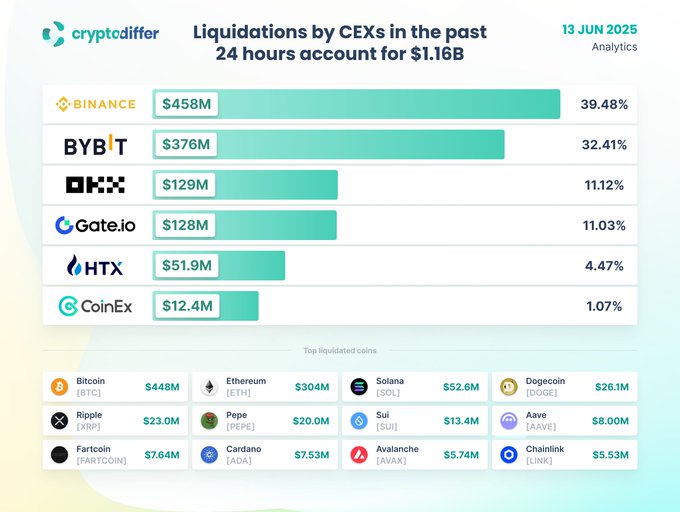

Analytical Platform Cryptodiffer reported $1.16 billion price of liquidation in centralized exchanges (CEXS) over the previous 24 hours. Geopolitical tensions, notably Israel's army strikes towards Iran, are extensively seen because the main drivers behind this sharp surge. The assaults have roared world markets, dwindled the worth of Bitcoin soaringly, resulting in widespread liquidation throughout main cryptocurrency exchanges.

Binance and Bibit drive 71% of cryptographic liquidation

Binance made the largest contribution to liquidation. The change liquidation totaled $458 million, accounting for 39.48% of the whole. BYBIT adopted behind, profitable $376 million, or 32.41% of the whole. Collectively, they accounted for over 71% of all liquidations, and had a significant influence on the cryptocurrency market.

sauce: x

Different exchanges additionally noticed appreciable settlement. OKX reported a $129 million liquidation, accounting for 11.12% of the whole. Gate.io has had a $128 million liquidation, accounting for 11.03%. HTX recorded $51.9 million liquidation (4.47%), whereas Coinex recorded $12.4 million, or 1.07% of the whole.

Bitcoin is dominated by a $448 million liquidation amid the turmoil of the market

The cryptocurrency that was considerably affected was Bitcoin (BTC). In complete, BTC positions price $448 million have been settled. Second place was Ethereum (ETH), which had a liquidation of $304 million. Solana (Sol), Dogecoin (Doge) and Ripple (XRP) are among the many different main cryptocurrencies, with liquidation price $52.6 million, $26.1 million and $23 million, respectively.

As of press time, Bitcoin was buying and selling at $104,756, marking a 2.85% decline over the past 24 hours. Within the meantime, Ethereum had skilled an much more substantial decline of 8.69%, presently at $2,514. The 2 largest cryptocurrencies have witnessed a large decline out there.

This surge in liquidation highlights the principle dangers of leveraged buying and selling in cryptocurrency. With leveraged capital, even small value modifications may end up in vital losses. Given the status of crypto market volatility, these occasions function precious classes for merchants.

With tensions within the Center East nonetheless not resolved, analysts warn that extra volatility and liquidation might be forward. In these unpredictable occasions, it reminds merchants to step rigorously when transferring into the market.

Associated: Crypto-Dispute: Bitcoin costs drop as we and Iran rumours escalate

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.