In response to the on -chain information, the profitability of Etherum Investor has seen a pointy turnaround in keeping with the newest rally of asset costs.

Ether Leeum Holder profitability lately noticed a dramatic reversal.

Within the new publish of X, the organs Defi answer offers a earlier INTOTHEBLOCK (Sentora).

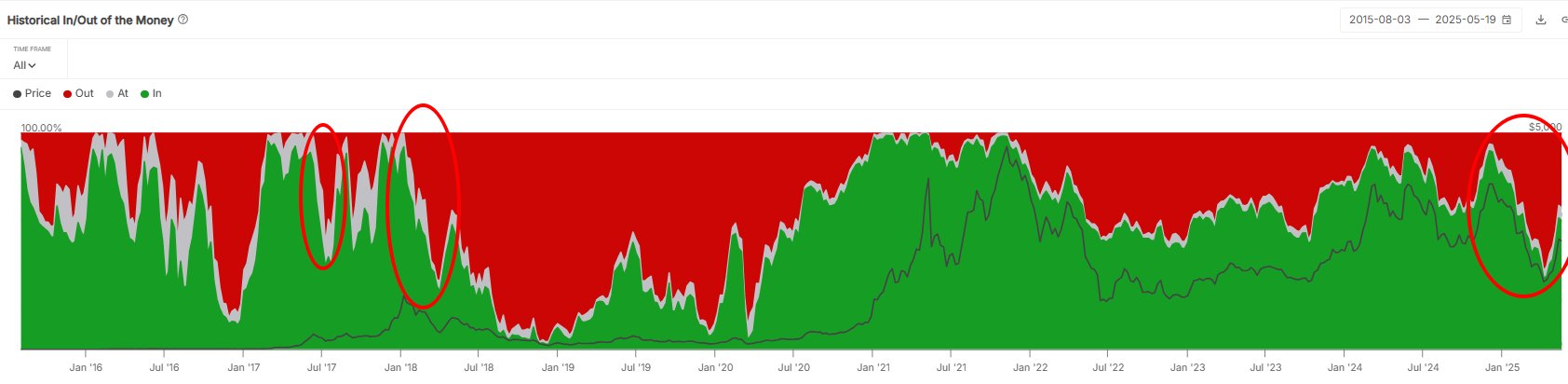

The chain indicator of the relevance right here is “historic/out of cash,” which tells us about which components of the ETH person base profit (“cash”), losses (“in cash”) and even (“in cash”).

This metric works by checking the typical worth of cash via the recent chain file of every deal with of the community. If this common value customary is decrease than the spot worth of the pockets, the particular person is taken into account to be in cash. Equally, the deal with assumes that the cash of the alternative case is out of cash when the 2 costs are the identical.

Now there’s a chart that reveals the Ether Lee Rim historic pattern of the final decade.

Appears to be like like the quantity of inexperienced buyers has gone up in latest days | Supply: Sentora on X

As proven within the graph above, Cash Ethereum Traders noticed a pointy decline after the sale, which started in December 2024, which recommended that this indicator was sitting at greater than 90percentand maintained a realized revenue. Nevertheless, by April 2025, this worth dropped to 32%, so the scenario of buyers was utterly the wrong way up.

Since ETH Worth has seen a pointy rally this time, one other change appears to have occurred within the deal with of Cryptocurrency. Nearly 60percentof the holders have returned to cash, and they don’t seem to be near the identical degree as the top of final 12 months, however a lot greater than the low quantity.

On this chart, the evaluation firm emphasised when Ether Lee's final profitability. Sentora mentioned, “Belongings haven’t witnessed volatility on this scale since 2017.

In different information, ETH has regained two vital scorching chains after the restoration, because the analytical firm GlassNode mentioned within the newest weekly report.

The value of the coin appears to have surpassed the True Market Imply | Supply: Glassnode's The Week Onchain - Week 20, 2025

Within the chart, it’s clear that Ether Lee Rium has regained the worth that realized the realized worth early. The realized worth represents the typical value of all buyers within the ETH community. This degree is at the moment situated at $ 1,900. In different phrases, on the present alternate price, the holder shall be a notable profit.

Cryptocurrency has now surpassed the precise market common, which is situated for $ 2,400, which has similarities to the worth of the mannequin, a mannequin mannequin. This goals to discover a extra correct common acquisition degree out there, excluding lengthy -term dormant provide.

Ethereum is now yet one more time to get better. The energetic worth of $ 2,900 is a mannequin that repeats once more at a realized worth.

ETH worth

Ether Lee Rium climbed to $ 2,660, following a rally of about 4percentlast week.

The pattern within the ETH worth over the previous 5 days | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com, INTOTHEBLOCK.COM, TradingView.com

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing customary and every web page is diligent within the high know-how specialists and the seasoned editor's workforce. This course of ensures the integrity, relevance and worth of the reader's content material.