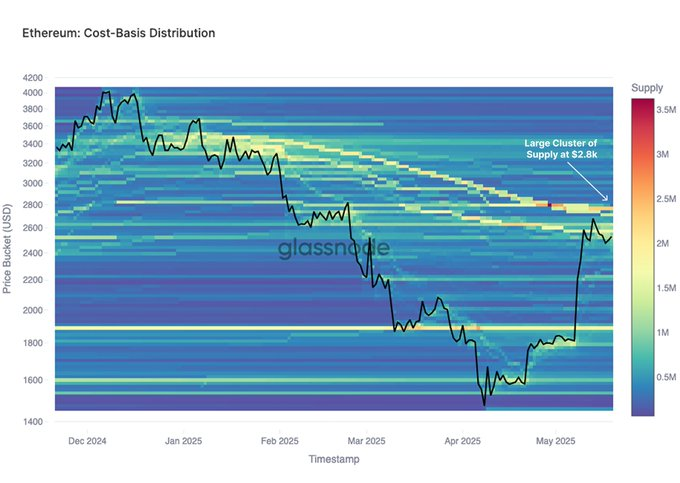

Ethereum's current upward climb has turn out to be a critical impediment this week across the $2,800 mark. Contemporary on-chain knowledge from GlassNode means that the spot is a serious provide zone, a serious provide zone the place many buyers who purchased earlier than the recession in March and April at the moment are approaching breaking evenly or seeing income. Which means these merchants can promote their actions as they resolve dangers or just money out.

There’s a outstanding cluster at an investor cost-based stage of about $2,800 for $ETH. As costs strategy this zone, it will probably improve the stress on the vendor aspect, as many earlier underwater holders might seem to take dangers close to the break-even level. pic.twitter.com/ukn2s7cojo

– GlassNode (@GlassNode) Might 24, 2025

Trying again from December 2024 to Might 2025, Ethereum (ETH) fell from over $3,800 to almost $1,600. The restoration trip since then has managed to undo ETH in its essential $2,800 neighborhood. In accordance with GlassNode's warmth map, the most recent cost-based distribution exhibits loads of pockets actions. The utmost focus on this heatmap clearly flags this $2,800 area as a dense provide zone, indicating a possible value cap except there’s a sturdy wave shopping for punches by resistance.

GlassNode: Advantages Turning to the $2,800 Zone, filled with ETH Lengthy-Time period Holders

Throughout the first quarter of 2025 market droop, on-chain knowledge exhibits that Ethereum pockets exercise has shifted considerably to a cheaper price vary. Provide density has been strengthened between $1,600 and $2,000. That is the extent to which served as a stable floor for Ethereum's rebound in Might. This accumulation interval might have positioned a short lived flooring underneath costs, however that $2,800 stage is approaching a serious cap the place ETH continues to be not decisive.

If Ethereum can truly push this $2,800 mark away with a important, sustained quantity, then it will probably invert the earlier resistance stage to the brand new assist. In any other case, persevering with to stumble upon this heavy provide band may result in new revenue acquisitions or rounds of defensive gross sales from neural holders.

Associated: Ethereum (ETH) signifies “golden cross”. Analysts will see a value goal of $3,000

Cryptoquant: Ethereum Energetic offers with rising lag costs

Including one other layer to the photograph implies that Ethereum's current value rise doesn’t match the proportional bounce of every day lively tackle exercise. Cryptoquant knowledge exhibits that, as of Might 2025, ETH is again to round $2,500, whereas the variety of lively addresses is hovering to almost 340,800. That determine is barely up from the 300,000 sub-level seen initially of the yr, however far beneath the addressing exercise spikes noticed in late 2023 and early 2024.

Supply: Cryptoquant

Historic tendencies usually present {that a} important improve in lively addresses is carefully associated to basic value gatherings or sign native tops. The present divergence right here is very appreciated, however it means that present individuals could possibly be the principle engine behind Ethereum's newest value switch slightly than a contemporary wave of latest consumer adoption.

Current ETH Worth Dip highlights the ceiling power of $2,800 resistance

As this report summarizes, Ethereum costs fell 3.46%, buying and selling at $2,567.78. It is a lower of over $100 from the day past's top. On high of this, in keeping with CoinMarketCap, buying and selling quantity truly rose 8.77% to $228.1 billion, whereas market capitalization fell to $309.9 billion. This quantity bounce alongside the value decline usually displays a rise in liquidity as promote orders hit the market, which may result in a halt order.

The shortcoming for Ethereum to exceed $2,600 on this current transfer highlights how necessary the $2,800 resistance space is. With no clear, decisive breakout on high of that heavy provide zone, merchants ought to count on a presumably short-term value tick to stay.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.