After falling under the rising flag sample, Ethereum boosted it to retest the damaged trendline. If gross sales at this stage of stress intensifies, a deeper drop to the $2K help zone may proceed.

By Shayan

Each day Charts

ETH has just lately collapsed from the ascending flag sample, inflicting a correction stage. After discovering robust help across the $2.1K stage, the cryptocurrency bounced again and retarded at $2.4k in the direction of the damaged pattern line.

Regardless of the rebound, the dearth of serious volatility and waning momentum round this important stage means that patrons are being exhausted. If gross sales stress will get stronger right here, ETH might full that pullback and lengthen the modification.

On this case, the $2K mark has appeared as the following main defensive zone the Bulls try to regain management.

4-hour chart

Zooming into the 4-hour timeframe, ETH initially discovered robust help within the 0.5-0.618 Fibonacci retracement zone. This can be a traditionally dependable stage underneath revision.

A pointy response from this vary prompted fast motion. Nonetheless, the rally is at present stagnating exactly on the decrease restrict of the earlier flag, and is now serving as a resistance of practically $2.4k.

This rejection will increase the probabilities of one other downward leg except the customer can shortly regain management. The $2.1K zone overlapping with FIB help stays an vital battlefield.

So long as this space is retained, the market construction retains bullish bias. Nonetheless, in the event you violate it, it may pave the best way for a deeper decline to $2,000.

By Shayan

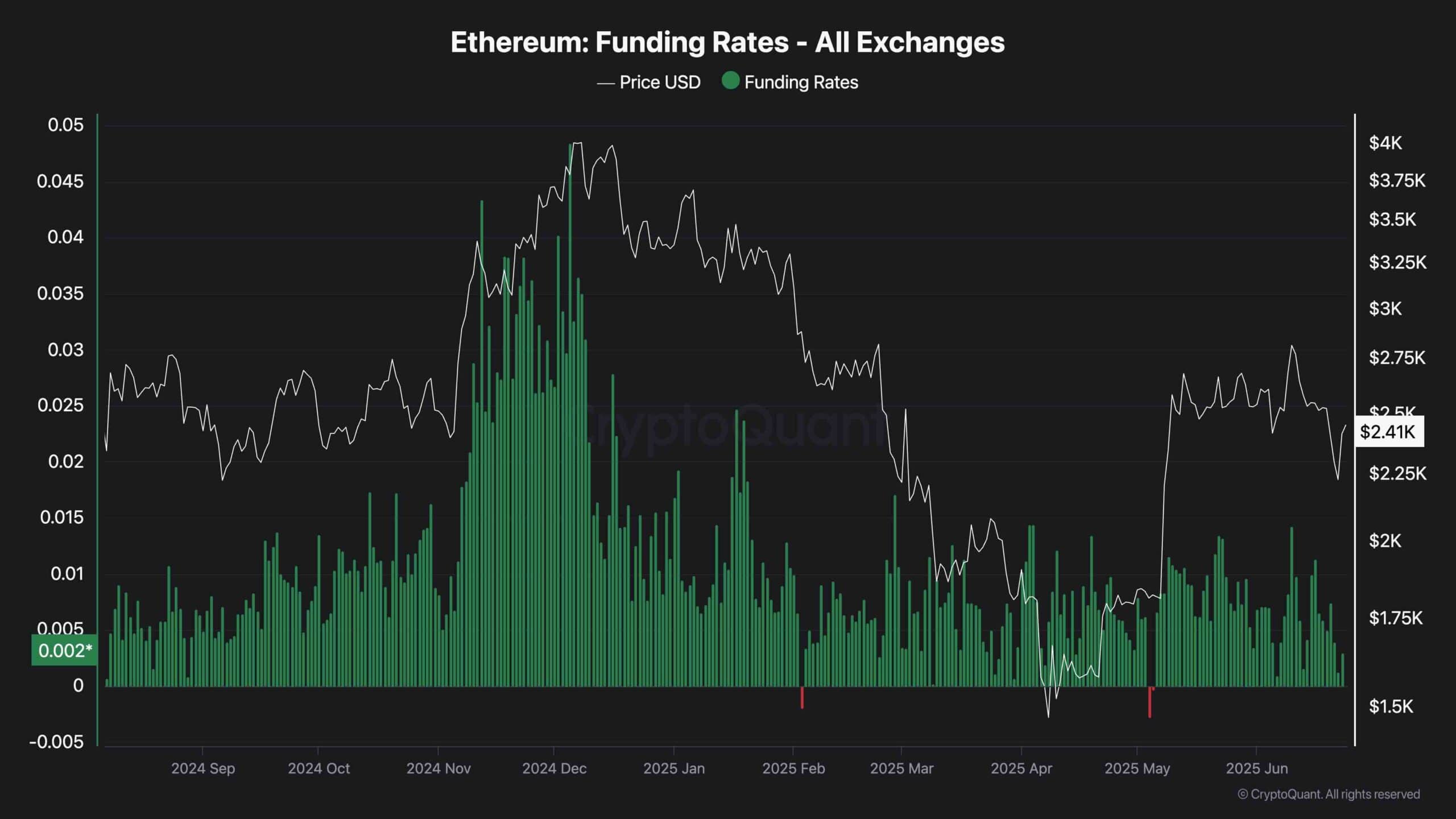

Funding price metrics function a key gauge of dealer sentiment throughout the futures market. Sometimes, wholesome and sustainable uptrends have steadily risen in funding charges, reflecting a rising curiosity from long-standing place merchants in each the lasting future and the spot market.

Nonetheless, latest tendencies have revealed a decline in Ethereum's funding price, eroding bullish momentum and fatigue for potential patrons. This shift will increase the potential for short-term rejection and deeper correctional motion.

That stated, approaching the impartial zone close to zero funding charges may counsel a reset at a leveraged place, indicating that the market is cooling. This surroundings is usually forward of recent demand, and as soon as the present integration part is over, it may pave the best way for a powerful bullish continuation.