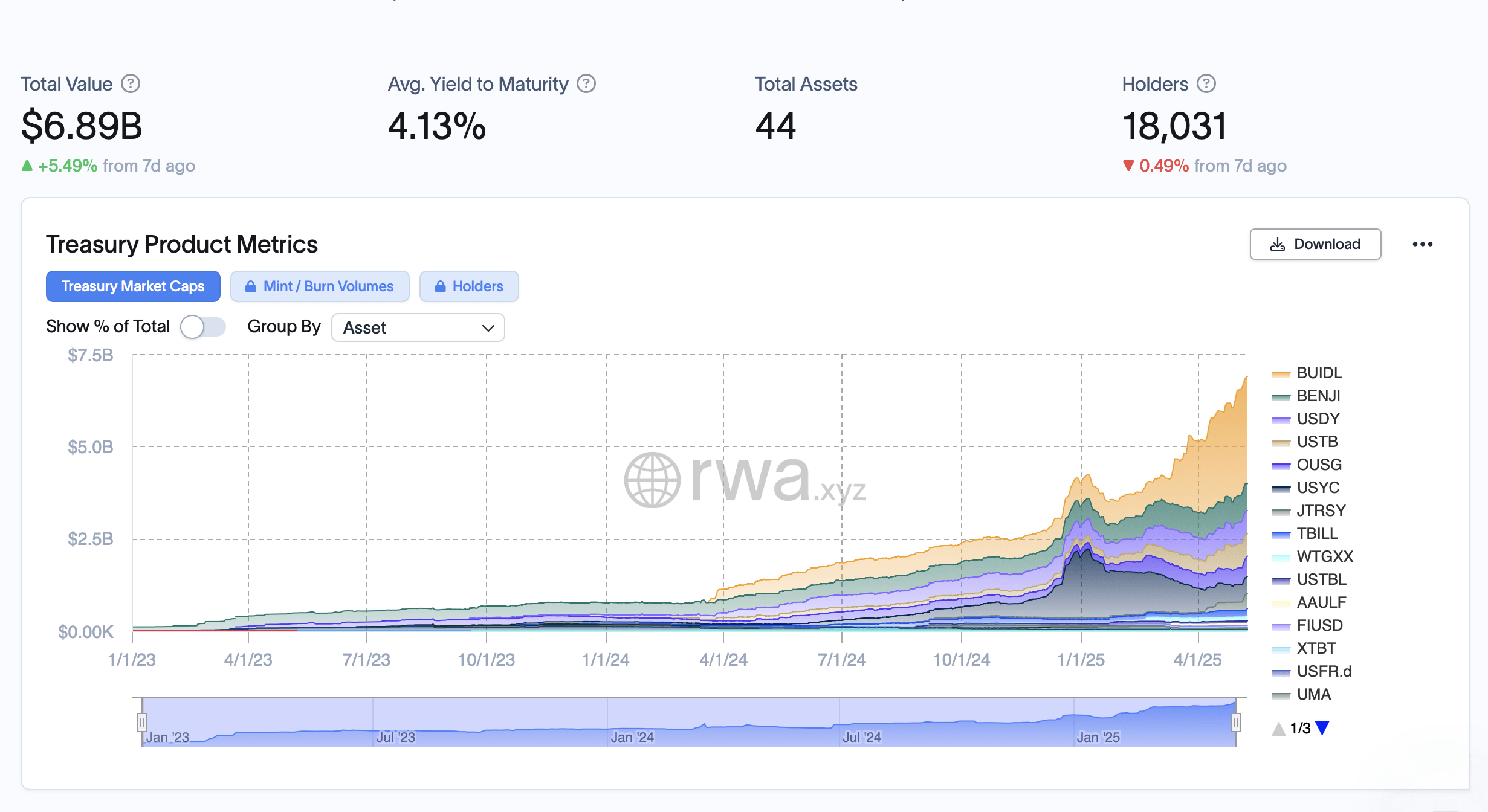

Based mostly on the newest knowledge, tokenized US Treasury bonds have been on an upward trajectory since Might 2, 2025, gaining 6%.

Tokenized Treasury Ministry – $689 million and mountaineering

On Friday, Might 2nd, the cumulative worth of the tokenized Treasury reached $6.5 billion. This can be a historic milestone. In only a week, the determine rose 6%, increasing to $68.9 billion, elevating about $390 million in new capital.

Since January 1, 2025, the tokenized Treasury bond sector has grown by 71%, up from $4.03 billion to its present valuation of $6.89 billion. BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) has injected $36 million since Might 2, rising its whole from $2.871 million to $2.97 billion.

Over the previous week, Franklin Templeton's Onchain US Authorities Cash Fund (Benji) added $10.61 million, up from $71684 million to $727.45 million. In the meantime, Ondo's USDY fund surpassed each high contenders, increasing from $581.20 million to the present $629.73 million.

In response to RWA.xyz Metrics, Superstate's short-term US Authorities Securities Fund (USTB) skilled a decline, however different funds have been registered final week, together with Ousg, USYC, Jtrsy, Tbill, WTGXX and USTBL. The earlier week of knowledge, USTB whole quantity fell to $607.43 million, all the way down to $651.51 million.

The everlasting influx into the tokenized Treasury highlights the enlargement of blockchain rail consolation between asset managers and their purchasers, indicating that digital rappers on authorities debt are not experimental curiosity, however the actuality of at this time. If yields are engaging and the advantages of a settlement are apparent, on-chain funds might transfer from area of interest allocation to essentially the most distinguished monetary actions.