Public keys are weekly abstract Decryption This tracks main crypto corporations which might be publicly traded.

This week: Why the Bitcoin Treasury's Champion Technique is inflicting so many equivalent lawsuits, Coinbase hits new peak closing costs as it’s close to the US and acquires different keys for Crypto's week.

technique Already seen

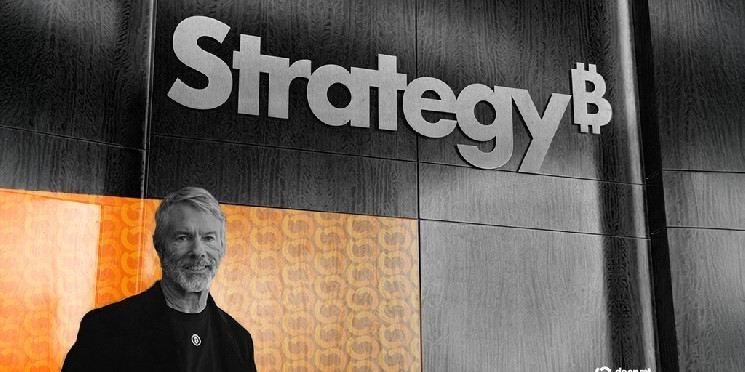

You’ll have heard that Bitcoin's big technique is the topic of sophistication motion lawsuits. It accused the corporate of misrepresenting the dangers related to BTC buying plans. Then perhaps you've heard concerning the swimsuit time and again.

That's as a result of there are not less than 5 totally different regulation companies which have filed imitation class actions (beforehand micro-strategic methods) towards methods traded on NASDAQ below MSTR tickers. Two regulation professors who spoke Decryption He stated the identical submitting is how every firm alerts its curiosity in main a case after being consolidated into one single class motion lawsuit.

If there are a number of class motion purposes, it is going to be a fallen to court docket to pick out a serious plaintiff, the professor stated. It often comes right down to the one that has probably the most pores and skin within the recreation. It's about making a big establishment like a pension fund like a candidate. And as soon as the main plaintiff is chosen, it’s as much as them to nominate an lawyer.

Not one of the regulation companies filed the lawsuit responded to requests for remark. Decryption. Nevertheless, the regulation professor wrote a fairly clear motive, College of Michigan Adam Pritchard, who stated, “charges will be very advantageous.”

Necessary Tolkien Replace: As we speak's worth, the $63.3 billion Bitcoin Treasury of technique is price greater than the gold the final nice dragon, Smaug, stockpiled in a lonely mountain.

Excessive coin file altitude and perps

Traders eagerly watched as Coinbase approached, Coin set the brand new, ever-highest-close worth on Thursday, buying and selling at $375.07. It was an enormous milestone, however the firm has not taken its eye on the awards.

In direction of the brand new excessive watermark, benchmark analysts known as the corporate “Transformative” and gave it a worth goal of $402. And Bernstein's analysts stated the coin was “misunderstood” and set a fair greater worth goal of $510.

Subsequent month, Coinbase will provide a everlasting US-regulated future for Bitcoin and Ethereum, Coinbase stated. Merchants have lengthy wished Perps. In response to Crypto Information Aggregator Defi Llama, it's no surprise Crypto Perps has made almost $10 billion up to now day and $382 billion up to now month.

This merely counts volumes from defi protocols resembling excessive lipids, Jupiter, and vertex protocols. Issues can change into much more fascinating as soon as Coinbase enters the chat.

In the meantime, the Ethereum Layer-2 community, which it incubated, has added Cardano and Litecoin to the wrap belongings already supplied on the community, resembling DogeCoin, XRP, and Bitcoin. This makes it simpler for Cardano or Litecoin homeowners to entry Ethereum's extra strong distributed monetary (DEFI) ecosystem, offering customers with the chance to work together with fashionable Ethereum-based protocols resembling Aave, Composite, and Curves.

Different keys

- Subsequent: Bitcoin Treasury Firm: Bakkt has by no means stopped reinventing himself. Earlier this yr, the corporate offered its failed cryptocurrency enterprise to its father or mother firm for $1.5 million and employed a brand new co-CEO to deal with its “Stablecoin Funds” product. This week we started elevating $1 billion so as to add Bitcoin to our steadiness sheet. NFT Assortment, what's subsequent?

- Altcoin Summer season: It seems like Bitwise's Dogecoin and Aptos ETF submissions are sunny. Usually talking, publishers renew their registrations to replicate suggestions from the SEC, stated Bloomberg analyst Eric Barknath. Decryption. “There was a lot engagement,” he stated. “That's an entire new angle from the SEC.”

Edited by Andrew Hayward