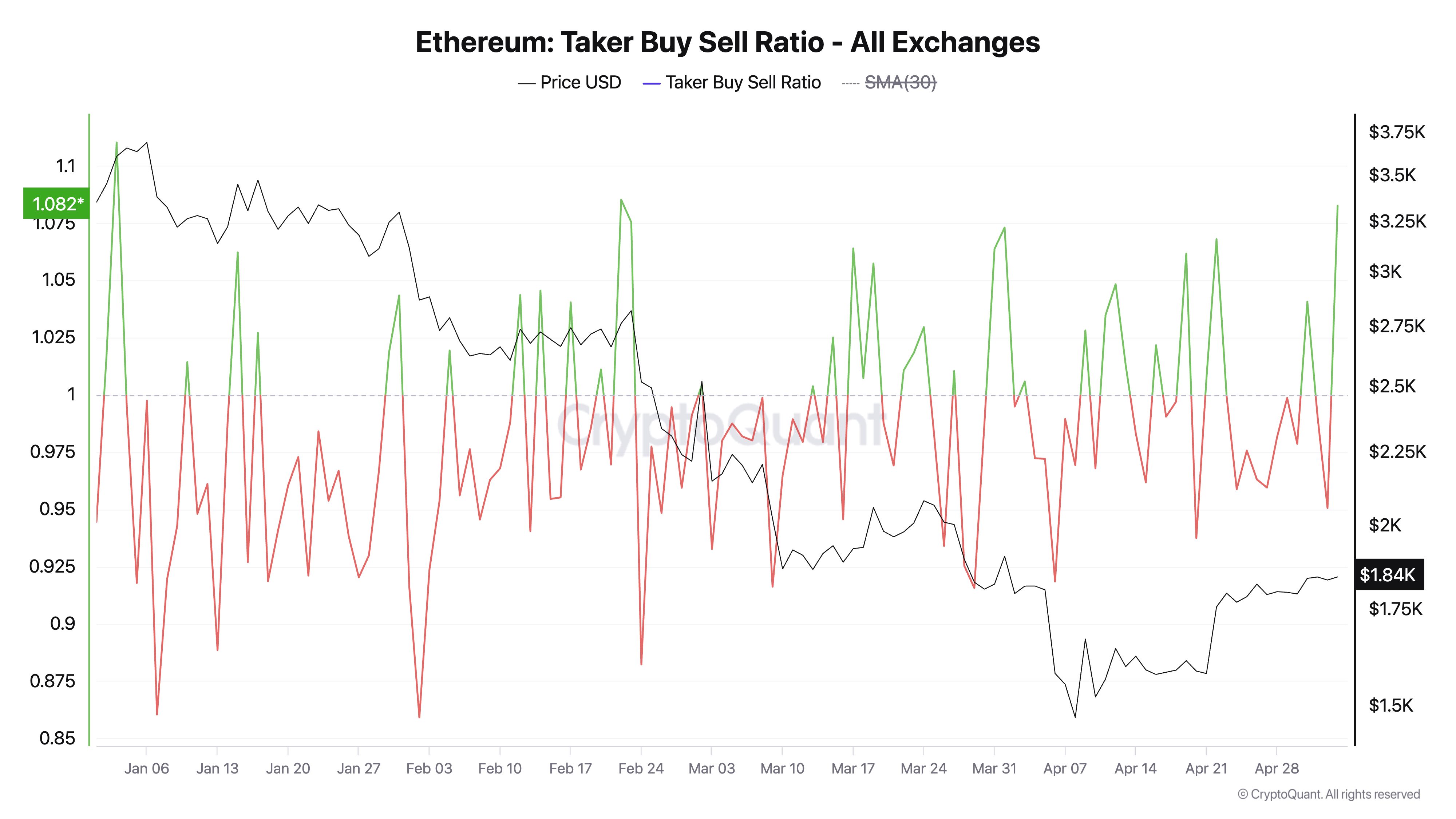

Based on Cryptoquant, Eth's Taker-Purchase-Promote ratio is presently at 1.08, the very best since early April.

Ethereum Taker shopping for and promoting ratio. Supply: Cryptoquant

This metric measures the ratio of ETH's futures market shopping for and promoting. Values above 1 recommend that extra merchants are shopping for ETH contracts extra aggressively than promoting, whereas values beneath 1 point out dominant gross sales stress.

At 1.08, ETH Taker's purchasing and gross sales ratio is clearly leaning in purchaser favor, reflecting a rise in confidence amongst merchants that costs may proceed to rise.

