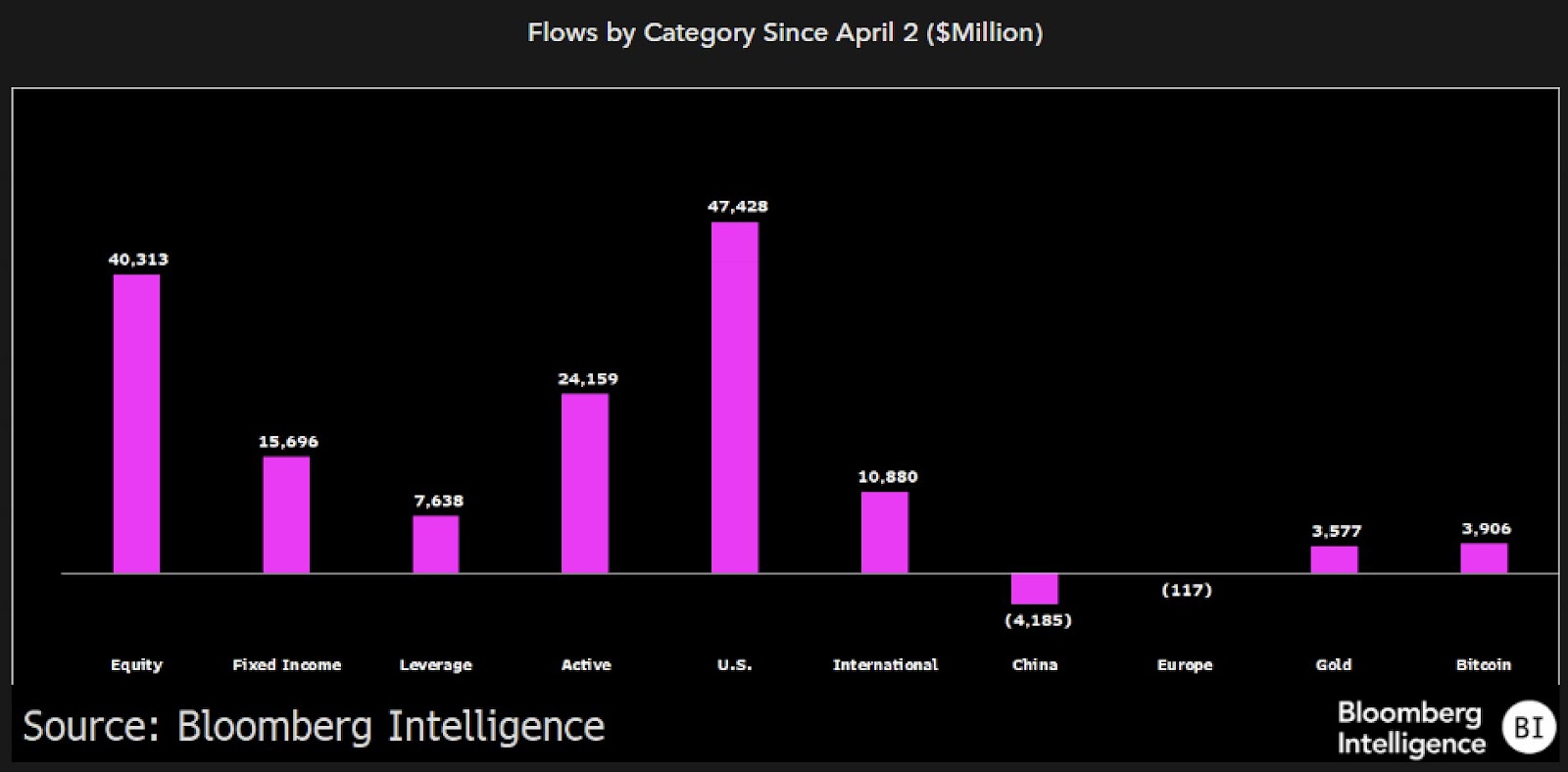

Since April 2025, buyers have poured $47.4 billion into US-focused ETFs, changing into a serious class by inflows. This makes it a frontrunner by way of inflow, based on newest market knowledge.

