- The function of chain hyperlinks in real-world asset tokenization has elevated dramatically.

- High Monetary Titans and Debt Protocols depend on many options in Chain Hyperlink.

The monetary business is altering quickly with the appearance of fund tokenization. It has its owned by Taurus, the main digital asset infrastructure supplier launch An in depth report on how this innovation reshapes funding administration.

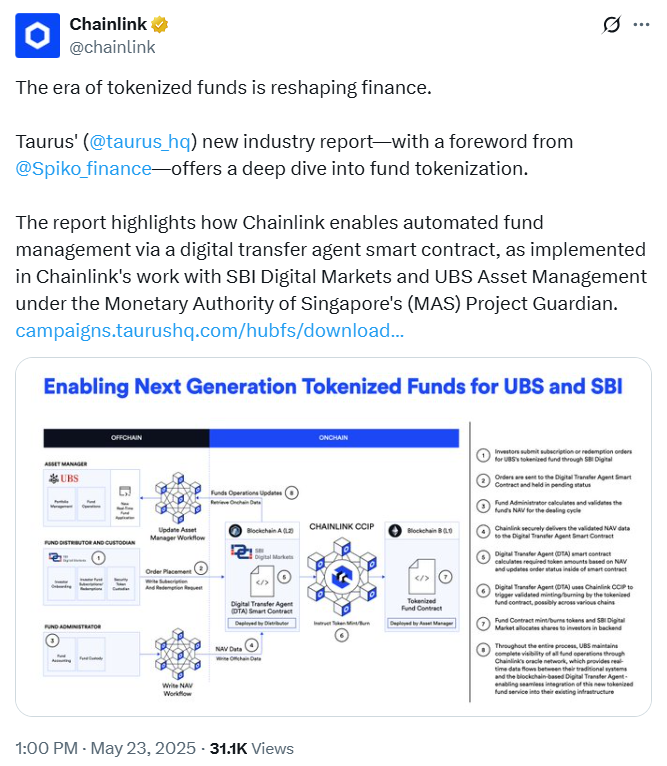

This report highlights how ChainLink may help automate fund administration as a decentralized Oracle community. Massive organizations akin to UBS, SBI Digital Market and the Singapore Financial Authority (MAS) are supporting this work.

How Chain Hyperlink Know-how Adjustments

Fund tokenization means changing shares from conventional funding property into digital tokens on the blockchain. This enables individuals to purchase, promote and commerce these shares extra simply and shortly.

Taurus' report defined that tokenization provides many advantages, together with quicker transactions, larger transparency, and decrease transaction prices. He identified that tokenization is not only an concept, however an actual resolution to realize traction within the monetary sector.

ChainLink's distributed Oracle community performs a key function within the tokenization course of. Accumulate information from a number of sources, confirm its accuracy, ship it firmly to sensible contracts, and allow it to reply to actual occasions.

As Highlighted In a earlier article, Tron Dao has formally appointed ChainLink because the main Oracle supplier in its blockchain ecosystem. ChainLink Information Feeds helps enhance information accuracy throughout your Defi utility.

In accordance with a report by The Taurus, ChainLink's expertise helps create digital sensible contracts that handle tokenized funds. These sensible contracts routinely deal with token purchases, gross sales and transfers with out having to manually carry out these duties.

A collaboration between MAS, UBS Asset Administration and SBI digital markets, Undertaking Guardian permits ChainLink's expertise to assist all fund transactions observe strict guidelines, velocity up processes and scale back prices.

Moreover, main establishments, together with Constancy Worldwide, ANZ Financial institution and Swift, tapped ChainLink's expertise. Defi platforms akin to Aave, GMX, and Lido additionally depend on the ChainLink infrastructure.

As It was talked about In a earlier information temporary, banking and monetary companies big JPMorgan used the primary cross-chain supply and cost (DVP) transaction utilizing ChainLink and Ondo Finance.

ChainLink: Main Oracle Networks

ChainLink solidifies its main distributed Oracle community function, offering sensible contracts with safe, real-world information. As blockchain purposes change into extra refined, there’s a rising demand for dependable Oracle companies.

ChainLink's partnership throughout a number of sectors, together with finance and gaming, highlights long-term relevance within the business.

Its Cross-Chain Interoperability Protocol (CCIP) has gained traction and additional expands its function in distributed finance. As It’s outlined In a current weblog publish, Sonic Labs integrates ChainLink expertise into its mainnet. Utilizing CCIP, builders can create safe apps that work throughout the blockchain.

These apps can transfer tokens, ship messages, and set off actions throughout blockchains. As It's lined Within the newest report, World Liberty Monetary is partnering with ChainLink to combine cross-chain interoperability protocols into USD1 Stablecoin.

This integration offers frictionless safe USD1 transfers between a number of blockchain networks, together with BBN chains and Ethereum.