As Bitcoin continues to interrupt information and attain document highs (ATH), a brand new wave of funding is rising. This time, it's not simply from funding funds or particular person traders. Conventional firms from varied sectors are additionally leaping in.

From training, healthcare, housing development to cybersecurity, companies massive and small all around the world compete to build up Bitcoin. They view it as a strategic asset sanctuary and are exhibiting a serious shift in firms' perceptions of cryptocurrency.

Bitcoin accumulation all through the business in Could

Public training firm Genius Group just lately introduced a 40% enhance in Bitcoin reserves. This transfer strengthens our long-term dedication to digital belongings. In the meantime, Basel Medical Group, a Singapore-based healthcare firm, shocked the market by asserting its $1 billion in Bitcoin purchases.

These strikes present that Bitcoin is not confined to expertise and funding firms. Now we’ve reached a historically unrelated sector.

In Europe, the H100 Group grew to become the primary Sweden to undertake a Bitcoin Reserve Technique. 4.39 We made an preliminary funding of 5 million knocks to purchase BTC. Equally, Blockchain Group, the primary European firm to carry Bitcoin reserve, added 227 BTC to its funds, bringing its whole holding to 847 BTC. This solidifies its pioneering function within the area.

NIC, CEO and co-founder of Coin Bureau, commented on the information, “We're build up Europe's stack on the company stage.”

These actions spotlight the rising acceptance of Bitcoin as a strategic asset, particularly as its worth reaches new heights.

Manufacturing and retail firms will take part within the motion

Manufacturing and cybersecurity firms are additionally concerned. Boxabl, a modular residence maker, has declared Bitcoin as a reserve asset. This transfer exhibits the development business's shift in direction of digital finance. On the identical time, publicly obtainable US electrical car retailer JZXN has authorized plans to buy 1,000 BTC inside subsequent yr.

The participation of firms from seemingly unrelated industries, reminiscent of vehicles and housing, signifies that Bitcoin has change into a preferred choice for diversifying its company portfolio.

A number of Web3-related firms additionally moved to construct Bitcoin reserves in Could after reaching the brand new ATH. Cybersecurity firm SecureTech has introduced its preliminary technique. Roxom International raised $17.9 million to fund the Bitcoin Reserve and develop its media community.

These initiatives mirror a robust ambition to mix digital belongings with revolutionary enterprise fashions.

Bitcoin is a macro asset with restricted provide

A latest report from Beincrypto suggests that there have been few retail traders at this newest rally. Nonetheless, the flood of the corporate's announcement of Bitcoin acquisition exhibits a wave of institutional FOMOs (fears of missed).

Technique is without doubt one of the main firms on this development. When Bitcoin reached a brand new excessive, the worth of its BTC holdings surged to $64 billion. However they haven't stopped. The corporate just lately introduced plans to lift one other $2.1 billion to proceed its Bitcoin buying technique.

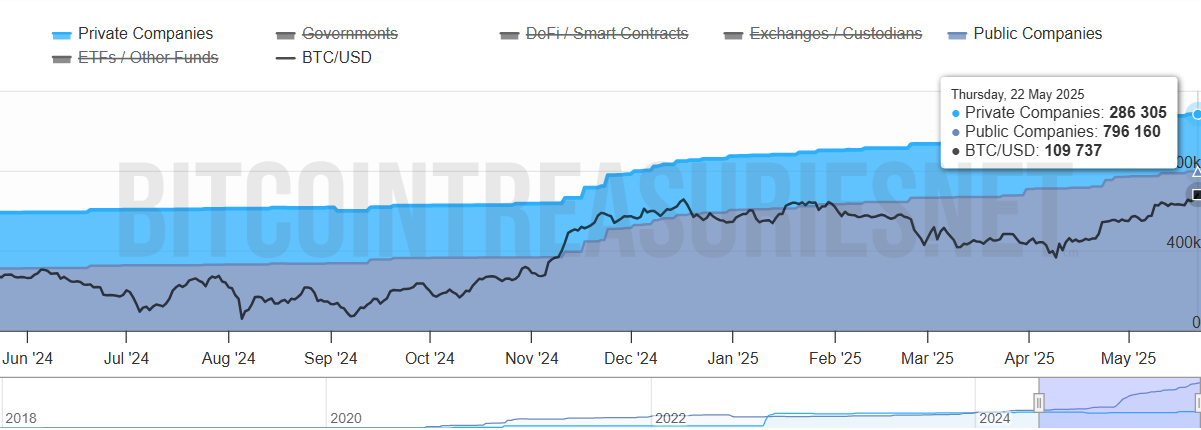

Whole Bitcoin accrued by firms. Supply: Bitcoin Treasuries

Knowledge from Bitcoin's Treasury exhibits that personal and public firms at present personal greater than 1 million BTC. That is greater than 5.4% of the circulation provide. In the meantime, the availability of Bitcoin stays fastened, and the variety of firms accumulating it continues to develop every month.

“Bitcoin, which breaks over $110,000, displays a brand new actuality. It's not a fringe asset. It's a macro instrument, an inflow of ETFs, and a sovereign curiosity, and structurally restricted provide drives institutional demand on a big scale. Mike Cahill, CEO of Douro Labs, stated in an interview with Beincrypto.

This development proves that Bitcoin has gained institutional belief in 2025. It’s not being rejected as a monetary bubble. As an alternative, it’s acknowledged as a strategic asset of the longer term.