The inventory ETF continued at $40.3 billion, whereas the energetic technique led to $24.2 billion. In the meantime, the bond ETF raised $15.7 billion, whereas the leveraged fund gained $7.6 billion.

The US ETF development will skyrocket above $47 billion from April. Supply: Bloomberg Intelligence

The US and technological ETFs dominate the current capital flows

Whereas US-focused funds have skyrocketed, worldwide ETFs (excluding the US) have drawn in $10.9 billion. China-centric ETFs have had a $4.2 billion outflow, whereas the European-centric fund has misplaced $117 million. Expertise ETFs have led the sector's movement.

Bloomberg's Eric Baltunas reported that tech funds have surpassed all classes of inflow since early April, calling it a “semi-shot” surge.

Bloomberg Intelligence knowledge exhibits that since “liberation date,” US buyers have supported home and technology-focused ETFs, pushing US-centric funds to the forefront of market movement rankings.

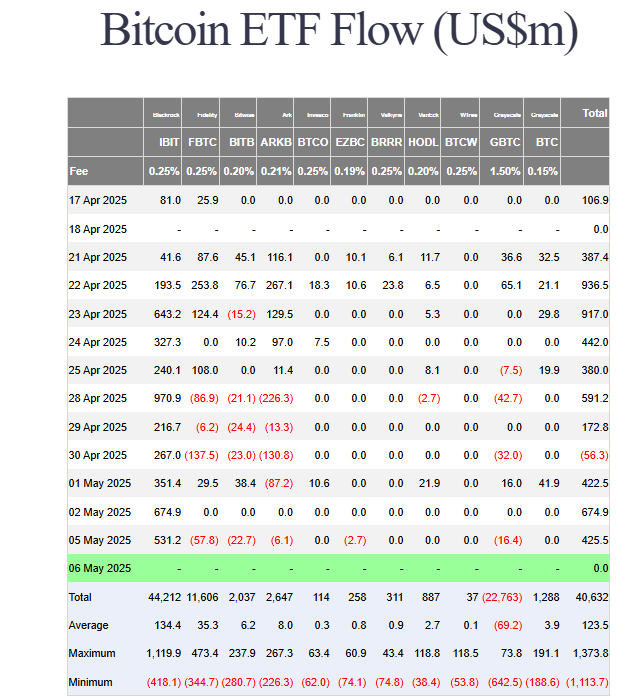

As Crypto ETF movement accelerates, Bitcoin ETF IBIT hits $5.58 billion in a 15-day straight win

In early Could 2025, buyers continued to switch capital to expertise and crypto-related ETFs. On Could fifth, BlackRock's iShares Bitcoin Belief ETF (IBIT) recorded 15 consecutive inflows, including $531.2 million. The fund started its profitable streak on April seventeenth, bringing its complete influx over that interval to $5.58 billion.

IBIT led the Bitcoin ETF influx on Could fifth with $531 million. supply: Farside Investor

IBIT's belongings beneath administration (AUM) rose to $34.3 billion, surpassing BlackRock's Ishares Gold Belief (IAU). Nonetheless, it’s behind SPDR Gold Inventory ETF (GLD), which holds $98.1 billion as of Could 6, 2025.

In the meantime, Bitcoin's 24-hour buying and selling quantity rose 12% on Could 6, reaching $22 billion on main exchanges. This quantity spike coincided with a steady improve in facility ETF exercise.

US inflows into European ETFs exceed $10 billion

Within the first quarter of 2025, US buyers allotted $10 billion to European fairness ETFs, a seven-fold improve from the primary quarter of 2024, based on the Funds Affiliation. This development continued into Could, with constant capital flowing into European-focused funds.

This development adopted Germany's 500 billion euro infrastructure plan and EU help for defence and renewable sectors. The iShares Msci Germany ETF (EWG) and Choose Stoxx Europe Aerospace & Protection ETF (EUAD) recorded the most important inflow. EUAD has raised $469 million since its launch in October 2024.

Bloomberg Intelligence has confirmed that inflows will improve after regional coverage modifications and sector growth. US buyers remained regular engagement with the European market as protection and vitality funding gained traction.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version just isn’t chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.