- Bitcoin Miner's income fell to $34 million, marking its lowest mark since April 2024.

- Whale habits is combined as small holders are offered and medium-sized wallets accumulate.

- The Bull flag signifies that breakouts above $109,000 may push Bitcoin to greater than $146,000.

Bitcoin miners are continuously experiencing income on the lowest. In keeping with Cryptoquant, the miners generated simply $34 million each day in June. That is the bottom stage since April. This fall, buying and selling charges can be diminished by 50% and Bitcoin costs can be diminished by 15%. The 2 metrics have a serious influence on the profitability of the miners.

Bitcoin Miner noticed the worst payday of the 12 months.

Day by day income fell to $34 million in June, the bottom since April.

Falling charges and Bitcoin costs are crushing margins. pic.twitter.com/txdn06cu1f

– cryptoquant.com (@cryptoquant_com) June 26, 2025

In keeping with the chart supplied by Cryptoquant, the income parameters are much like these for July 2022. This sudden drop has raised considerations concerning the sustainability of the mining trade resulting from elevated working prices. Mining corporations are pressured to promote reserves or droop operations to scale back losses.

A decline in profitability happens when Bitcoin is tough to crack $108,000 in resistance. Whereas the community foundations stay sturdy, miners' give up may introduce short-term gross sales pressures if miners offload cash to cowl prices.

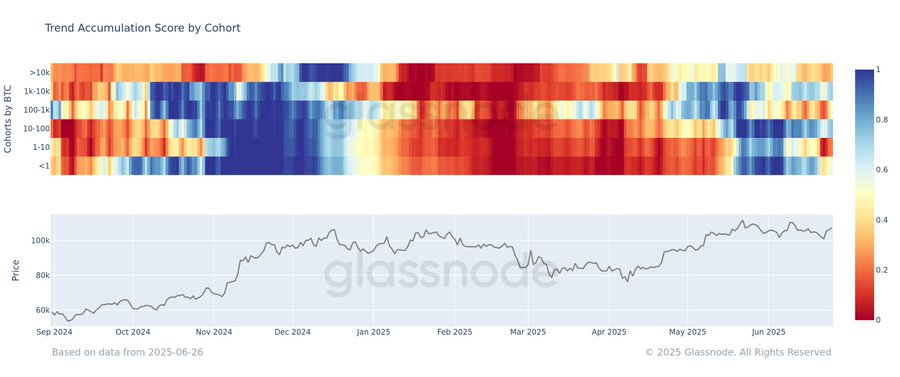

Combined whale habits suggests market uncertainty

GlassNode knowledge reveals pictures break up between bitcoin holders. Small whales of 1-10 btc actively redistribute them, however bigger buyers with 10-100 btc BTC are starting to build up them. This variance speaks to the contradictions within the whale strategy.

Supply: GlassNode

The buildup development rating elevated from 0.25 to 0.57, indicating that medium-sized buyers are as soon as once more . Nevertheless, with out wider whale aggregation, the route of costs stays unsure within the close to future.

