Information reveals that sentiment within the Bitcoin market is cut up into territory of utmost greed after it surpasses the brand new excessive of cryptocurrency above $111,000.

The Bitcoin Concern & Greed Index has skyrocketed just lately

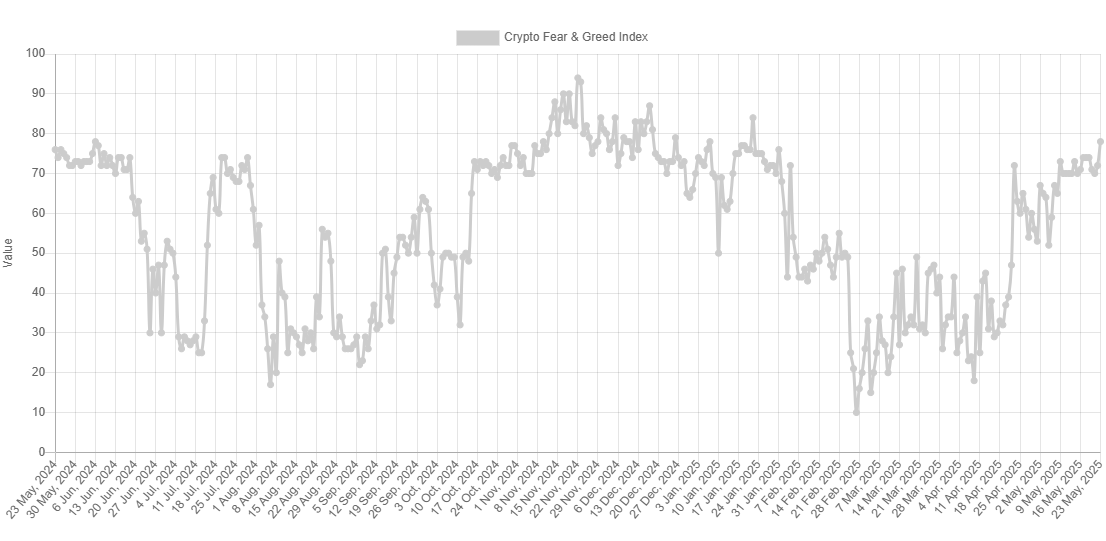

“Concern & Greed Index” refers to metrics created by alternate options that talk to us in regards to the sentiment held by the typical dealer in Bitcoin and the broader cryptocurrency market. Metrics use numerical scales that run from 0-100 to precise emotion. All values above 53 characterize greed amongst traders, whereas values under 47 point out concern. The index between these two cutoffs means a web impartial mentality.

Along with these three primary zones, there are two “excessive” areas referred to as The Excessive Treed (over 75) and Excessive Concern (underneath 25). At the moment, market sentiment is among the many two former, in keeping with the newest values of Concern & Greed Index.

Traditionally, excessive feelings have retained nice significance for Bitcoin and different digital belongings, as they have an inclination to kind main tops and bottoms. However the relationship was the other, however a very bullish vibe permits for tops, which means it goes past the underside of despair.

It’s because some merchants use this reality to measure their buy and gross sales actions. This buying and selling method is often often called reverse funding. A well-known quote from Warren Buffet is, “Concern when others are grasping and others are grasping when they’re grasping.”

With Bitcoin's sentiment now returning to the acute grasping area, it’s potential that followers of this philosophy are starting to take a look at the exit.

That stated, the Concern & Greed Index is at present value “Simply” 78. For comparability, the highest in December was round 87, and on January 1st it occurred at 84.

So, assuming that demand from traders is just not misplaced, it’s possible that the present market is just not overheated by way of sentiment. Nonetheless, it stays to be seen how Bitcoin and different cryptocurrencies will evolve underneath this excessive greed.

Talking of demand, Whale has simply made a big quantity of withdrawal from the Binance platform, as identified by X-Put up-encrypted group analyst Maartunn.

The indicator proven on the chart is “Change Netflow.” This reveals the online quantity of Bitcoin transferring into wallets related to central alternate.

Clearly, Binance Change Netflow has noticed a big destructive worth, which means traders have shifted a notable quantity of cash out of alternate. Extra particularly, the online spill of the platform was 2190 BTC or about $237 million.

This might probably point out demand from large-money traders to embrace cryptocurrency of their impartial wallets.

BTC worth

On the time of writing, Bitcoin has elevated by greater than 4% over the previous seven days.

Featured photos from charts on Dall-E, cryptoquant.com, altrtivative.me, and tradingview.com