Bond efficiency is within the trenches, however Bitcoin is at an all-time excessive. Savvy Monetary Advisors is now telling their friends to throw away their bonds and exchange them with codes.

Abra's Barhydrt predicts that Crypto will exchange the traditional 60/40 asset allocation

By allocating 60% of the capital to shares, 40% of the debt might result in a decades-long rule of thumb for diversifying the property of your consumer portfolio, and a so-called “60/40” mannequin, bonds, that are more likely to go down the trail of Dod Birds due to the crypto. Not less than that's what Invoice Barhydrt, CEO of Crypto Wealth Administration Platform Abra, informed Bitcoin.com Information in an interview.

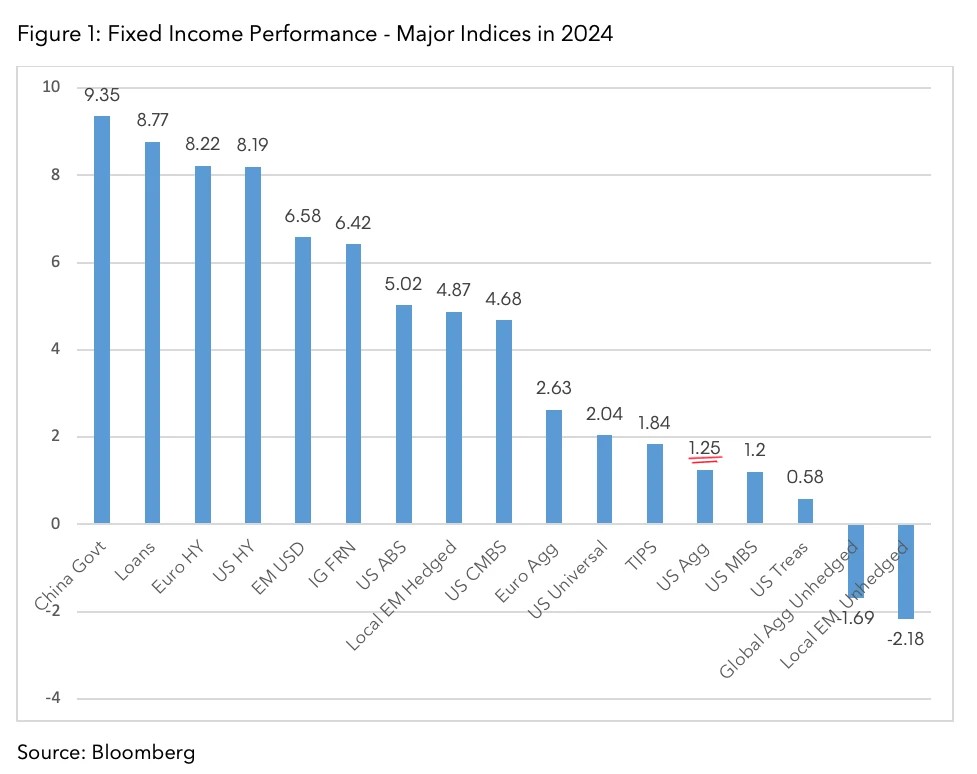

“Now, the normal mannequin of Wealth Advisor is the 60-40 mannequin,” defined Barhydrt. “And we all know how properly the '40' has finished,” he provides, hinting on the disastrous bond market efficiency over the previous few years. Bloomberg's US tally bond index returned simply 1.25% in 2024, a 0.05% worsening over the previous 5 years.

(Bloomberg's US Intensive Bond Index returned 1.25% in 2024 / Bloomberg)

With an eclectic background working for CIA, NASA, Goldman Sachs and Netscape, the online browser firm within the Nineties, Barhydrt first launched ABRA as a Bitcoin-based cash switch app. The corporate skilled a number of pivots earlier than touchdown on cryptocurrency administration.

“That's what occurs if you're early,” Burhid mentioned. “The market will let you know the place to go if you happen to're listening.”

Barhydrt appeared in 7th On the annual imaginative and prescient assembly held in Arlington, Texas on Tuesday, we won’t solely give shows, however we may also hear what the Funding Advisor group needed to say about Crypto. Conferences organized by the Council of Digital Asset Monetary Consultants (DACFP) often entice tons of, generally hundreds of advisers fascinated by cryptocurrencies.

“The environment has utterly modified,” Barhydt mentioned of the final sentiment on the assembly. “After we first introduced it at this occasion 5 years in the past, we went from “Sceptical Magical Web Manance Nonsense” to “Hey, we have to present this to our purchasers.”

Barhydrt defined that Tradfi Advisor has develop into the Crypto Evangelist of Ric Edelman, additionally founding father of the DAFCP, and introduced the demise of the 60/40 mannequin.

In accordance with a press launch from DAFCP, Edelman mentioned, “We have to exchange shares and bonds – shares and bonds – with shares, cryptos and bonds that includes.” “The proper allocation now’s to put between 70% and 100% of the consumer's portfolio in shares and crypto. Bonds are lower than 30%, and debt securities might be zero.”

With the potential flood of recent companies ready on the wing, Abra desires to ascertain himself as a go-to firm for advisors in search of crypto publicity of their purchasers' portfolios. The corporate affords not solely Spot Crypto, but additionally borrowing, lending, yields and different companies.

“If it's zeros (allotted), now’s the time to drop zeros,” says Barhydt. “Bitcoin represents the perfect financial alternative of our life.”