It additionally withstands momentum alerts. The relative power index (RSI) sits at 69 close to an extra degree, however refers to persevering with curiosity from the Bulls. The current bullish cross on the transferring common helps the potential for being extra the wrong way up within the close to future. These indicators replicate power quite than fatigue at this stage.

- Miners slowly switch cash to change, suggesting nerves with extra damaging aspect actions.

- Costs nonetheless maintain inside bullish chart setups, however the elevate requires a clear break of over $105,000.

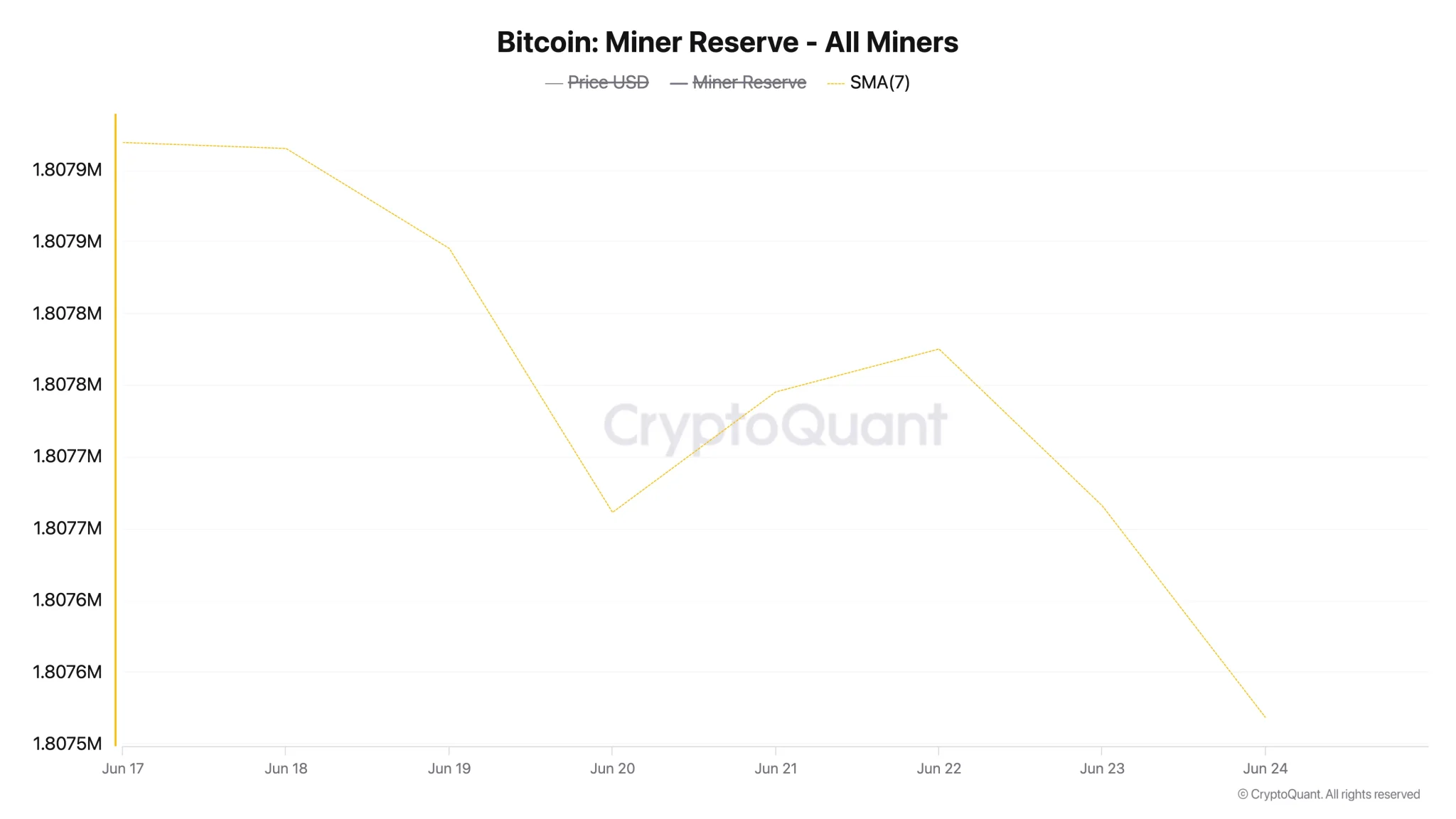

Bitcoin miners seem to point out restraint, trimming publicity and bracing maybe attributable to wider market weak spot. Minor reserves monitoring the quantities held by Bitcoin Miners have dropped simply 0.022% over the previous week on a seven-day common. Though small, this transformation means that some miners are leaning in direction of gross sales.

This shift refers back to the decline in reliability, particularly after Bitcoin fell beneath the $100,000 degree over the last two buying and selling periods. That value acts as a psychological line for a lot of, and drops by way of it could point out an elevated uncertainty throughout the market.

Supply: Cryptoquant

Including weight to this emotion is a pointy 55% spike within the miner's place index (MPI) inside three days. This metric compares the quantity that Bitcoin miners ship in exchanges in opposition to the common of 1 yr. Normally, a rise in MPI means miners are transferring extra holdings for change. Normally, they’re indications that they will promote.

Market tensions develop as Bitcoin miners go away

Latest tendencies in MPI recommend a rise in gross sales exercise, suggesting miners are assured in Bitcoin's short-term efficiency. The shift in cash from wallets to exchanges reveals the assumption that costs will both go down even additional or that they will be unable to realize upward traction for now.

Nevertheless, some analysts retain a special view. Cryptoooelites expresses and says strong optimism,

In the event you assume that the rally hasn't come for Bitcoin, you most likely don't know something.

One other market watcher, Analyst Jere, believes Bitcoin stays in a bullish pennant sample. He mentioned that the primary breakouts from this sort of setup are sometimes misleading. He mentioned that when costs regain power and exceed $110,000, they break by saying, “This can fly a lot increased.”

#bitcoin is again in bullish pennant!

Normally, utilizing these patterns, the primary breakout is faux. If costs flip again, a real breakout is correct across the nook.

Above $110K, that is a lot increased.

Take a look at 👀pic.twitter.com/tislkcur8i

-Jelle (@cryptojellenl) June 24, 2025

Cup and Deal with Targets $144K – Close to Key Breakout

Bitcoin at the moment reveals cup and deal with patterns on its day by day chart. This can be a setup that merchants typically relate to upward actions. The worth is traded inside the deal with part, with resistance sitting at $105,000. This degree additionally coincides with a easy 50-day transferring common. Close by above it paves the way in which to $109,000, representing the patterned neckline.

Breaking $109,000 with a powerful quantity may pave the way in which for a retest of its Could twenty third excessive of $112,000. If Bitcoin was closed on it, merchants started monitoring all targets within the Cup Sample at $144,000. That is about 37% above the present value.

Supply: TradingView