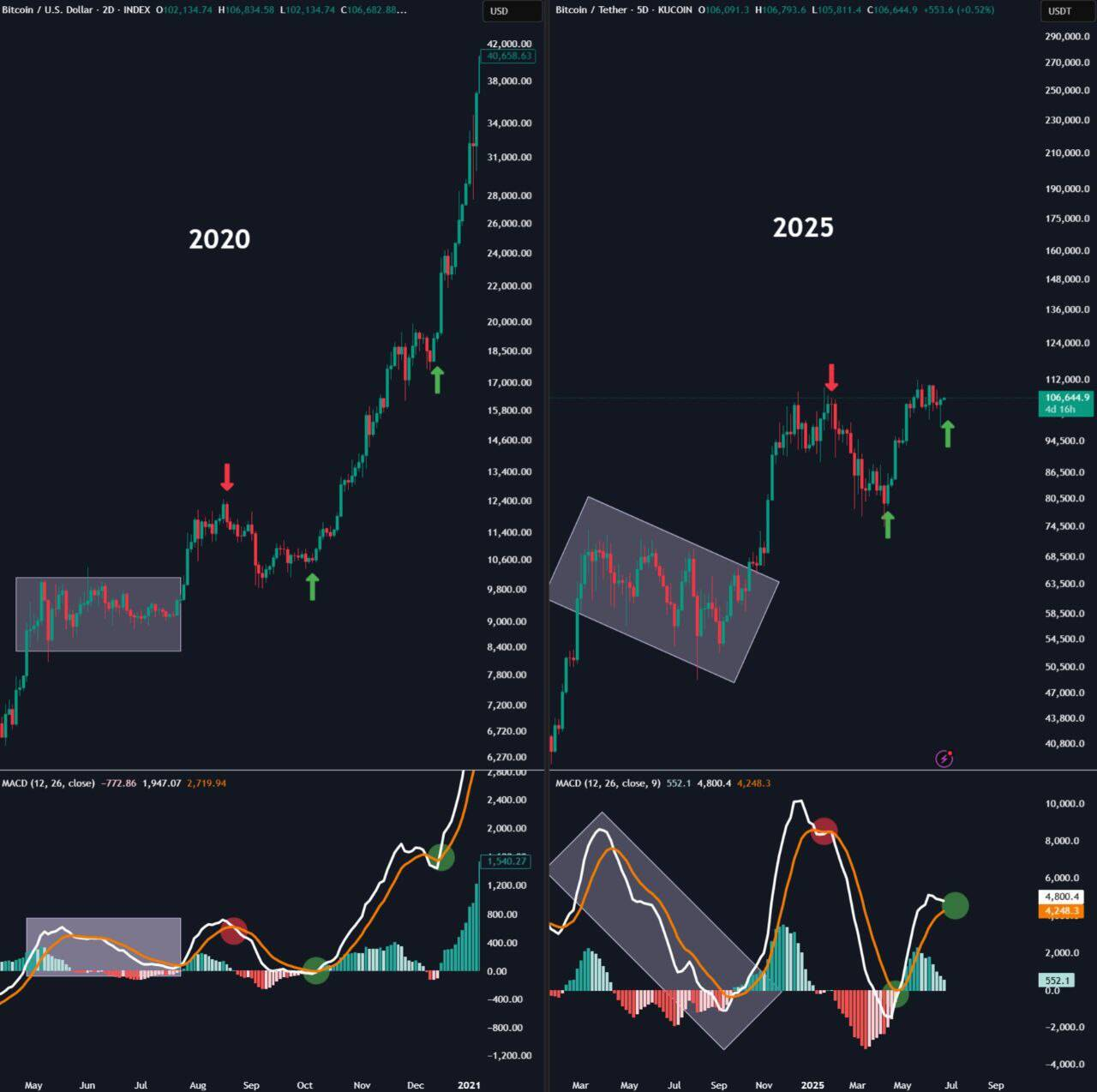

Bitcoin was structurally bullish regardless of the whale sign, which is the alternative of the stress of miners, based on analysts. The combination between $102,000 and $108,000 created the Bull Flag. This can be a technical formation that results in nice breakouts.

Market analyst Cas Abbe stated in a put up on X that there’s a attainable breakout just like the 2020 cycle. He compares the 2 durations and reveals the key rally patterns of MACD's crossover, vary breakout, and the final rally that Bitcoin has made.

Supply: x

Abbè is concentrating on a transfer from $150,000 to $180,000 earlier than a blow-off prime in the direction of the second half of the cycle. He dismisses the supercycle declare and reminds everybody as soon as once more that Bitcoin continues to be in its regular four-year cycle. His place has all the time been out there, so after creating a brand new finest, he strengthens his expectations in a deep set-off.

If the MACD indicators keep bullish momentum, Bitcoin may rise from 50% to 80% by October. This projection is according to Abbè's side-by-side chart evaluation evaluating patterns from 2020 and 2025. Each durations share virtually the identical setup and weight the prediction.