At this time's Ethereum Worth: $2,510

- Ethereum Community has steadily added practically a million new addresses every week since Could.

- The Genius Invoice, which handed the Senate by 68-30 votes, is more likely to function a catalyst.

- ETH can undergo from a powerful failure if it can’t preserve the decrease restrict of key channels.

Ethereum (ETH) is buying and selling round $2,500 in its early Asian session on Friday, regardless of a surge in new handle progress over the previous month. The event follows advances in digital asset regulation after the rules and institution of nationwide innovation because the US Stubcoin (genius) invoice handed the Senate.

Ethereum's new handle surges amid developments in stablecoin invoice passages

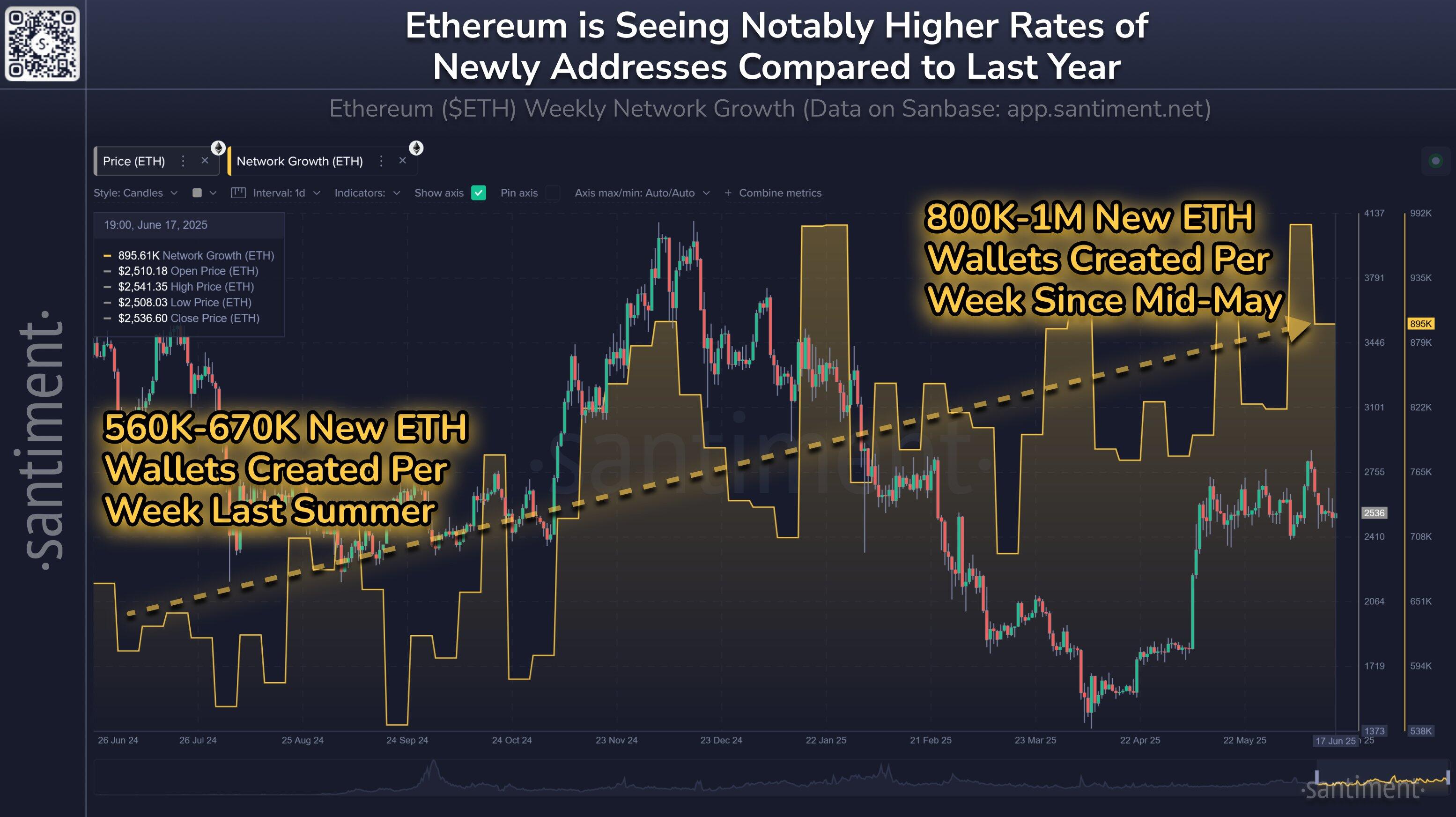

Santiment information reveals that the variety of new ETH addresses created in every week has elevated over the previous month, up a couple of third of the identical interval final yr.

“The quantity of recent weekly ETH addresses created ranges from about 800k-1m per week in comparison with a couple of third lower than this level final yr,” Santiment analyst wrote in X-Put up on Wednesday.

Deal with progress, significantly within the genius regulation, Stablecoin Invoice, has handed the Senate with robust bipartisan assist, following the constructive developments surrounding the Ethereum ecosystem over the previous month.

Progress of the ETH community. Supply: Santiment

President Donald Trump has urged Home Republicans to behave “lightning” in transferring ahead to his desk the Senate-approved genius invoice. He famous that lawmakers ought to go the invoice “as quickly as attainable” with out additional delays or changes.

“That is the perfect American sparkle, and we're going to point out the world how you can win with digital belongings like by no means earlier than,” Trump stated in a put up on the reality about social media platforms on Wednesday.

The Senate handed the Genius Invoice with a 68-30 vote on Tuesday, bringing the stablecoin Act nearer to the end line. Home Republicans are anticipated to think about the regulation quickly, with hopes amongst market members that the invoice shall be handed earlier than the August break. If handed, the Genius Invoice would develop into the primary crypto-related Congress to develop into regulation in america.

