Bitcoin was buying and selling at $106,537 on July 1, 2025, with a market capitalization of $2.11 trillion and a 24-hour buying and selling quantity of $21.87 billion. Digital belongings fluctuate inside a slender vary of $106,544 to $107,938, as technical indicators recommend a combined but prudent market atmosphere.

Bitcoin

The 1-hour BTC/USD chart exhibits a transparent downward development that stems from the current peak of $108,800. Quantity escalates the crimson candles violently, pointing to sustained bear stress, and gross sales actions affirm tendencies. Merchants are specializing in weak daytime bounces between $107,500 and $108,000 as potential quick entries, however take into account the short-term help threshold of $106,000 for exit methods. The gradual decline lacks the velocity of panic gross sales, however exhibits a secure distribution. Quick-term outlook stays bearish until momentum indicators change considerably.

BTC/USD 1 hour chart through BitStamp on July 1, 2025.

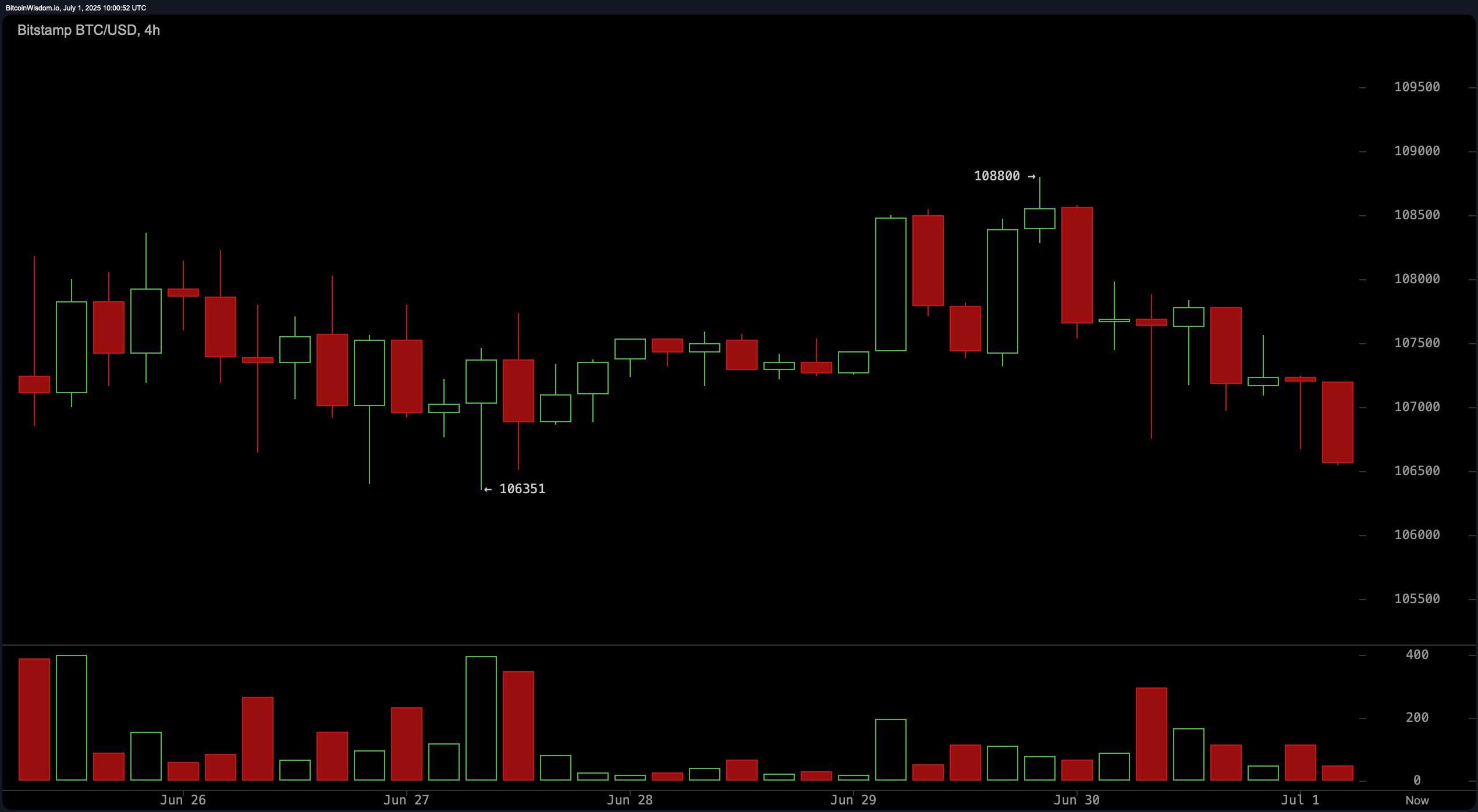

On the four-hour chart, Bitcoin seems to be sure to vary after failing to make a breakout of over $108,800. Assist was round $106,300, however the general construction suggests indecisiveness, evidenced by the small candle and the diminished quantity after division. This cooldown section can final until momentum improves considerably. The scalper entry alternative can happen close to the $106,000 mark, and earnings may restrict a resistance of round $108,000. Assist The breakdown under brings new bear concentrating on on the $105,000 stage.

BTC/USD 4-hour chart through BitStamp on July 1, 2025.

