This can be a phase of the Provide Shock E-newsletter. Subscribe to learn the complete version.

Eight years in the past, round this time, just one factor was approaching turning Bitcoin overturned.

In June 2017, Bitcoin was within the ultimate levels of warming up in the hunt for a historic push of practically $20,000 by Christmas.

The costs of the Altcoin have been eccentric. Bitcoin is flat for per week, however cash like Bitshares soar considerably by 250%. Others like Stratis and Digibyte have dropped by as much as 50% over the identical interval.

In the meantime, Ethereum was poised for an explosion of token tasks. One research calculated that $7 billion had flowed into ICOs all through 2017. That is seemingly 4 instances larger than inventory investments in crypto firms over the identical interval.

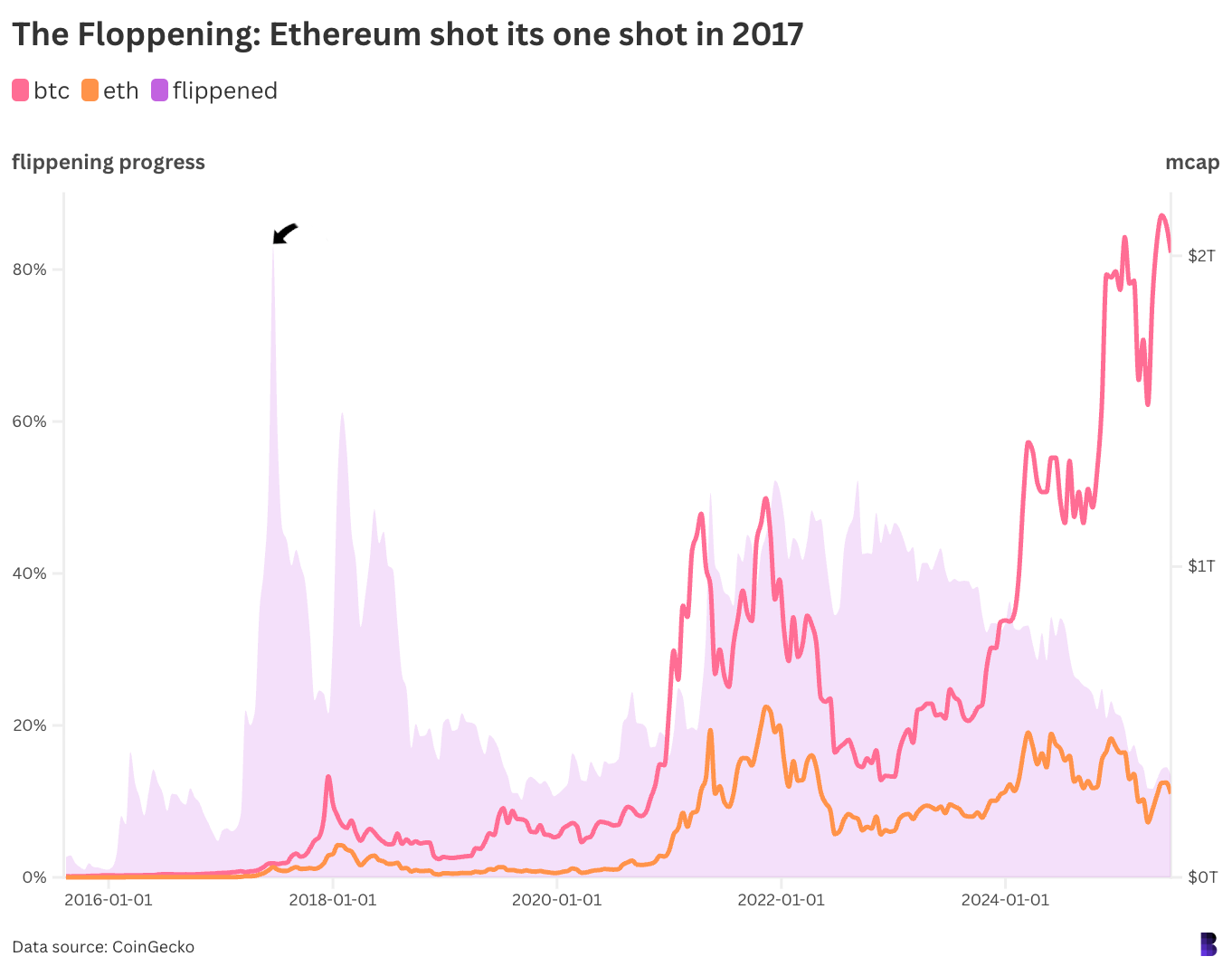

ETH costs rose as buyers loaded into coin choices by Ethereum's native tokens. And on June twelfth, ETH's market capitalization was inside 17% of Bitcoin, starting from $36.8 billion to $44.3 billion.

Had Bitcoin stayed flat, ETH would have needed to soar from $400 to $470 and slide to primary.

This New York-era banger was revealed just a few days in the past.

This New York-era banger was revealed just a few days in the past.

However that's by no means the case: each BTC and ETH will drop 60% subsequent month, main the best way to the top of the BTC bull market, however solely 9 instances the case for ETH. The ether by no means retreated the bottom.

By late June 2017 it was starting to turn into clear that flipping was not life like.

By late June 2017 it was starting to turn into clear that flipping was not life like.