International threat urge for food has been hit arduous as geopolitical tensions between Iran and Israel escalate as soon as once more. These conflicts usually inject short-term volatility into conventional and crypto markets. Ethereum isn’t any exception.

ETH has been comparatively steady at $2,500 in current weeks, however the rising worry within the macro market is starting to emerge in value construction and emotional modifications.

It is a delicate second for merchants. The ETH sits on the fringe of the vital vary.

Technical Evaluation

Shayan Market

Day by day Charts

Ethereum's day by day chart exhibits a transparent rejection from the $2,800 resistance space. This additionally coincides with the 200-day shifting common and bearish order block. After a powerful reduction rally from the $1,500 area originally of the quarter, ETH was built-in into an upward channel sample, however may now fall under that channel's decrease trendline.

This construction normally exhibits bullish momentum when the market is unable to push regardless of a very favorable short-term setup. The RSI has returned under the 50 mark, reflecting its bearish momentum.

Costs are at present re-entered into the midrange zone between $2,800 and $2,150. If Ethereum is unable to regain $2,800 instantly, the door will open for a transfer that would return to a help degree of $2,150, which coincides with the 100-day shifting common and the highest of the final main accumulation vary. The bouncing off of it is very important keep the broader bullish bias in current months.

4-hour chart

On the 4H chart, the property are damaged down from the upward channel, which has been revered for a number of weeks. The rejection from the $2,800 order block left an imbalance (FVG) close to the $2,600 zone, making a sudden drop that’s at present performing as a short-term resistance. This construction is just like the potential distribution stage, particularly when the value breaks beneath the channel with out recent buying strain.

Moreover, the RSI stays weak, hovering at just under 50, exhibiting no indicators of bullish divergence. Additionally, current bounces have lacked a notable quantity, suggesting that demand has change into dry as macro uncertainty looms. If a channel breakdown happens, ETH may retreat in the direction of a $2,300 demand zone. Dropping that space can result in a deeper correction to $2,100, so it's vital to maintain it.

Emotional evaluation

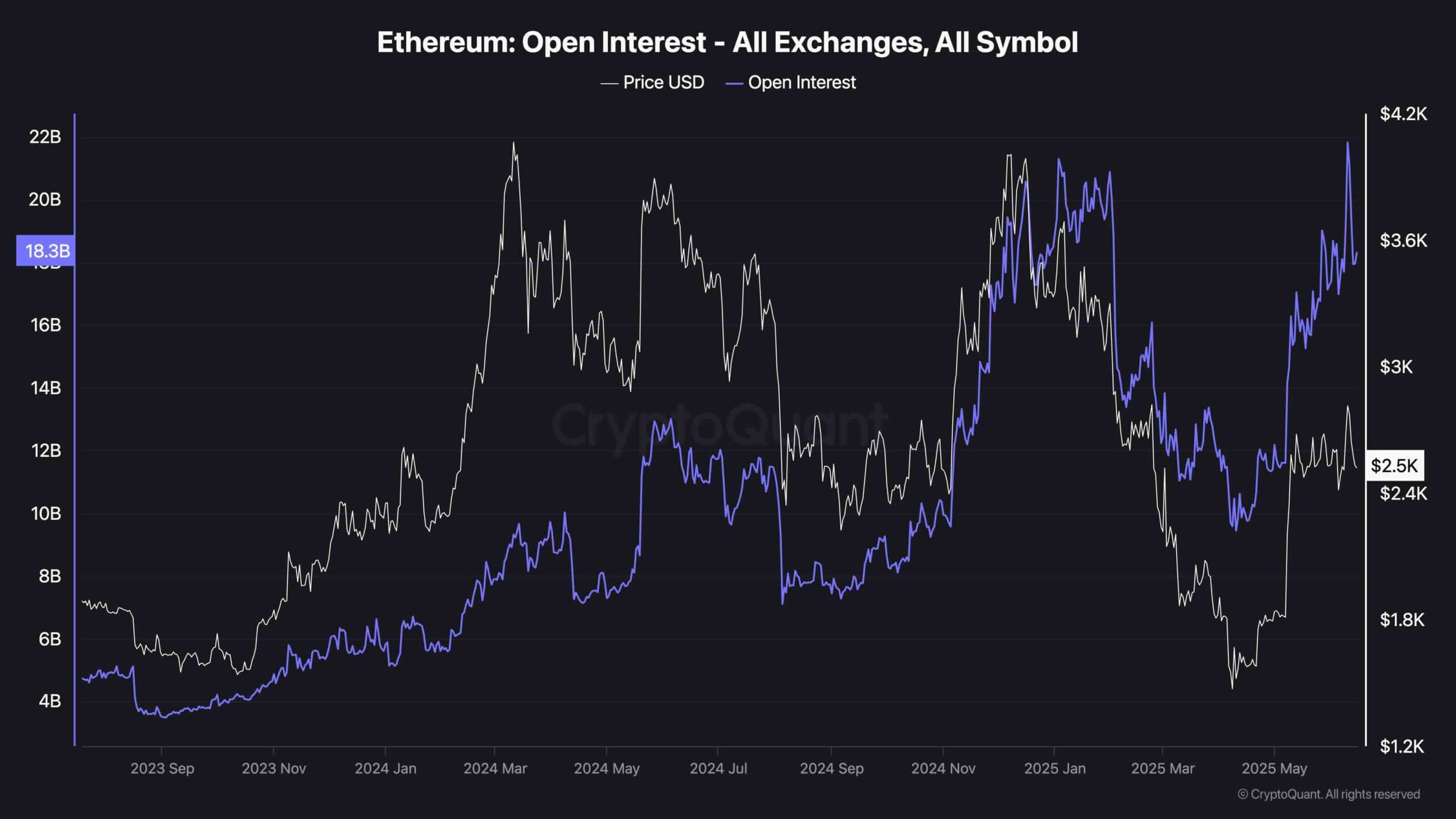

Ethereum Derivatives' open earnings (OI) reached its highest level over the previous few years, exceeding $21 billion earlier than experiencing marginal drops as a consequence of liquidity attributable to Center Jap tensions. What makes this growth much more fascinating is the truth that this surge in OI has occurred whereas ETH is buying and selling considerably decrease than when it rose.

This divergence normally signifies that the buildup of leveraged areas that aren’t flushed from the system is lengthy and brief.

Traditionally, such divergence of oi-prices usually precede large-scale liquidation occasions. If the market is unable to supply a clear breakout instantly, volatility spikes can happen attributable to rewinding stacked positions. This coincides with growing geopolitical threat, and will catalyze a fast re-rick as international buyers transfer to risk-off property. In different phrases, the by-product is flashing a warning. Even when costs stay calm, the undercurrent will not be steady.