Over the previous few years, a wave of digital asset corporations has collapsed for causes. Some have been dragged into earlier disasters like FTX and Terraform Labs Fiascos. This offers a more in-depth take a look at a handful of wallets tied to the now-deprecated enterprise and a glimpse into what continues to be sitting on-chain.

The collapsed crypto entities nonetheless handle $1.5 billion on-chain wealth

These corporations have disappeared because of collapse and chapter, however such corporations tied to FTX have their wallets beneath the management of court-appointed chapter properties. These wallets quietly preserve a substantial quantity of worth within the wreckage and proceed to take care of a big sum of money. Terraform Labs collapsed in Might 2022, when the algorithm Stablecoin UST broke PEG, erasing about $45 billion and flattening three Arrows Capitals and corporations like Celsius.

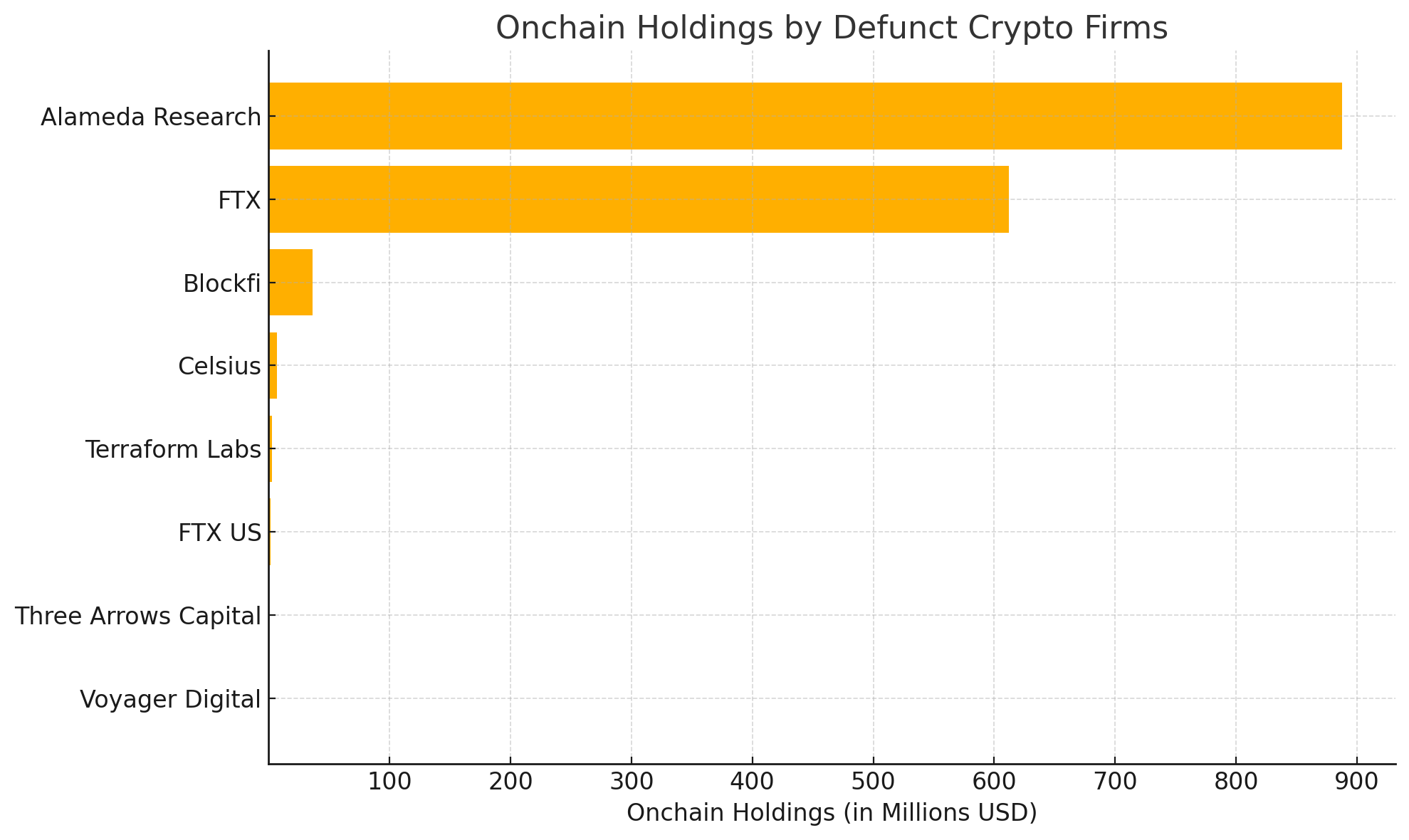

Following November 2022, FTX unleashed a wider shockwave after it was revealed that disclosures had misappropriated buyer funds and used them to assist their very own tokens. Nonetheless, as of June 14th, Arkham Intelligence information reveals Terraform Labs nonetheless holds $2.45 million on-chain. Most of its worth resides in two tokens. $1.09 billion with $1.26 million convex monetary tokens (CVX) and Governance Ohms (GOHM).

Subsequent is FTX. In response to Arkham, the bankrupt change controls a pockets holding $61.93 million in digital property. It has roughly $266 million in stems from 9.777 billion Oxy tokens. One other $232 million is tied to the platform's native token, FTT. Surprisingly sufficient, it nonetheless trades at $0.90 per coin. As of press time, the FTX pockets accommodates 257.87 million FTT. The corporate additionally holds $16.31 million on a map of about $52 million and FIDA.

FTX US, the now-deprecated American arm of the change, nonetheless manages $1,640,348 on-chain property, with Lion's share coming from 5.938 million trons (TRX). Blockfi, a crypto lender who filed for chapter in November 2022 following his publicity to FTX, has maintained $36.37 million with Digital Holdings. The vast majority of that complete is concentrated in Ethereum (ETH), with the corporate sitting at 12,223 ETH value $3,000.84 million.

The Celsius Community, which stopped its withdrawal in July 2022 amid liquidity points and a harmful wager, presently holds $6.89 million. Its greatest asset is $6.1 million in Savax and $576,000 much less in ETH. The pockets, tied to Voyager Digital, which filed for chapter in July 2022, returns $41,600 to a comparatively low $41,600, exhibiting minimal on-chain publicity.

In the meantime, FTX's quantitative buying and selling arm Alameda Analysis nonetheless holds a formidable $887.46 million in digital property. Of this, roughly $735 million is present in Solana (SOL), with the corporate's wallets set for SOL of 5.099 million. Alameda's reserves additionally embody ETH's $52 million and 205.006 BTC, value $21.61 million. In distinction, Three Arrows Capital (3AC) holds simply $46,036. On the time of writing, these eight out of date entities collectively maintain on-chain property of $1.546 billion.