Over the previous few months, Ethereum has skilled a major decline in person exercise on the blockchain. This slowdown decreased the burn fee within the community. It is a mechanism that helps cut back the provision of ETH over time.

Much less tokens burn, the circulating provide of ETH will increase, placing inflationary strain on belongings. Because of this, Coin has struggled to take care of a steady value of over $2,000 in current months.

The low burn fee equals lots of the cash in circulation

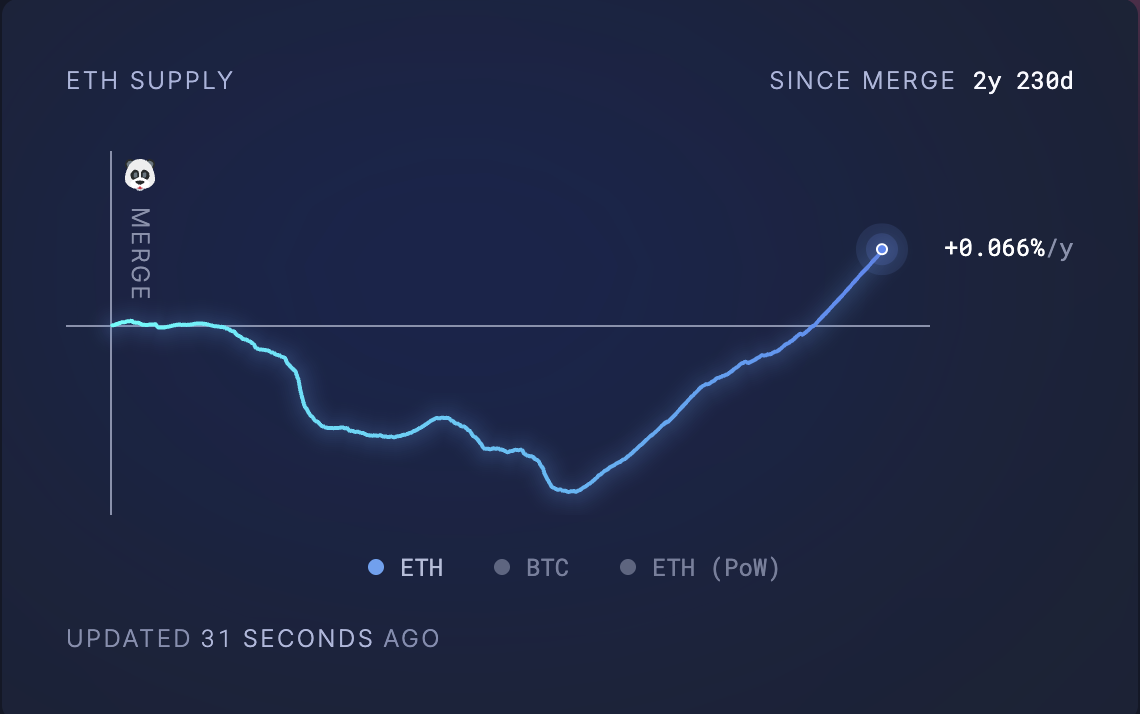

In accordance with UltrasoundMoney, 72,927 ETH, valued at present market costs at $134 million, has been added to ETH's distribution provide previously month alone.

On the time of urgent, that is positioned at 120,730,199 ETH, considerably exceeding the pre-merge stage.

Circulating Ethereum provide. Supply: UltrAsoundMoney

This enhance in ETH provide is pushed by a decline in person exercise on the Ethereum Community, leading to a decrease fireplace fee. The Ethereum burn mechanism launched via EIP-1559 destroys a number of the buying and selling charges to cut back the circulation provide of ETH.

Nonetheless, this mechanism is immediately linked to community use. Due to this fact, when such transactions are low, when ETH is burned, the provision of ETH will skyrocket.

