Crypto's lawyer John E. Deaton rekindled hypothesis a few potential Ripple early public providing (IPO), claiming that the success of the digital asset firm Circle's public debut offered a transparent benchmark for what was value. His evaluation means that if Circle can order a excessive score, the $100 billion valuation of the Ripple IPO will probably be “not far-off.”

Deaton's commentary focuses on a direct comparability of the monetary strengths of the 2 firms, highlighting the large-scale XRP holdings from Ripple supply vital advantages.

@Bgarlinghouse is aware of that @Ripple unexpectedly stated it wasn't public. They definitely don't want to boost capital. That's usually the primary purpose for publishing. Nonetheless, IPO timing can be a significant consideration. @Ripple, nearly 40B XRP, if @Circle can attain the market capitalization of 62B-75B, @Ripple, nearly 40B XRP,… https://t.co/msfnmy6i8e

-John E Dealon (@Johnedeaton1) June 23, 2025

Circle IPO as an analysis benchmark

The core of the dialogue depends on a easy comparability of market values. Circle, writer of USDC Stablecoin, has achieved a public valuation of the landmark and units a brand new precedent for the way digital asset firms are valued within the open market.

Deaton's view is that if the market turns into a circle on the present degree, Ripple, which has a basically bigger and extra worthwhile stability sheet by means of the retention of its monumental tokens, can logically order a better score whether it is revealed.

Ripple's monetary firepower

To assist this case, the evaluation factors to Ripple's personal Treasury Ministry. Ripple at present holds round 40 billion XRP, which ends up in a valuation of round $80 billion at a buying and selling worth of $2.15. This estimate relies on in the present day's costs and the distribution provide of 59 billion tokens for XRP. Specifically, XRP's market capitalization now reaches over $116 billion, highlighting its place because the dominant power within the crypto sector.

This substantial stability sheet signifies that Ripple permits for strategically spending time on potential IPOs, relatively than the pressing want to boost capital. Nonetheless, the success of different crypto-related IPOs could make public lists extra interesting.

XRP Market and Technical Context

This excessive degree of valuation dialogue is being held towards the backdrop of a cautious XRP market. The XRP worth is at present at $2.15, a rise of 5.90% over the past 24 hours, however a lower of 4.5% over the past 7 days.

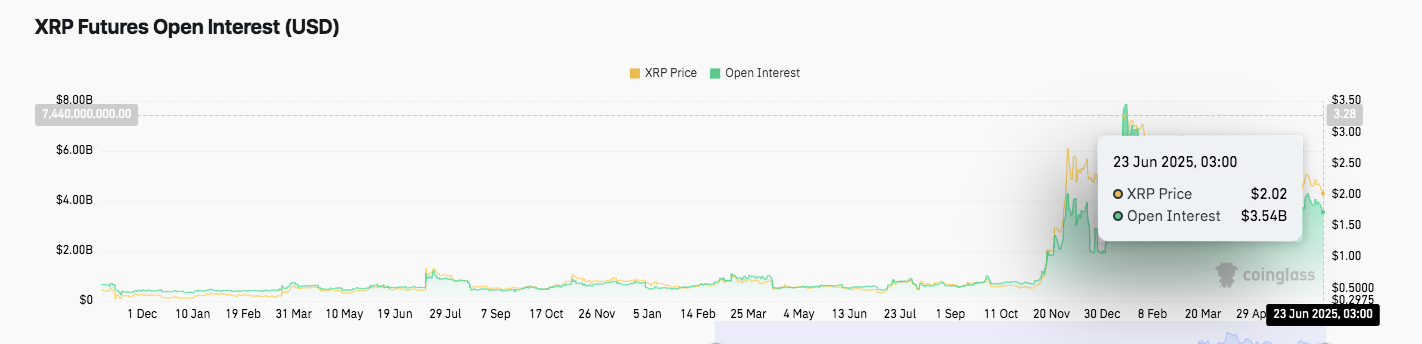

Open curiosity knowledge for XRP futures gives deeper perception into market conduct. For many of 2024, open curiosity was under $2 billion.

Supply: Coinglass

Nonetheless, it surged quickly in late November, reaching $7.444 billion by early 2025. This enhance displays XRP's bullish worth rally. As of June 23, Open Curiosity has far surpassed the $3.54 billion rally degree, indicating a strong involvement for merchants.

XRP/USD Day by day Worth Chart, Supply: TradingView

Nonetheless, merchants' curiosity stays excessive, however technical indicators counsel warning. A relative power index (RSI) of 32.68 signifies that XRP is approaching unsold territory. Traditionally, such ranges have brought about a worth rebound to a notable rebound.

The MACD indicators at present counsel destructive momentum, however each strains are under zero, decreasing the bear stress suggesting a doable shift. Moreover, constant engagement in futures buying and selling signifies that merchants are nonetheless positioned for additional volatility, or maybe restoration.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.