This can be a section of the 0xResearch e-newsletter. To learn the entire version, Subscribe.

Crypto centralized exchanges are driving enterprise quickly lately.

And to get there, they're all utilizing their largest trump card: distribution.

Case examine primary.

Bybit introduced Byreal on Sunday. This can be a Solana Dex, scheduled to be launched later this yr. Together with Dex, there are additionally Ildo Cults (Revive Vault) and Token Launchpad.

Byreal routes liquidity from CEX by way of Hybrid RFQ (Citation Request) + CLMM (Concentated Liquidity Market Maker) mannequin. Due to this fact, Onchain customers can change Onchain at CEX's liquidity depth.

My guess is that BYBit customers also can entry Byreal from the principle CEX app.

Case Research No. 2.

A couple of days later, Coinbase introduced its direct integration into the Base DEXS change enterprise, which is scheduled to be rolled out this week. The dexes from different chains are additionally finally built-in.

This opens gas-free buying and selling entry to hundreds of altcoins for tens of millions of Coinbase customers (though the same old CEX buying and selling charges are nonetheless paid).

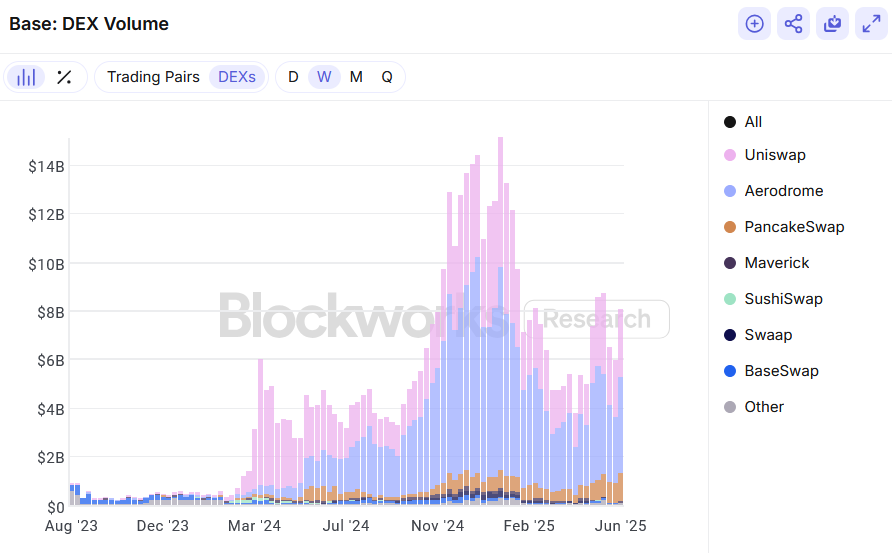

That's an vital tailwind for the bottom dex. In different phrases, it's aerodrome, the largest one. Aero tokens, which generate income from DEX buying and selling charges, have put a worth of 52% since its announcement.

