Bitwise's analysis director not too long ago shared an annual replace on the corporate's 2025 worth forecasts for Bitcoin, Ethereum and Solana.

Earlier this 12 months, we shared Bitwise of those finest cryptocurrencies and had been hoping for a powerful market rally. Six months later, specialists returned to debate what has modified, what’s secure, and the way the present market state of affairs has affected these forecasts.

On the Milk Street podcast, Ryan Rasmussen stated that worth predictions are on no account correct, however he’s assured that Bitcoin will attain $200,000. “We maintain Bitcoin strongly,” he confirmed.

Nevertheless, Bitwise fastened earlier targets for Ethereum and Solana. The corporate had beforehand forecast $7,000 for Ethereum, however now expects it to achieve its document excessive of simply over $4,500 by the top of the 12 months.

Associated: Ethereum is turning into a “grasp ledger” for finance, says co-founder Joseph Rubin.

Supply: TradingView

Solana was additionally anticipated to be costly, however is presently forecast to achieve a historic document of round $250. Rasmussen defined that international points corresponding to gradual retail curiosity, unsure markets and commerce tensions are delaying rallies the place international points are anticipated.

Associated: Solana and BNB are placing strain on a market that solely has one thing to do with Bitcoin

Regardless of reducing the short-term goal, Rasmussen believes the larger bull run shouldn’t be over. He stated the market cycle might develop in early 2026, with Bitcoin, Ethereum and Solana more likely to hit new highs on the time. He added that whereas latest occasions gradual the momentum of the crypto, there’ll stay sturdy long-term belief in these prime belongings.

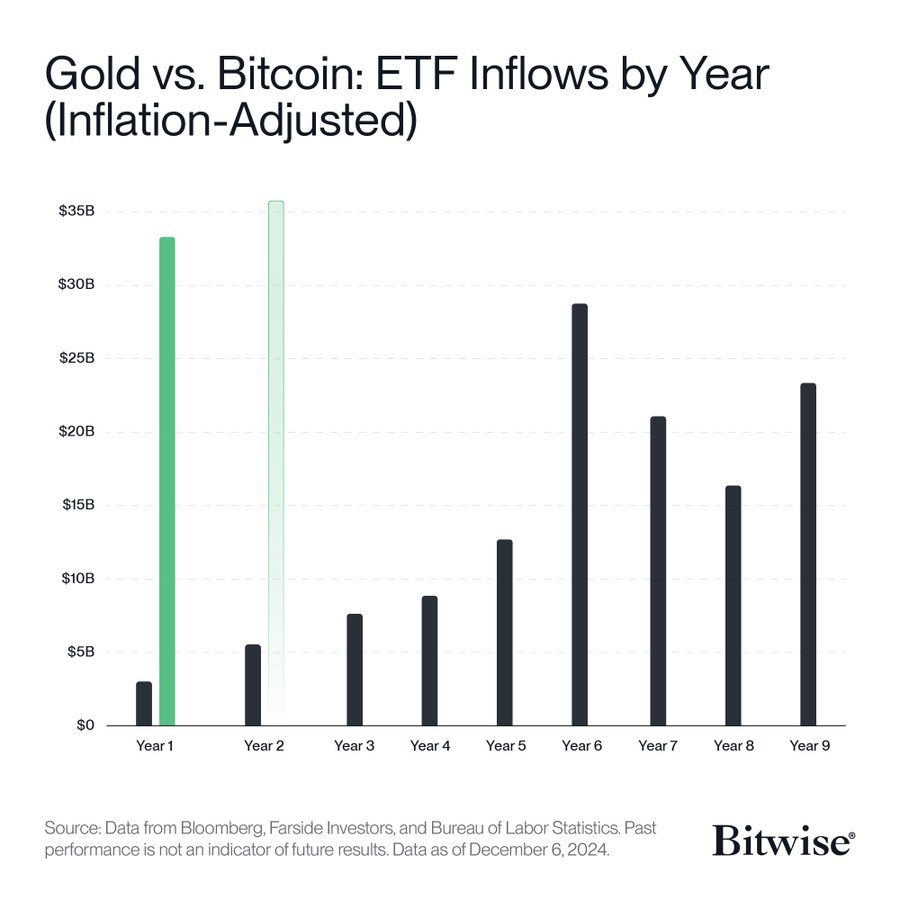

Bitcoin ETF inflows stay an essential issue

Bitcoin has been in comparison with gold by conventional buyers and establishments, but it surely was beforehand unusual. Many of those large gamers are unable to purchase spot bitcoin straight, so that they flip to ETFs for publicity.

Supply: Ryanrasmussen

Final 12 months, US Bitcoin ETF noticed a document $35 billion influx, seven instances greater than earlier information. To this point, in 2025, round $9 billion has flowed into Bitcoin ETFs. Though the tempo is slower than final 12 months, Bitwise nonetheless believes there may be quite a lot of undeveloped demand, and expects the overall annual influx to achieve between $3.5-40 billion.

Moreover, it was identified that 9 international locations would maintain Bitcoin as a part of a nationwide reserve or sovereign wealth fund earlier this 12 months. The quantity has now elevated to 11. Bitwise believes that extra governments will be a part of the listing by the top of the 12 months, however could not double what was initially forecast. He expects that round 15 international locations will be capable to maintain Bitcoin by the top of 2025.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.