It's been about three months since World Liberty Monetary's USD1 Stablecoin debuted. New studies reveal that notable development milestones have been achieved thus far, notably by way of quantity.

USD1 Stablecoin quantity is rising quickly. Latest surveys reportedly present that the day by day quantity is over $1 billion. It's a formidable feat contemplating it hasn't existed for greater than six months.

The Focus of World Liberty Monetary

USD1 Stablecoin reportedly reportedly earnings greater than $1.25 billion on Saturday. It surged even greater on Sunday, hitting $1.36 billion throughout that point, in accordance with CoinmarketCap.

Additional analysis revealed that USD1 Stablecoin achieved these spectacular volumes and was restricted to Binance Sensible Chain (BSC) and Ethereum Community.

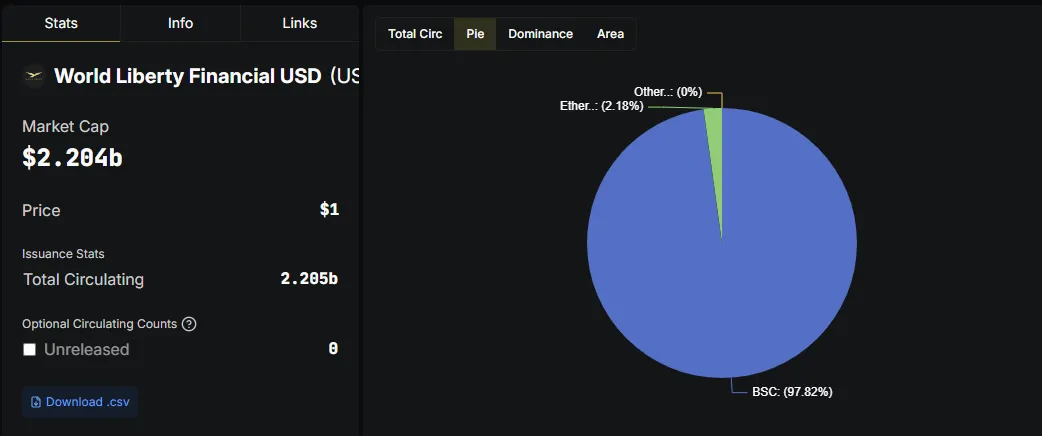

In response to Defillama, 97.8% of Stablecoin was operated with BSC, with the remaining 2.18% being on the Ethereum blockchain. The entire market capitalization of USD1 is at the moment at $2.28 billion.

USD1 token distribution by community | Supply: Defilama

The spectacular USD1 quantity confirmed that WLFI issued Stablecoin is quickly gaining consideration. From a day by day quantity perspective, I used to be even in a position to rank it just under USDT and USDC.

The entire market capitalization of USD1 was regularly being erected greater, and it was in peril of constant to push it greater.

WLFI might doubtlessly Mint extra Stablecoins if demand is excessive, and particularly as a result of must benefit from the elevated demand for Stablecoin, notably after the not too long ago handed Stablecoin invoice.

Pancakeswap that handles many of the USD1 transaction quantity

The information additionally revealed that many of the USD1-related volumes occurred in Pancakeswap Dex. The rationale for this was as a result of aforementioned integration of Stablecoin and Binance Sensible Chain.

Pancakeswap maintains a stable lead between BSC's Dexes, permitting it to seize most USD1 volumes.

It has additionally been found that World Liberty Monetary (WLFI) is working with Pancakeswap to advertise the adoption of USD1 and working a marketing campaign.

CoinMarketCap revealed that greater than $1.28 billion day by day volumes occurred on decentralized exchanges on Sunday. The remaining $78.9 million day by day quantity occurred in a centralized trade.

This knowledge supplied a broader perspective on the place the amount was transferring. Diving deep into the USD1 circulate, it was revealed that USD1 has change into a base asset that promotes liquidity each inside and outdoors the 57 memocoin pair.

Can USD1 keep its present momentum?

The Memecoin pair paved the trail to adoption of USD1 Stablecoin to some extent, but in addition highlighted restricted pairing with different belongings. Additionally, restrictions by way of blockchain attain.

Moreover, some stub cash, equivalent to PayPal USD, have been initially kicked off with sturdy notes, however finally the hype cooled down. This was one of many essential criticisms that not too long ago emerged for every USD1 as volumes surged.

Some critics hope that the amount will cool over time. Others imagine the truth that WLFI is carefully linked to President Trump could also be one of many essential causes for the hype round Stubcoin.

Linking with President Trump could have supplied a lift, however the long-term success of USD1 requires cocktails of different elements. Amongst them is growth to different networks.

In the end, it could be too early to determine whether or not USD1 Stablecoin will keep its present trajectory for the long run. The efficiency numbers could also be spectacular, however they’re pale and white in comparison with the highest stubcoins.

On the one hand, this implies they’ve a protracted approach to go earlier than narrowing down the gaps, whereas then again it might point out that there’s loads of room for development.

The truth that we had already achieved spectacular development charges in such a brief time frame was already an excellent indication of adoption and adoption.