The inflow of Ethereum into centralized exchanges surged sharply in early July. This might trigger concern for buyers who need to get well ETH.

Under are some chain indicators that recommend that many whales could also be making an attempt to promote.

Ethereum strikes to change – what do the analyst say?

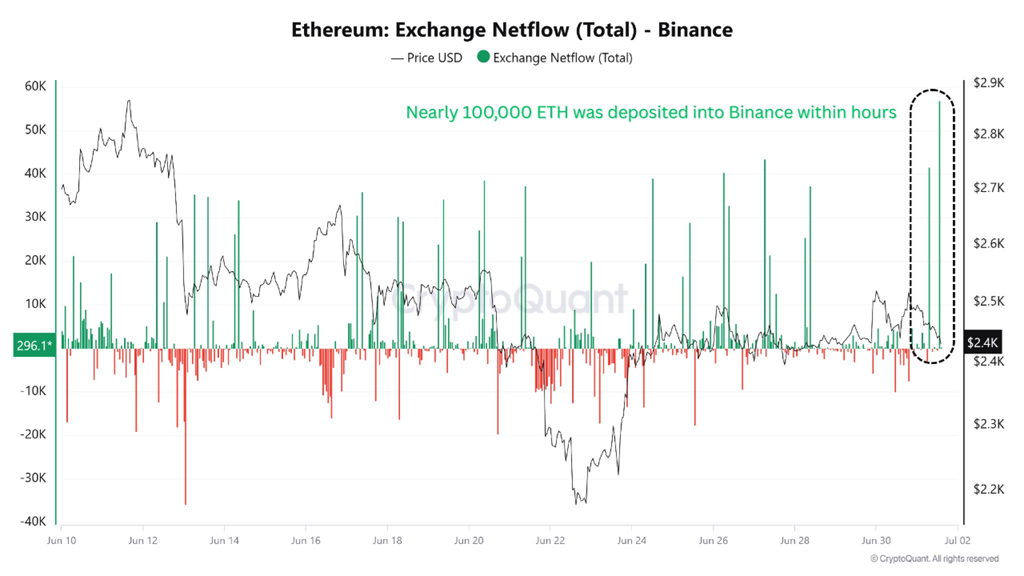

Almost 100,000 ETH individuals had been deposited in Binance on July 1, 2025, value roughly $250 million, in line with information from Cryptoquant. This exhibits the very best each day inflow of exchanges over the previous month.

Ethereum Change Netflow – Binance. Supply: Cryptoquant.

In comparison with current value conduct, giant each day influxes usually result in corrections in ETH costs or preserve value transactions inside shut, lateral ranges.

Moreover, on-chain observers famous that over the previous three weeks, giant entities have withdrawn 95,313 ETH from staking contracts utilizing two pockets addresses. The entity then moved 68,182 ETH (roughly $165 million) to centralized exchanges similar to HTX, OKX, and BYBIT.

The typical staking value was round $2,878 per ETH, and the present value was near $2,431, with the entity shedding about $42.6 million. This motion suggests a halt technique or a restructuring of the portfolio, growing the gross sales stress out there.

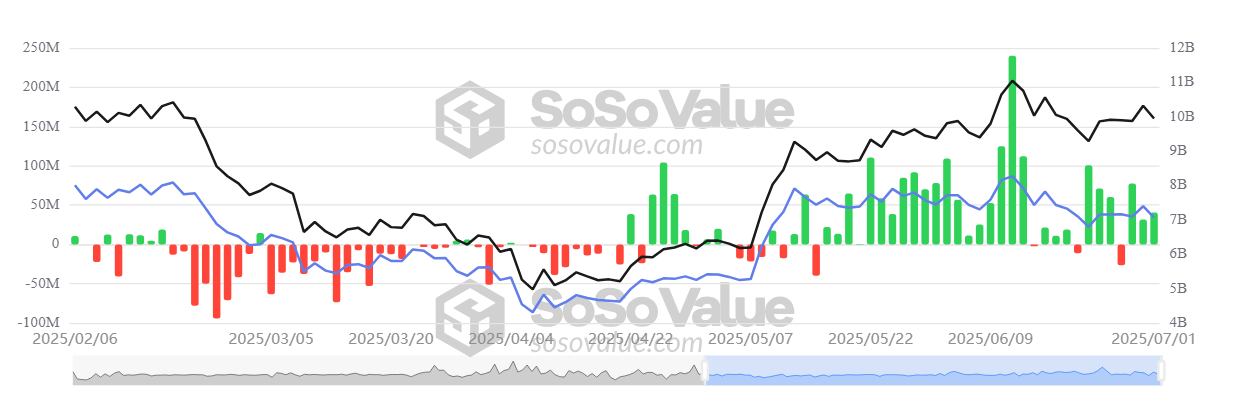

In the meantime, information from Sosovalue exhibits that web inflow into US spot ETH ETFs is slowing, whereas remaining optimistic.

All Ethereum spot ETF web move. Supply: SosoValue

Particularly, netflows for these ETFs fell from over $240 million on June 11 to over $40 million on July 1. This displays a slower ETF buy momentum.

All these information factors could be weighed and priced for ETH within the first week of July. On the similar time, Coinglass statistics present that Q3 is traditionally the weakest quarter of ETH, with a mean return fee of simply 0.59%.

“In response to the improved broader macroeconomic situations, Ethereum's long-term bullish outlook stays intact. Nevertheless, Ethereum may face a slight short-term pullback.”

Specialists present consensus on the long-term advantages of ETH

Specialists appear to be broadly agreeing with the long-term potential of ETH.

MEXC Analysis famous that Ethereum is taking up a robust restoration to enhance staking effectivity and enhance the clearer stubcoin laws caused by the Genius Act.

“Together with the danger urge for food slowly returning to the market, stabilizing the geopolitical scenario and bettering international liquidity, ETH seems to be nicely positioned for additional advantages over the approaching weeks. MEXC's analysis advised Beincrypto.

In the meantime, Bitget's chief analyst Ryan Lee highlighted core components similar to clearer regulatory indicators and robust chain actions that may improve ETH costs by means of the Genius Act.

“Ethereum has gained important momentum and is supported by upgrades in its validator spine, bettering staking effectivity and contributing to a decline in ETH provide. In a near-view, Ethereum may take a look at the $2,800-$3,000 vary by mid-July.”