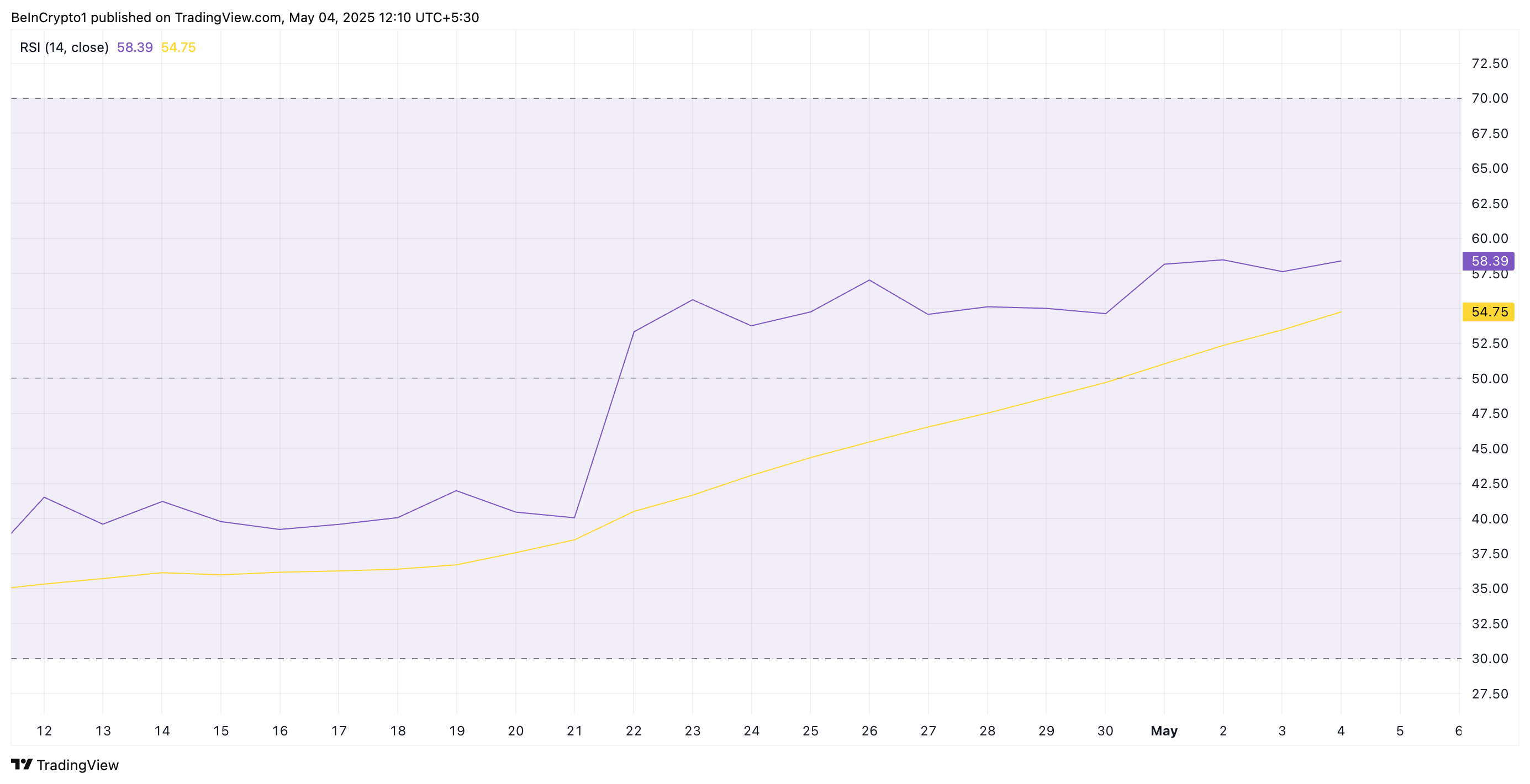

Moreover, Altcoin's relative energy index (RSI) continues to extend in favor of this bullish narrative. Throughout the press, the mountain climbs at 58.39.

Ethereum RSI. Supply: TradingView

The RSI indicator measures the market circumstances for asset acquisitions and overselling. It ranges from 0 to 100, with values above 70 indicating that belongings are being over-acquired and are anticipated to say no. Conversely, values underneath the age of 30 point out that the asset is being offered an excessive amount of and may witness a rebound.

ETH's RSI studying confirms the strengthened bullish bias towards Altcoin and reinforces the view that it will probably profit additional.

ETH builds energy past short-term assist

At present costs, ETH is above the 20-day index shifting common (EMA), forming a value beneath $1,770.

The 20-day EMA measures the common value of belongings over the past 20 days, giving weight to current costs. When belongings commerce above this necessary shifting common, they present short-term bullish momentum. This exhibits that current costs have been greater than the common for the previous 20 days. Merchants usually view this as an indication of underlying energy or early uptrends.

So, ETH can hold the rally in direction of $2,027 when it beneficial properties momentum when buying stress.

Ethereum value evaluation. Supply: TradingView

In the meantime, if buying exercise is waning, the coin may lose its current earnings, falling beneath the 20-day EMA and attain $1,385.