The Fee is getting ready to current a brand new information to regulating the Stablcoins market, in line with a Monetary Occasions report knowledgeable of its content material.

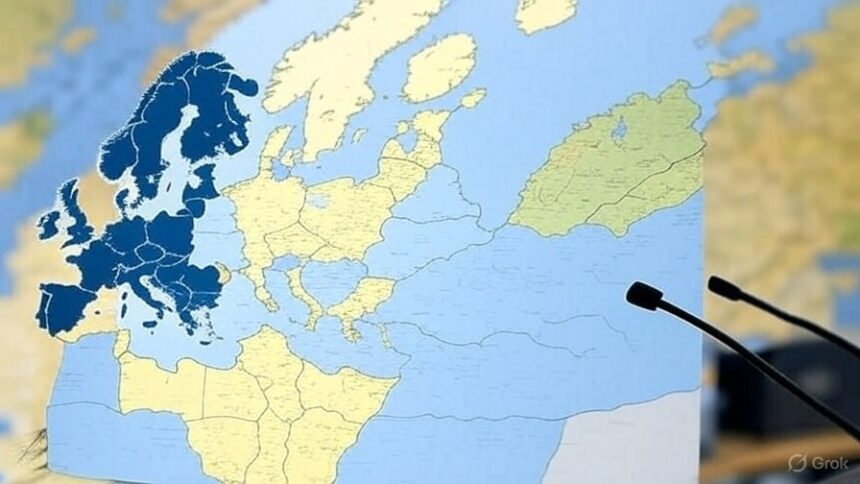

Based on the informants, the initiative created friction with the European Central Financial institution (ECB). Regardless of monetary establishments' warnings concerning the dangers these belongings could symbolize for monetary stability, Brussels seems to be decided to maneuver ahead.

These are anticipated to be deliberate by the European Union company. I suggest that stubcoins launched outdoors the eurozone may be thought of exchangeable for authorised comparable variations throughout the blockin the event that they correspond to the identical broadcast or come from the identical operator.

ECB President Christine Lagarde warned in entrance of the European Parliament Stubcoins pinned to the US greenback symbolize dangers to the euro's financial coverage and monetary stability international. He additionally emphasised the significance of creating sturdy requirements, significantly once they function at a cross-sectional stage, to keep away from strengthening their acquisition of US forex.

The ECB exhibits that holders of silly situations issued outdoors the European Union can try to redeem belongings throughout the group's monetary system. This can put strain on the reserves and, in the end, the blockbanks..

Based on laws in impact within the European Union, stubcoin issuers throughout the territory should preserve a big portion of European financial institution reservations and permit customers to redeem the token instantly.

The European Central Financial institution raised it to cut back danger The necessity for different nations to grant authorized ensures that permit efficient switch to the European Union in instances of disaster. The measure seeks to stop assist belongings from falling uncontrolled of European supervisors earlier than they’re applied on overseas stubcoins.

Nevertheless, this month's closing door assembly confirmed that there aren’t any bilateral or multilateral agreements between the European Union and different jurisdictions that acknowledge its laws as comparable or promote the implementation of its ensures.

The European Union is pushing for stablecoins laws, however necessary legislative actions are additionally registered within the US. As reported by Cryptootics, The Senate has authorised the Genius Act with widespread bipartisan assist.

Along with being topic to common audits to make sure transparency and security, the Genius Act proposes that stubcoin emitters require that they preserve full assist in US {dollars} or equal liquid belongings.

Senators Invoice Hagerty and Tim Scott, the principle drivers of the regulation, spotlight that. The initiative seeks to strengthen US management within the digital monetary sector and strengthen the position of the greenback as a world reserve forex.

Based on Hagerty, the mission not solely encourages the large adoption of stubcoin within the conventional economic system, but in addition permits it to place its releasers as a few of the biggest holders of American treasure bonds by 2030.

(TagStoTRASSLATE) Cryptocurrency (T) Newest authorized body (T) Steady (T) European Union