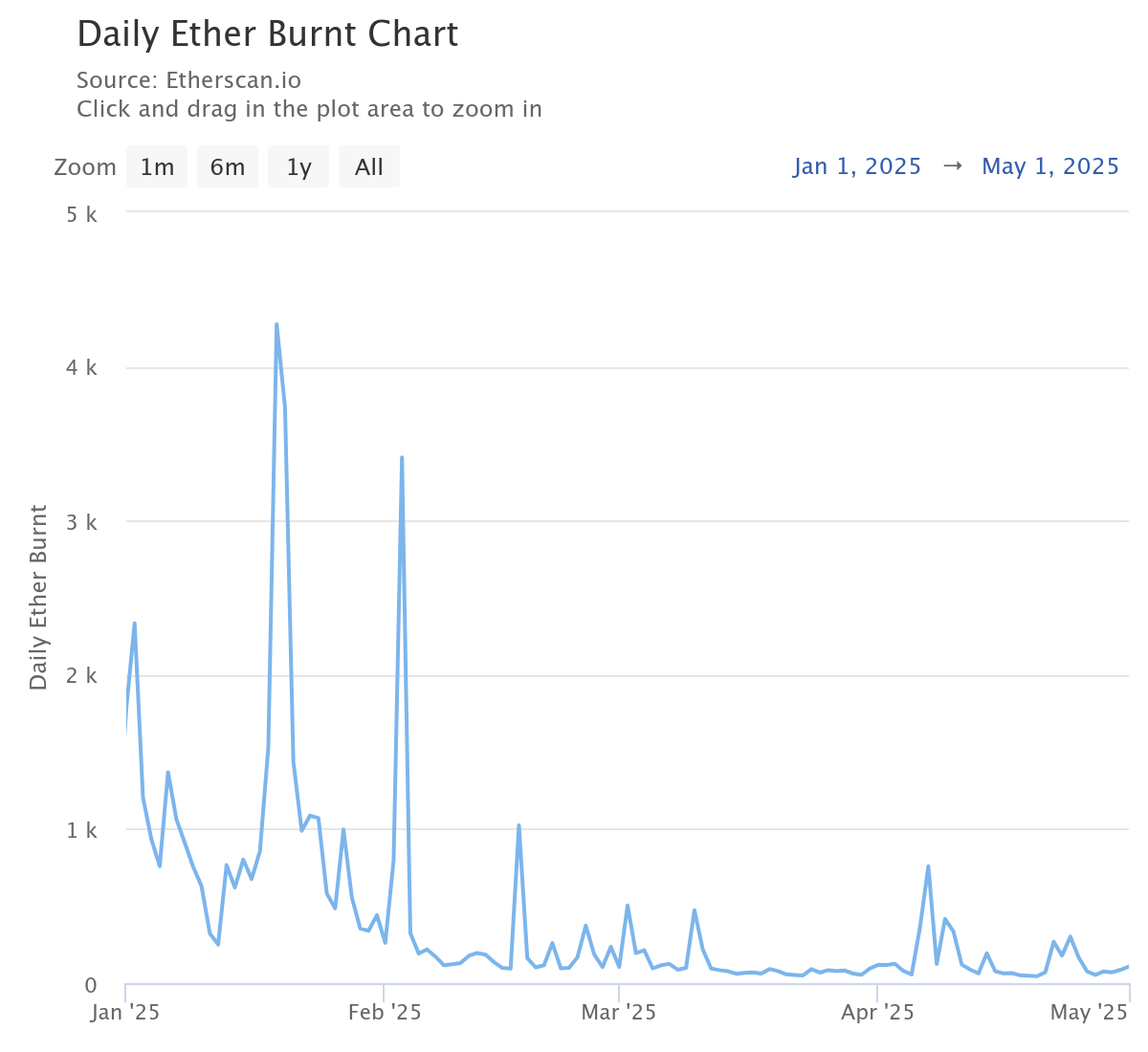

In accordance with Etherscan, each day burning volumes have fallen by 95% because the begin of the 12 months. In truth, the community just lately recorded the bottom quantity of cash burned in someday on April twentieth.

The ether was burning every single day. Supply: Etherscan

Why do Ethereum customers go away the blockchain?

