Cryptocurrencies look like unmoved by important developments within the broader financial system.

Inventory step on water as a bitcoin flat line

US President Donald Trump introduced that he had simply completed a “superb name” with Chinese language chief Xi Jinping on Thursday morning and initially despatched shares up, however Bitcoin (BTC) barely sprouted and shares later retreated.

“I concluded an excellent name with Chinese language President XI, discussing a number of the complexities which have been created not too long ago and agreeing to commerce offers,” Trump famous the settlement in Could that the 2 international locations abolished the triple-digit retaliation charges beforehand imposed on one another. “The decision lasted about an hour and a half, and it led to a really optimistic conclusion for each international locations,” the president added.

In accordance with CNBC, the S&P 500, Nasdaq and Dow rose by 0.41%, 0.72% and 0.26% respectively, respectively, with the S&P 500, Nasdaq and Dow leaping into the information, however these earnings had disappeared after they reported. CoinmarketCap information exhibits that Bitcoin is bordered 1.84% decrease and is at present buying and selling just below the $104,000 mark.

Even the $1.05 billion preliminary public providing (IPO) by the Stablecoin Issuer Circle (NYSE: CRCL) didn’t assist BTC and the broader crypto market because it was revealed at this time on the New York Inventory Trade. CoinMarketCap exhibits the Crypto sector has shrunk by 2.24%, bringing its market capitalization to $3.24 trillion.

Market Metric Overview

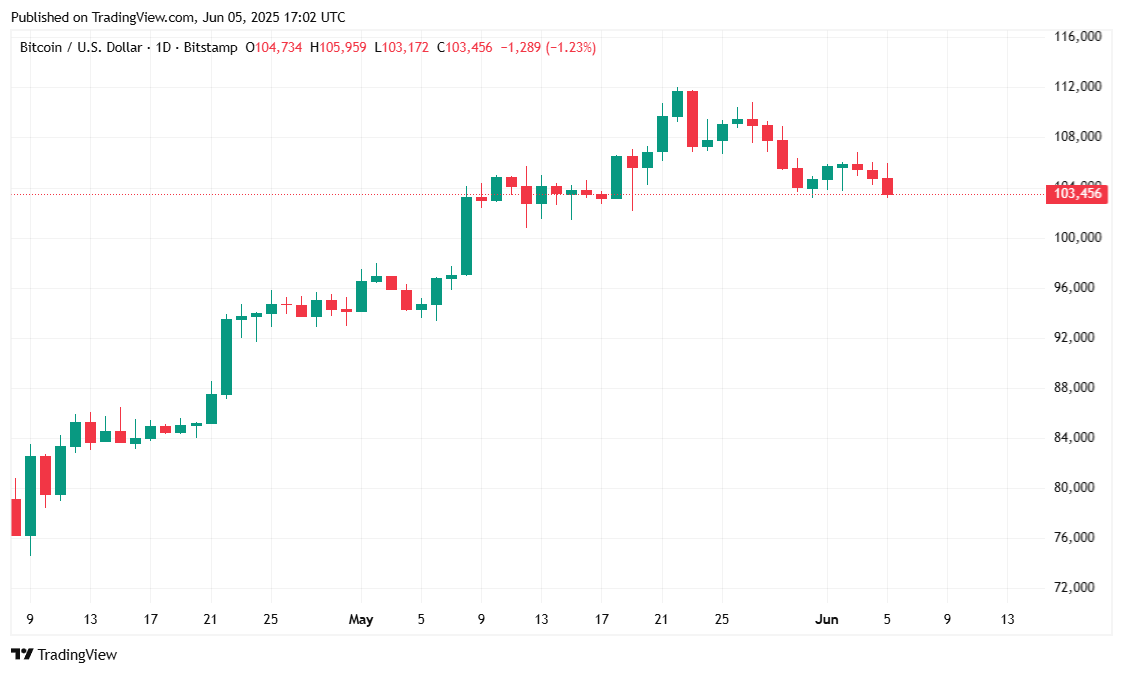

In accordance with Coinmarketcap, Bitcoin has soaked 1.84% within the final 24 hours at its present worth of $103,517.75. The decline extends the broader 7-day slide of three.05%, with worth motion being restricted between $103,483.65 and $105,936.69. The suppressed motion suggests an on-the-scene method amongst merchants regardless of information about US-China commerce growth and circle IPOs.

(BTC Worth/Commerce View)

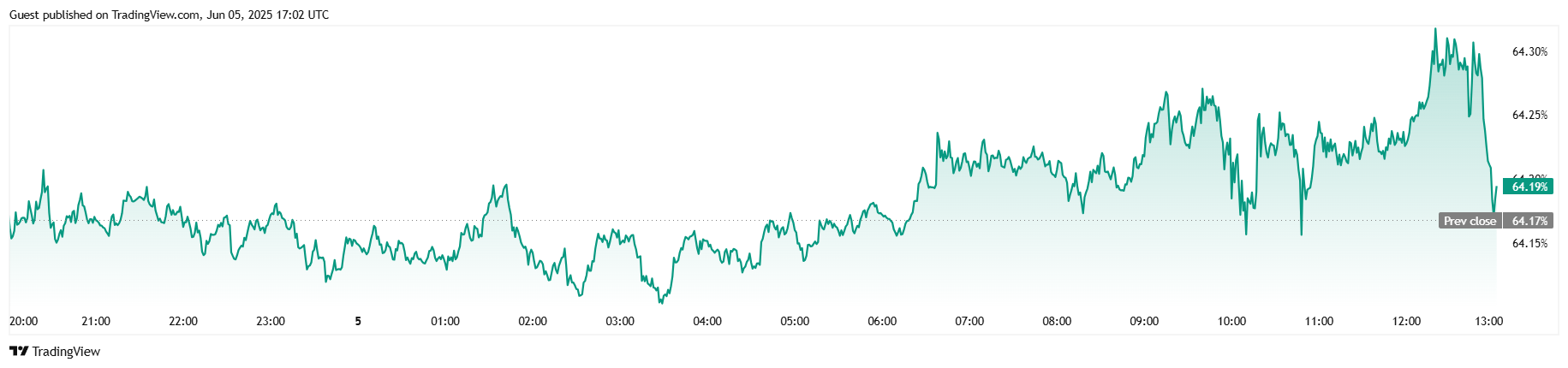

Market exercise displays worth suffocation as 24-hour buying and selling quantity fell 8.06% to $41.84 billion. Bitcoin's market capitalization fell 1.85% to $2.05 trillion, whereas BTC's management rose 0.08% to 64.21%, suggesting Altcoins' comparatively weak efficiency. The futures market is barely increased, with whole open curiosity rising 0.40% to $71.03 billion, reflecting a secure need for speculative positioning.

(BTC dominance/commerce view)

Margin buying and selling information from Coinglass reveals attention-grabbing modifications. The overall liquidation initially pale at round $83,770, however later swelled to $12.93 million.