Bitcoin rose to the underside on Monday after Moody's score downgraded the US sovereign credit standing after a serious shift in investor sentiment.

The credit standing company diminished the long-standing US “AAA” score to “AA1,” citing rising fiscal strain as a consequence of $36 trillion citizen debt and elevated curiosity. The choice marked Moody's first US downgrade since 1919 assigning a century-long highest rating score.

The timing of the downgrade coincided with Bitcoin pullbacks from the four-month peak. After hitting an in a single day excessive of $107,060 and a strongest weekly finish of practically $106,500, Crypto fell to $102,200 throughout the session.

Over the previous 24 hours, Bitcoin's worth has dropped by 1.29%, wiping out weekly earnings. The retreat responded to growing monetary uncertainty by lowering buyers' publicity to speculative belongings and highlighted a shift in threat urge for food.

Nonetheless, in response to downgrades, White Home spokesman KushDesai It was criticized Moody's reliability refers to perceived omissions throughout earlier administration.

In the meantime, Treasury Secretary Scott Bescent downplayed the rapid affect of the choice, calling it a “lag indicator” that has a minimal affect on monetary planning.

Breaking:

trump Trump is against Moody's resolution to downgrade US credit score rankings. pic.twitter.com/nlly9vm57t

– Marzell (@marzellcrypto) Might 19, 2025

The exercise of derivatives signifies elevated volatility

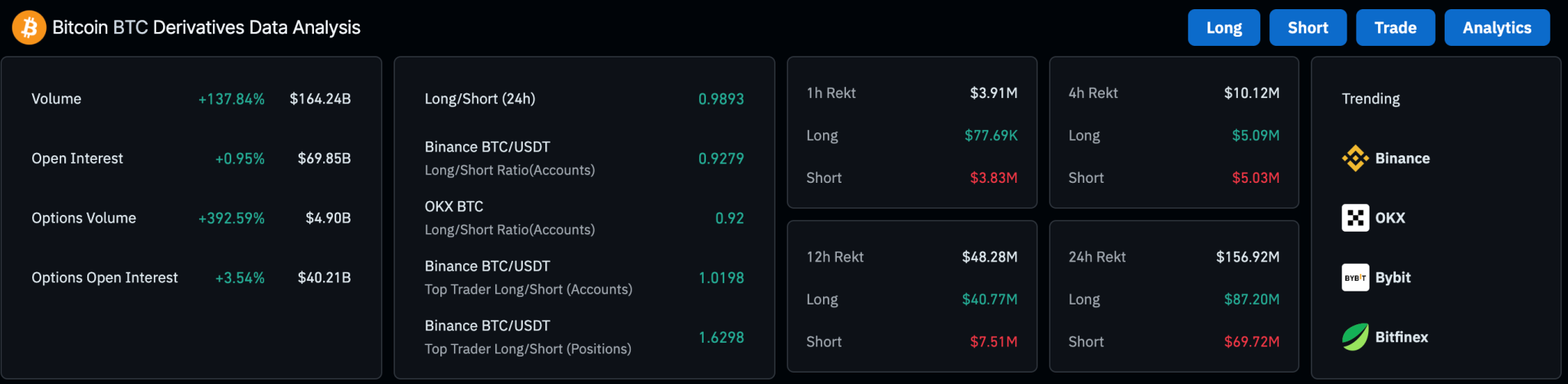

Amid the broader market response, the Bitcoin by-product market skilled a big surge in exercise. Buying and selling quantity elevated by 137.84% to $16.424 billion, indicating a rise in speculative earnings. However, open curiosity elevated by simply 0.95% to $69.85 billion, suggesting a fast place departure relatively than a long-term dedication.

The liquidation information highlighted this volatility. Past the 12-hour window, the full liquidation reached $48.28 million, with the lengthy place accounting for $40.77 million. Over the course of 24 hours, a complete of $156.92 million was liquidated, with a protracted $872 million and a $6,972 million shorts.

Will there be extra volatility?

The Moody's downgrade follows an identical motion with the 2023 Fitch score and the Commonplace & Poor's score in 2011. Analyst It's attracting consideration That the cumulative results of those downgrades may contribute to elevated borrowing prices for each the private and non-private sectors of the US. This might result in higher volatility in monetary markets.

Spencer Hakimian of Tolou Capital Administration reported that downgrades may result in long-term monetary burdens throughout the market, and will increase capital prices.

The event quickly disrupts the rally to Bitcoin's all-time excessive, however commentators within the Crypto business have been virtually shocked by the short-term pullback. Specifically, the launch of the “Altcoin Season” and the continued Bitcoin Rally forecast by influential figures reminiscent of Arthur Hayes have been up to date to $250,000.

Apparently, MicroStrategy's Michael Saylor additionally revealed immediately the acquisition of thousands and thousands of {dollars} of recent Bitcoin. This continues to institutional belief in belongings regardless of macroeconomic headwinds.