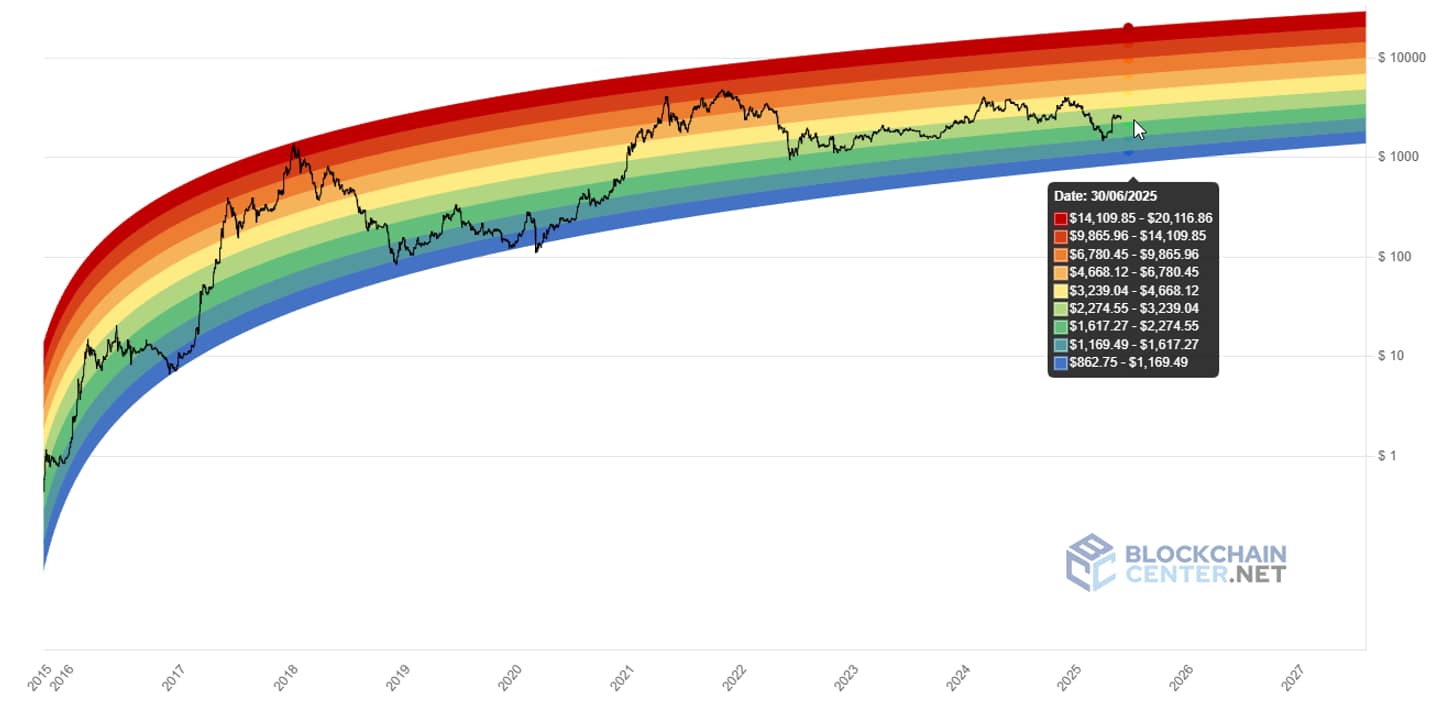

Ethereum (ETH) at present guarantees the $2,480 mark, with Rainbow Chart predicting that costs might fall to triple digits or rise to the five-digit vary by the tip of the month.

This chart makes use of logarithmic regression curves to trace Ethereum's historic worth efficiency and tasks future costs on a color-coded scale divided into 9 zones. Every zone represents a special stage of market sentiment, starting from important underestimation to intense overexcess.

On June thirtieth, Rainbow Chart forecasts its worth vary from $862 to $20,117.

The bottom coloration band labeled “Hearth Sale” is projected to be between $862.75 and $1,169. This vary signifies deep underestimation and uncommon buying alternatives. Above that, the band is “Purchase!”, starting from $1,169.49 to $1,617.27, and is taken into account an equally enticing entry level.

Second, the “accumulation” stage has grown from $1,617 to $2,274, suggesting a average bullish outlook. On high of that, the “nonetheless low-cost” zone covers the $2,274 to $3,239 vary. Right here, Ethereum is taken into account beneath truthful worth, however it rises attractively. At present costs, ETH is at present on this zone.

“Hoddle!” A band that ranges from $3,239 to $4,668. This band displays impartial to constructive feelings. On high of that, the so-called “Is that this a bubble?” zone ranges from $4,668.12 to $6,780.45 with worth momentum starting to attract consideration to the market.

At a better up, the “FOMO Enhancement” ranges from $6,780.45 to $9,865.96, bringing elevated speculative enthusiasm. As costs go up additional, the “Promote. Severely, Promote!” zone affords peak market warmth starting from $9,865 to $14,109.

The “most bubble territory” band, the highest zone, ranges from $14,109 to $20,116.86, suggesting excessive overvaluation.

Ethereum worth evaluation

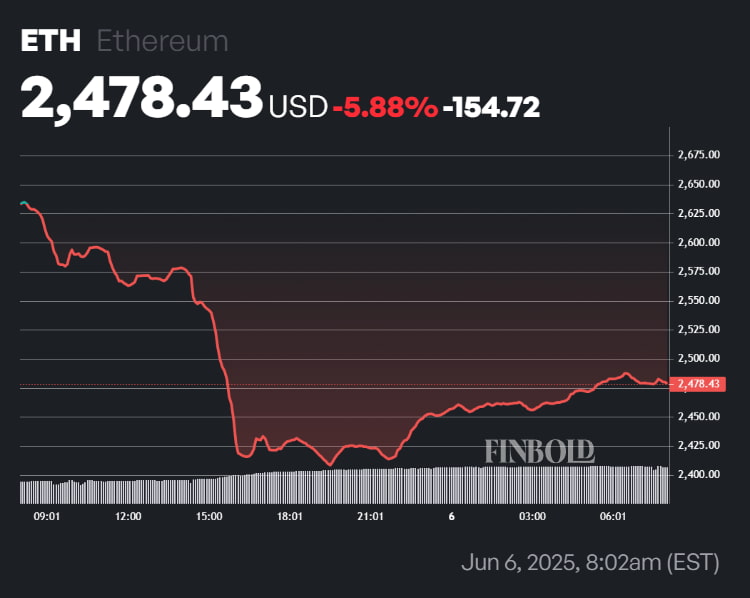

On the time of urgent, Ethereum is buying and selling at $2,478, a DIP of -5.88% over the past 24 hours.

This implies will probably be positioned someplace in the course of the “nonetheless low-cost” zone, and it’s buying and selling beneath truthful worth, and it’s probably that the attraction will quickly improve.

Actually, upcoming upgrades like Fusaka and Glamsterdam might enhance Ethereum's throughput and bullish long-term outlook. Nonetheless, elevated leverage might additionally improve the danger of volatility.

Moreover, the bearish sign features a shifting common convergence/divergence (MACD) histogram of -40 and a relative power index (RSI) of 46.72, suggesting integration.

Featured Pictures through ShutterStock