In accordance with the on -chain information, Etherum Alternate Internet Move has maintained a unfavourable state of Etherum Alternate Internet Move, which can be moral indicators final week.

Ether Lee Alternate Netflow suggests a withdrawal pattern.

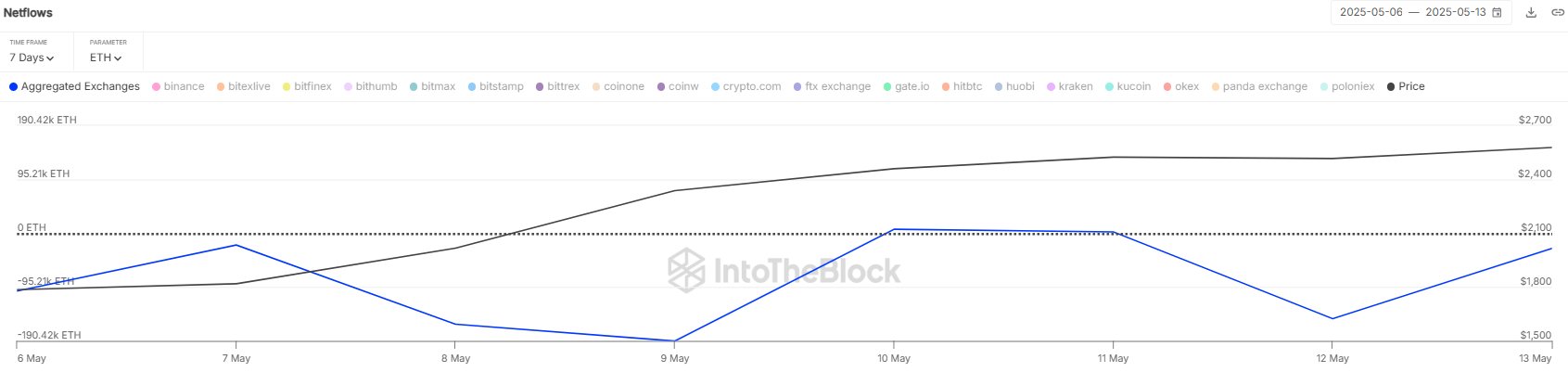

Within the new submit of X, Sentora (previously Intotheblock), a supplier supplier of the engine Defi Options, talked about Ethereum's newest traits. Right here, “Alternate Netflow” represents a heat -chain metric that traces the online quantity of cryptocurrency that strikes or goes out to a pockets related to the centralized platform.

If the worth of this metrics is constructive, it signifies that the investor deposits a pure token on this platform. One of many primary causes for the holder to switch to the alternate is that this sort of pattern for the aim of gross sales can have an effect on the weak point of the ETH worth.

Then again, indicators of lower than 0 recommend that leaks surpass the influx. Normally, buyers take cash from the alternate custody for the long term, and this sort of pattern could be optimistic about property.

The chart shared by the analyst now exhibits the pattern of Ether Leeum Alternate Internet Move final week.

The worth of the metric seems to have been unfavourable in current days | Supply: Sentora on X

As proven within the graph above, Ether Leeum Alternate Internet Move has been discovered to be unfavourable contained in the window, which signifies that the holder is drawing provide from the centralized alternate.

The overall buyers withdrew $ 1.2 billion with this leak. Sentora stated, “The continued pattern of web leaks that has been strengthened from early Could has continued to build up alerts and lowered gross sales stress.

ETH has lately developed this sturdy growth, however Cryptocurrency could not provide an opportunity to enter proper now, because the analytical firm Santiment defined in insights.

The info for the 30-day and 365-day MVRV Ratios of ETH | Supply: Santiment

The symptoms shared by the Analytics firm are “MVRV (Malket Worth to Remized Worth) ratio” and principally measures the advantages of Bitcoin buyers.

On the chart, Santimate comprises two variations of the 30 and twelve months. The previous informs the profitability of buyers bought over the past 30 days and the profitability of consumers final 12 months.

As could be seen within the graph, Ether Lee's 30 -day MVRV ratio has a notable constructive worth and means that the client positive aspects important income. Extra particularly, the metrics are sitting in 32.5%, which is far greater than the 15% harmful zone of the Altcoins really helpful by the analysts.

“This doesn't imply the worth drops, however it's seemingly that the rally will gradual or cease till the 30 -day MVRV falls again to extra affordable.

ETH worth

On the time of writing, Ether Lee Rium trades $ 2,600, up greater than 43% final week.

The pattern within the ETH worth over the past 5 days | Supply: ETHUSDT on TradingView

DALL-E, SANTIMENT.NET, Intotheblock.com's primary picture, TradingView.com chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing commonplace and every web page is diligent within the prime expertise specialists and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.