Most companies and banks are already searching for it This impact There are notable examples reminiscent of Apple, Amazon, JP Morgan, and Morgan Stanley, who’re exploring Stablecoin Options.

The Readability Act, which goals to ascertain a broader regulatory framework for digital belongings, has additionally contributed to rising curiosity in Ethereum. Bitcoin transaction. In line with information from Defilama, Ethereum Layer 1's Stablecoin's market capitalization is over $126 billion, a gradual enhance over the previous few weeks, displaying a 50.2% benefit over different blockchains.

“This may begin rebirth and switch blockchain into infrastructure, and develop into an infrastructure during which blockchain will develop into a world power-on, monetary infrastructure and varied different functions (social, logistics, provide chains, and so on.) shall be just like the web. fxStreet.

“ETH has lengthy been performing as a result of we have been below regulatory purgatory. Now, it lifts all the pieces up, so in some unspecified time in the future in 'Tech Play' it's very restricted to worth storage, international infrastructure like oil,” he added.

Ethereum value forecast: ETH should maintain a decrease sure on key channel to stop robust failures

Ethereum In line with Coinglas information, Futures has skilled a $16.59 million liquidation over the previous 24 hours, with an extended liquidation totaling $7.77 million and $8.82 million, respectively.

ETH continued to carry $2,450 in assist at 38.2% because the 200-day Easy Shifting Common (SMA) proved tough to beat Fibonacci Retracement. The degrees are bolstered simply above the decrease bounds of the important thing channel as a result of convergence of the SMA and exponential transferring common (EMA) over 50 days.

ETH/USDT Day by day Chart

As quantity continues to lower, ETH should preserve a decrease boundary of key channels to stop robust failures. Holding this stage and sustaining motion above SMA for 200 days can doubtlessly retest the channel's higher restrict resistance. Nevertheless, failures under the decrease boundary might ship ETH to the $2,260-$2,110 vary, and is enhanced by a 100-day SMA.

The relative energy index (RSI) and the stoch oscillator (Stoch) transfer sideways throughout impartial ranges, displaying barely dominant bearish momentum.