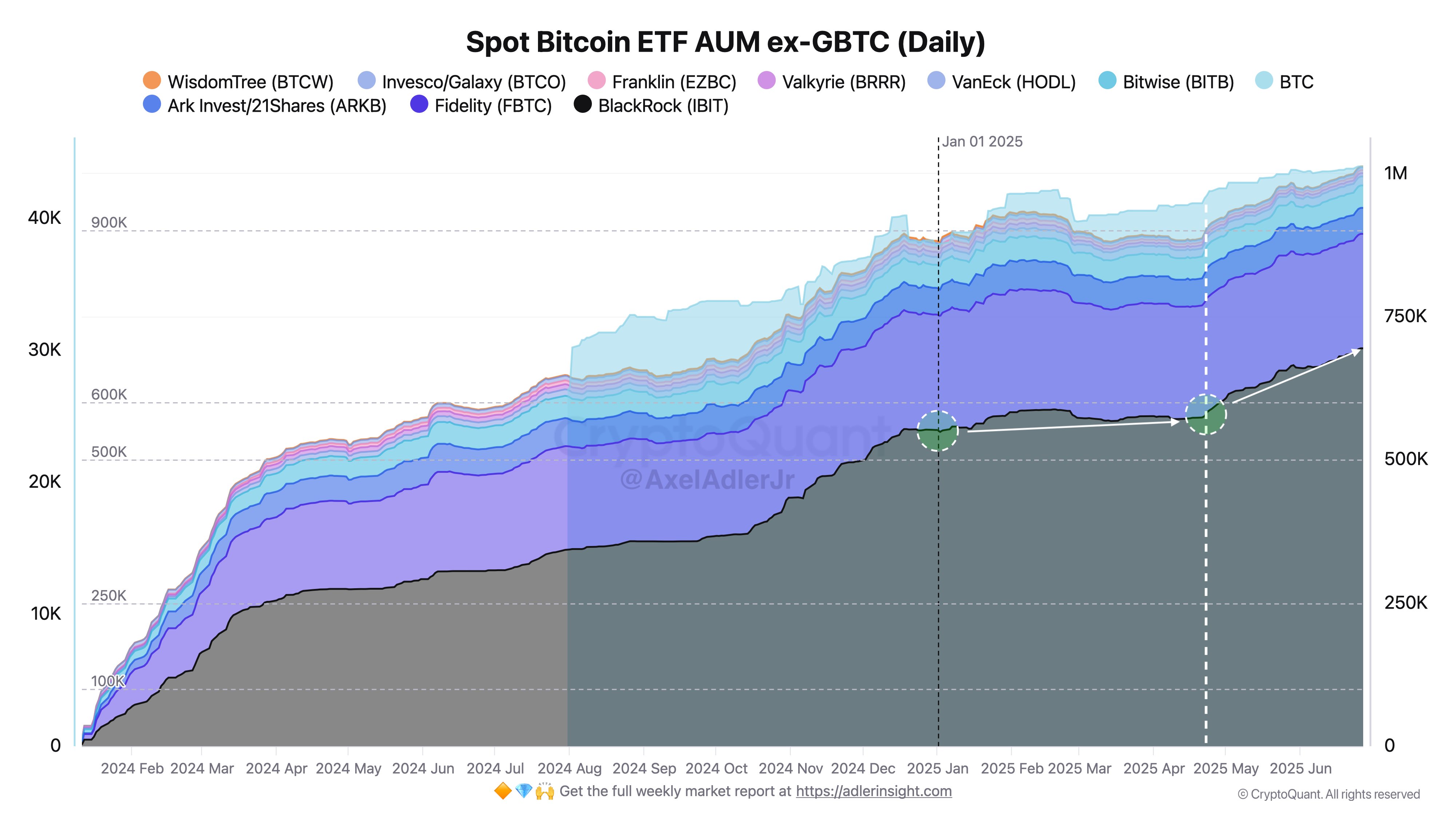

The US Bitcoin Spot ETF has been one of many predominant robust drivers of the market cycle, and institutional traders have been launched into the BTC ecosystem. In 18 months, ATF secured 6.25percentof Bitcoin's market cap out there.

Curiously, AXEL Adler Jr., a distinguished market analyst, factors out the current optimistic development within the Bitcoin ETF area, suggesting extra possible and robust for the following few months.

By September, Bitcoin Spot ETF may have 1.2 million BTC -Analysts

On June 28, market analyst Axel Adler Jr. emphasised a robust development of the buildup sample of US Bitcoin Spot ETF over the previous three months.

The well-known analysts clarify that the ETF's AUM web belongings, aside from Grayscale GBTC, have elevated considerably from 932,000 BTCs to 1,056,000 BTC in April 2025. This improvement exhibits web revenue of 124,000 BTC for 87 days, and a mean of 1,430 BTCs per day exhibits spectacular influx.

As a controversial market chief, BLACKROCK IBIT occupies most of this development, which attracts 1,360 BTCs a day with deposits of most of this development. In distinction, the remaining 11 ETFs mix a complete of 6,000 BTC or 70 BTC a day to point a transparent focus of traders' curiosity in Blackrock's merchandise.

In keeping with ADler JR., if an institutional investor maintains a 1,430 BTC accumulation pace, the Bitcoin ETF is within the strategy of hitting 1,840,000 BTC AUM by September and indicating 9.25percentof the circulation BTC token. Throughout the whole Blackrock Ibit is predicted to have about 817,000 BTC.

Together with GBTC's present AUM, ADler JR. predicts that US Bitcoin SPOT ETFS may have a big variety of web belongings of greater than $ 195.4 billion.

Bitcoin value define

On the time of writing, Bitcoin is buying and selling at $ 107,339, which displays a small value of 0.28percentduring the last 24 hours. In the meantime, the day by day buying and selling quantity of belongings decreased by 33.88% and price $ 30 billion.

In a bigger time-frame, Pryptocurrency additionally maintains optimistic efficiency with 5.61percentand 1.06percentof the weekly and month-to-month charts, respectively, exhibiting potential optimistic momentum after a couple of weeks of bounds.

Because the institution of a brand new file of $ 111,970 in late Could, Bitcoin has been tough to discover a brand new value vary, and as an alternative, it has settled on a down channel between $ 100,000 and $ 110,000.

Libertex's predominant picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing normal and every web page is diligent within the high know-how consultants and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.