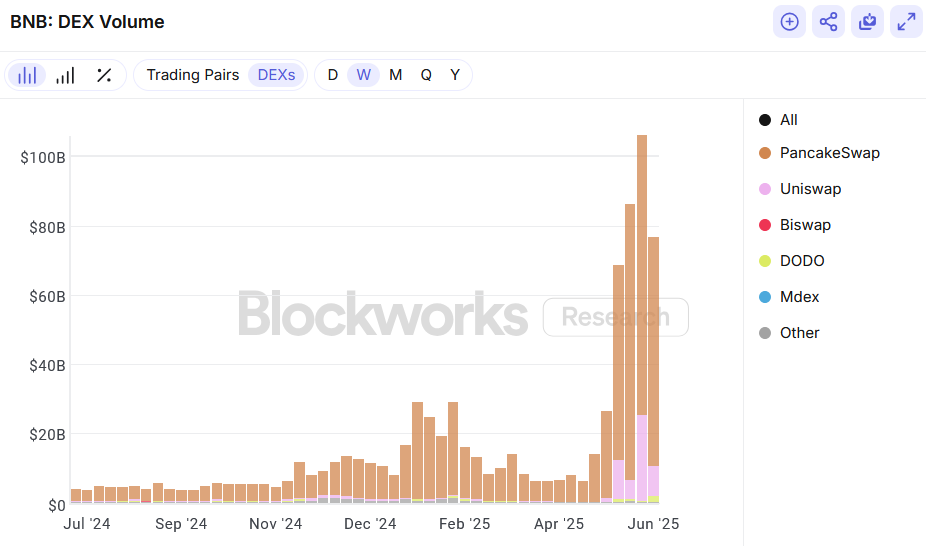

Supply: BlockWorks Analysis

Supply: BlockWorks Analysis

This isn’t the primary try by Coinbase to push Onchain out with some great benefits of its distribution. CBBTC, its wrapped Bitcoin merchandise, was bootstrapped utilizing Coinbase as the principle distribution rail.

By integrating Base's lending market beneath the hood, Coinbase CBBTC holders can simply borrow USDC in opposition to Bitcoin collateral with out leaving the Coinbase app.

Loading Tweets…

Case Research No. 3.

Binance and its extraordinarily difficult alpha marketing campaign have been operating since Could.

Inside Alpha there are quite a few “buying and selling competitions” that reward customers with “Alpha Factors” to commerce chosen belongings, which grant you the best to airdrop. However calling it a contest is deceptive. Most of those factors are distributed primarily based on buying and selling quantity, not P&L requirements.

It's puzzling till you understand there's a double-lined technique right here.

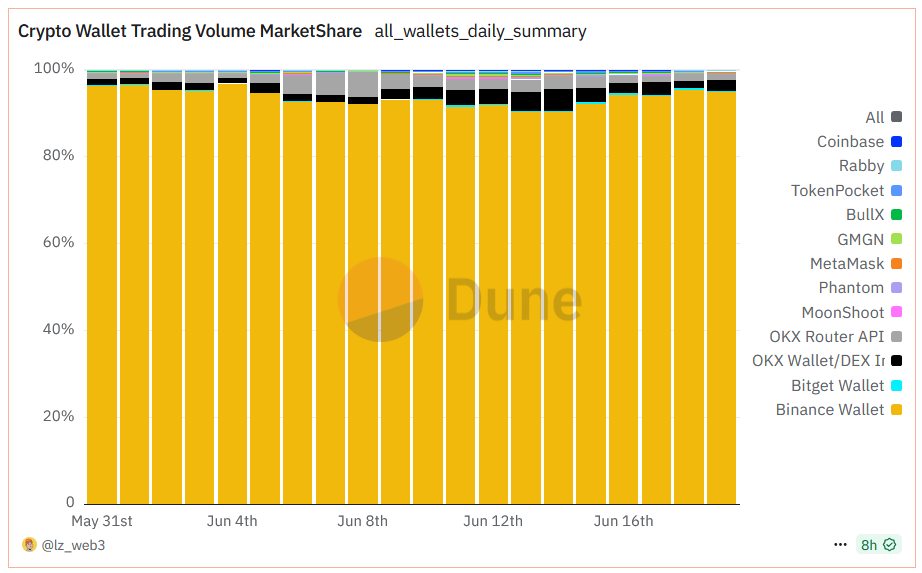

The primary prong is to encourage adoption of a benance pockets. Alpha Factors are solely eligible when you commerce utilizing a keyless binance pockets. This allowed Binance to completely management the “pockets market share” of crypto as proven under.

Supply: Dune

Supply: Dune

There are two issues to notice right here. For one factor, the actions are usually not natural.

Secondly, these are merely “Binance CEX” customers, and subsequently are usually not “Binance Pockets” customers.

As merchants nonetheless pay Binance CEX buying and selling charges, income seize is totally different from the income of MetaMask customers who pay for utilizing the in-app buying and selling function. Calling it “pockets market share” might be deceptive.

Nonetheless, Binance encourages the adoption of wallets, permitting customers to doubtlessly funnel customers with fragments of their infrastructure, which will be monetized later.

The second prong of the technique behind Binance Alpha is to strengthen its personal on-chain ecosystem with the BNB chain.

What drives these alpha token trades beneath the hood is the pancake swap that has exploded in quantity for the reason that alpha kicked off in Could.