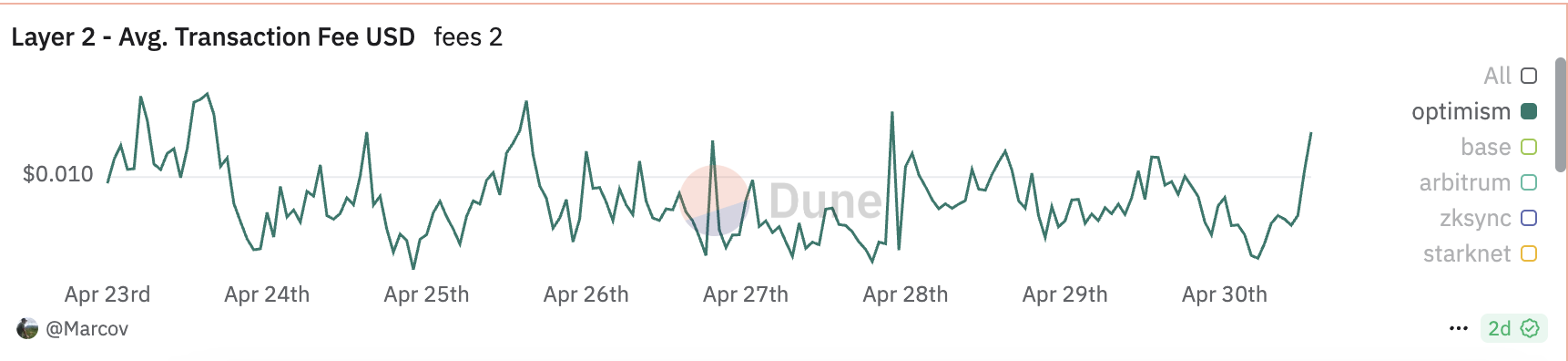

Many customers and builders are transferring from Ethereum equivalent to Optimism and arbitrum to Layer 2 (L2) options. These networks considerably cut back transaction charges, present quicker execution, and cut back person exercise on Ethereum's mainnet.

For instance, as of April 30, the typical buying and selling payment for optimistic Mainnets was solely $0.024. In distinction, finishing a direct transaction on Ethereum prices customers a median of $0.18 on the identical day, which is greater than seven instances dearer.

Common transaction charges for optimism. Supply: Dune Analytics

Plus, due to current Meme Coin Mania, “Ethereum Killers” equivalent to Solana have gained appreciable traction previously few months, pulling customers away from the L1.

Collectively, these traits led to a lower in transaction counts for Ethereum, thus leading to a low burn fee for the community.

How do Ethereum fundamentals stack up?

The decline in person demand for Ethereum and subsequent enhance in ETH provide have raised essential questions on its elementary energy.

Vincent Li, chief funding officer at Kronos Analysis, supplied his perspective when requested what Ethereum is at present evaluating it to different Layer 1 (L1) networks amid the broader market weak point.

“The fundamentals of Ethereum stay sturdy in comparison with different Layer 1, particularly for those who think about the $36.892.1 billion complete (TVL) to be on the high of the leaderboard,” Li mentioned.

Though Liu admitted that he ranks fifth in 24-hour bills behind Tron, Solana, Hyperquid, Bitcoin and BNB chains. He emphasised that the community nonetheless “indicating essential demand and utilization.”

Temujin Louie, CEO of Wanchain, shares an analogous perspective. Whereas speaking to Beincrypto, Louie identified:

“In comparison with the opposite Layer 1, the basics stay Ethereum's energy. In contrast to many Layer 1, which have aggressive inflation as a part of the design, Ethereum's multi-global structure probably deflates it.

Whereas the rise in exercise via Layer-2 (L2) options and “Ethereum Killers” like Solana could have contributed to a lower in person demand for Ethereum itself, Louie believes the L1 community is “a frontrunner in decentralization and has a near-decommissioned monitor document of constant to safe its place available in the market.”

What about ETH costs?

Even with a robust basis, slower exercise at Ethereum poses ETH challenges within the brief to medium time period. Commenting on this, Liu defined {that a} decline in community exercise signifies a weaker demand for ETH usually.

On the identical time, a rise in coin issuance throughout the community undermines Ethereum's deflationary mannequin, which is designed to help value will increase.

“This mixture may result in a bearish value motion,” Liu warned. “Specifically, buyers take a look at various layer 1, providing higher scalability and decrease charges.”

Kadan Stadelmann, CTO of Komodo Platform, additionally highlighted the function of macroeconomic elements.

“Utilization may considerably decrease costs relying on Ethereum if utilization is expanded, particularly if the Fed continues its quantitative tightening coverage in comparison with quantitative easing. Within the brief time period, costs may drop to the $2,000 vary.

ETH bolsters RSI, a $2,000 breakout

ETH is at present buying and selling at $1,834, specializing in a 1% value drop previously day. Regardless of the brief pullback, bullish strain within the Coin's spot market continues to be mirrored and strengthened within the Coin's Climbing Relative Power Index (RSI).

At press, this momentum indicator is 57.68. RSI measurements of ETH point out a rising bullish state. This means that AltCoin has room for upward motion as buy strain will increase.

On this situation, its value could possibly be over $2,027.

ETH value evaluation. Supply: TradingView

Nonetheless, for those who lose momentum when buying strain, the worth of your ETH can drop to $1,733.