Ethereum continues to combine slightly below the Key Resistance Zone, following a formidable gathering from the start of this month. Costs stay technically bullish, however ETH has but to substantiate any breakouts above this crucial degree.

Technical Evaluation

Day by day Charts

On the every day charts, ETH is buying and selling slightly below the confluence of 200 days and $2,800 provide ranges. Nonetheless, the 100-day shifting common is at present beneath the property, offering help slightly below the $2,100 demand zone. As costs are trapped between these two shifting averages, a breakout to both aspect might be the start of a brand new impulsive motion.

In the meantime, the RSI is slightly below the situation of round 66, however the downtrend exhibits that the energy of the the wrong way up is slower, making a bearish divergence, indicating that it may be corrected within the coming weeks.

4-hour chart

When it drops over the four-hour time-frame, Ethereum exhibits indicators of weakening momentum. After the explosive motion exceeds $2,100, costs are built-in inside slim ascent channels, near the $2,500-$2,600 vary. Nonetheless, RSI has been on a slight upward pattern, indicating that momentum is slowly altering in favor of patrons throughout this time-frame.

However for a significant gathering to start, the market should get away of the channel with energy and quantity. In any other case, drops beneath the $2,600 degree, which at present function short-term help, may result in a breakdown of the channel, with worth drops returning to the $2,100 demand zone.

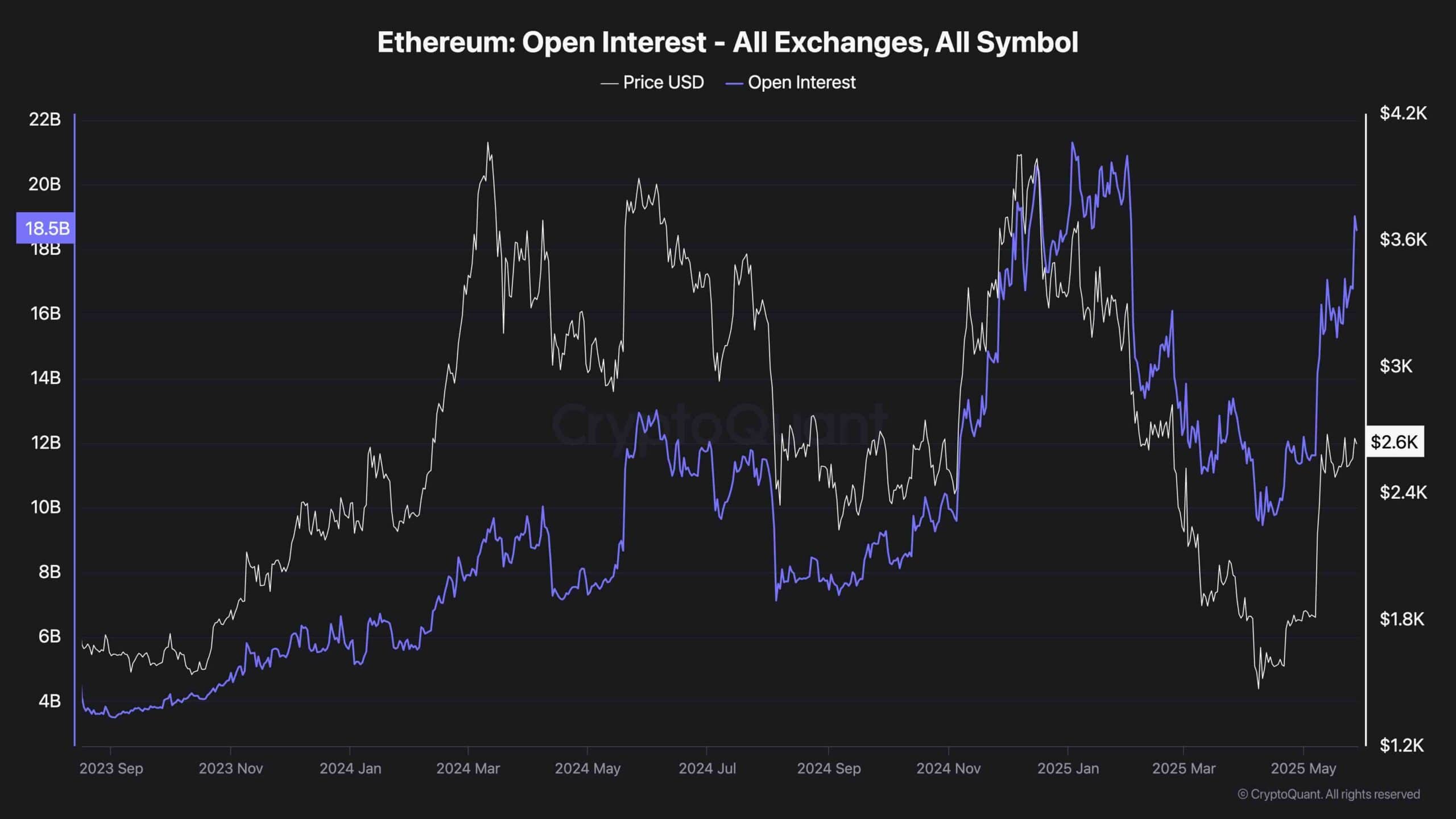

Open curiosity at Ethereum has skyrocketed, now standing at $1.85 billion, near the earlier excessive seen earlier this 12 months. Together with worth will increase, this important improve in open curiosity suggests the buildup of lengthy positions which can be leveraged throughout the market.

This usually exhibits robust bullish sentiment and dealer belief, but in addition introduces potential dangers. Energetic climbing with out clear breakouts with open curiosity can sign overcrowding and improve the probability of liquidation-driven pullbacks. Present positioning displays excessive breakout forecasts above $2.8,000.

Nonetheless, if the ETH fails to clear its resistance, the market will be capable to see a fast repair because the over-covered lengthy is washed away.