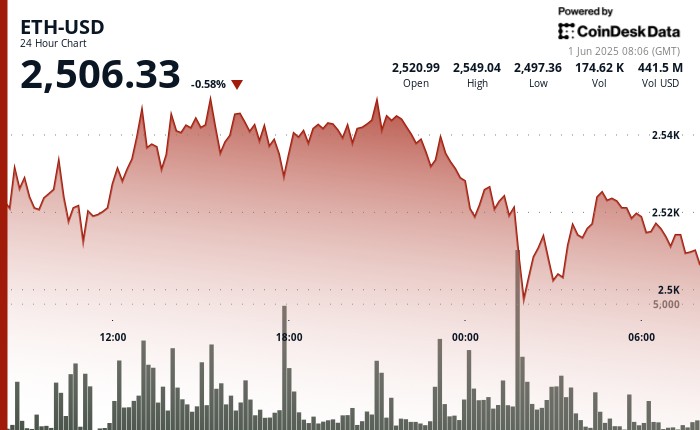

Ethereum (ETH) confronted late, up to date draw back pressures with buying and selling beneath the $2,500 stage as gross sales volumes surged and wider danger sentiment weakened. World commerce tensions and up to date US tariff dangers create risk-off flows, and digital belongings are more and more reflecting conventional markets in response to geopolitical uncertainty.

On-chain knowledge revealed a big inflow into centralized exchanges (notably 385,000 ETH is Binance). ETH has since recovered modestly to commerce round $2,506, however market observers have been carefully watching whether or not patrons can defend this stage or if one other foot is imminent.

Technical Evaluation Highlights

- ETH traded between $2,551.09 and $2,499.09, inside the $48.61 vary (1.95%).

- Value Motion shaped a bullish ascending channel earlier than breaking on the remaining time.

- Huge gross sales confirmed up at almost $2,550, and accelerated into a pointy turnaround by making earnings.

- ETH dropped from $2,521.35 to $2,499.09 between 01:53 and 01:54, with whole quantity exceeding 48,000 ETH in two minutes.

- The amount was promptly normalized, the value recovered barely, consolidating the band between $2,504 and $2,508.

- The $2,500 stage is presently serving as interim assist, however the momentum stays weak as latest quantity patterns nonetheless reveal indicators of distribution.

Exterior reference

- “Ethereum value evaluation: Will ETH be dumping to $2K subsequent, as momentum is fading?”

- “Ethereum Bulls Defend Help – Key indicators are short-term assembly ideas,” NewsBTC, revealed on Might 31, 2025.