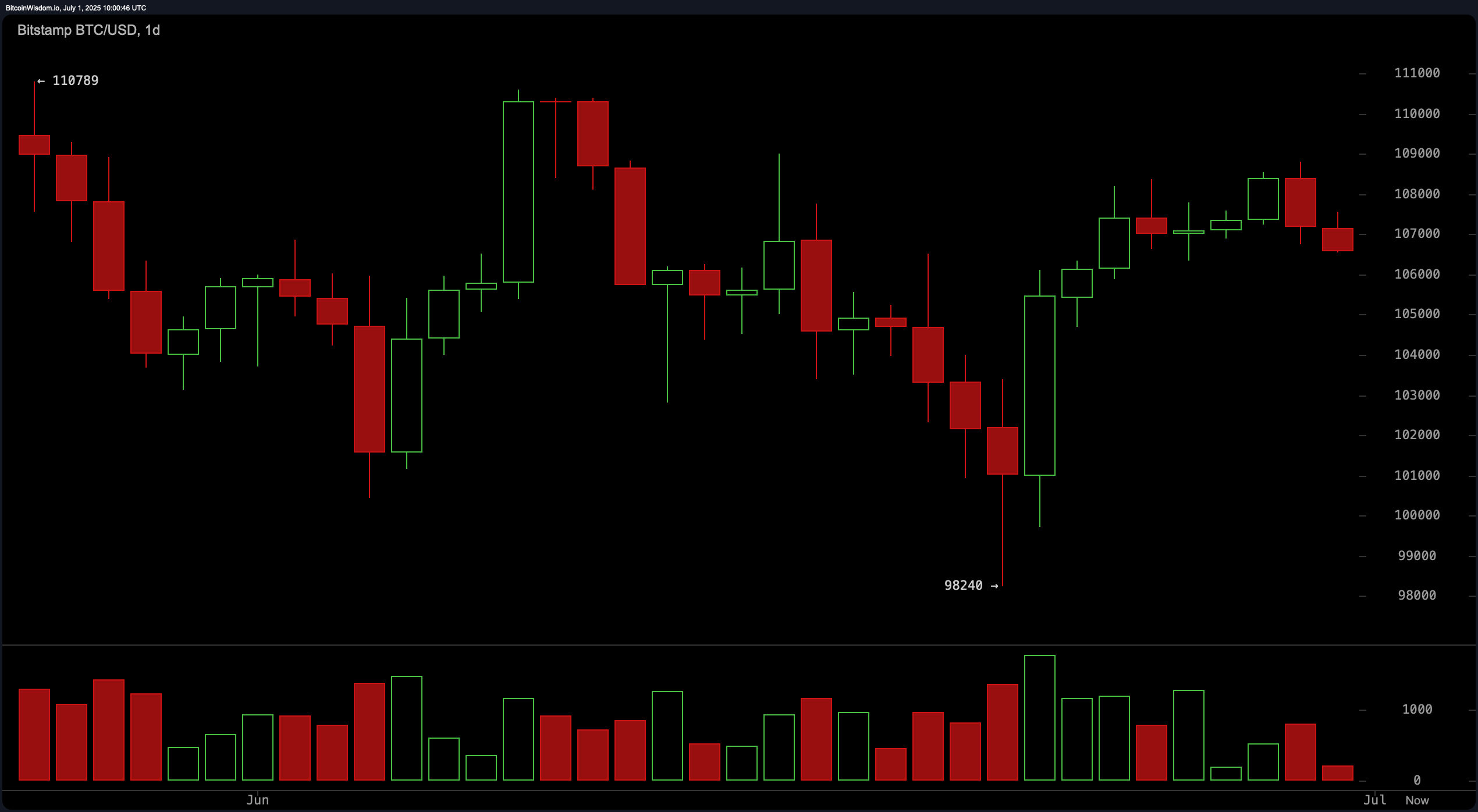

Bitcoin's day by day chart depicts a broader integration section after the rally peaked at practically $110,789, adopted by a pullback to its current lowest of $98,240. Rebounds from that stage point out curiosity on the acquisition, however sellers have persistently appeared at practically $108,000. If momentum can not regain higher resistance, a bearish siege sample has developed, pointing to potential unfavorable elements. Merchants are monitoring entries within the $102,000-103,000 vary, specializing in exits round $108,000-110,000. A important break under $98,000 may drive gross sales stress.

BTC/USD 1-Day Chart through BitStamp on July 1, 2025.

The oscillator measurements present pictures combined from impartial. The relative power index (RSI) reads 52, signaling equilibrium, stochastic %ok (14, 3, 3) reads 86, suggesting the situation purchased with the promote sign. The 58 commodity channel index (CCI) and the 12 imply directional index (ADX) each present neutrality. In the meantime, a momentum index of 4,462 and a MACD stage of 557 (12, 26) level to residual bullish feelings. This distinction emphasizes market indecisiveness, favoring short-term buying and selling reasonably than directional bets.

Transferring averages (MAS) help a cautious, bullish long-term angle regardless of short-term weak spot. The tenth interval index transferring common (EMA) of $106,607 points a gross sales sign, indicating a tenth interval easy transferring common (SMA) of $106,367 purchases. Transferring averages for all lengthy intervals, together with EMA and SMA for 20, 30, 50, 100, and 200 intervals, mirror the continued power of the broader development and buy indicators. These averages function dynamic help ranges that might cap unfavorable facet actions as Bitcoin turns into much more weaker. General, the confluence of short-term bearish conduct and long-term bull buildings recommend tactical flexibility for merchants.

Bull Verdict:

If Bitcoin retains $106,000 in help and patrons re-enter the $102,000-$103,000 zone, the long-term uptrends supported by bullish transferring averages may resume. A break above $108,000 may pave the best way for retesting $110,000 and in the end retesting $111,000, reinforce the plain bullish construction in a better timeframe.

Bear Verdict:

If $106,000 in help will not be retained, the technical indicators recommend {that a} discount to the $103,000-$100,000 vary is feasible. Steady gross sales pressures recognized by oscillator weak spot and bearish intrinsic buildings can speed up decrease momentum, particularly if $98,000 is compromised.