ether

Institutional income stay robust, with Coinshare reporting $429 million in web inflows into ether funding merchandise over the previous week, reporting about $2.9 billion a 12 months. This pattern coincides with a decline in ETH provide on the change and rising staking ranges, with over 35 million ETH (28% of complete provide) at the moment locked in proof contracts. Market analysts recommend that these components cut back liquid provide and strengthen ether long-term funding papers.

Robinhood introduced on Monday that it’s growing its personal Layer-2 blockchain utilizing Arbitrum's rollup infrastructure. The community isn't stay but, however the initiative will finally help Ethereum staking, tokenized inventory buying and selling, and everlasting crypto futures. Though the L2 is in growth, the choice to construct on Ethereum's roll-up ecosystem is taken into account a long-term vote of confidence in Ethereum's scalability roadmap.

Vitalik Buterin, co-founder of Ethereum, has additionally launched a brand new digital identification framework utilizing zero data proofs. The system permits customers to confirm their traits and credentials with out viewing non-public information, and is designed to assist Web3 apps incorporate identification methods that present privateness. Analysts see this as an necessary step in direction of adopting distributed functions that require delicate consumer authentication extra broadly.

In the meantime, the Ethereum Group Convention (ETHCC) started in Cannes, France, and attracted over 6,400 contributors and 500 audio system. The occasion will showcase Ethereum's ongoing developer momentum by way of a presentation on new instruments, scaling methods and protocol enhancements.

Regardless of optimistic momentum, ETH is barely beneath the 200-day shifting common, suggesting that technical obstacles nonetheless exist. Nevertheless, the confluence of inflow, developer developments, and scaling plans continues to help constructive outlook.

Technical Evaluation Highlights

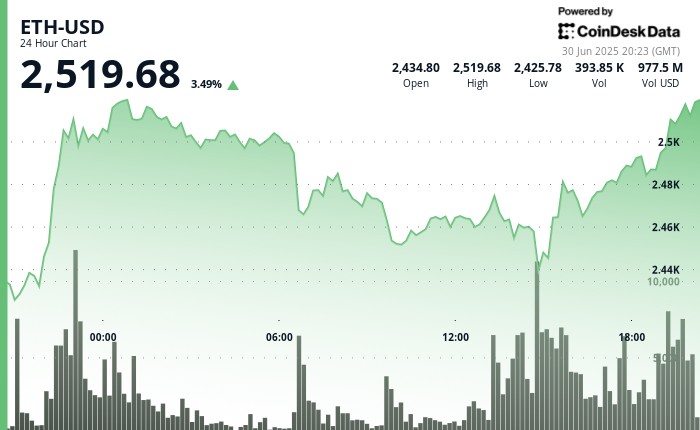

- Ether traded between $2,438.50 and $2,523 from 7pm on June twenty ninth to June thirtieth, starting from 3.47%.

- The largest spike occurred on June twenty ninth at 10:00-10:00 UTC window. This has briefly pushed the $2,500 barrier, surged by 2.9% at a quantity of 368,292 ETH.

- At 15:00 UTC on June thirtieth, ETH discovered robust help of about $2,438 on above common quantity and confirmed the bullish ground.

- It reached an area excessive of $2,523 and established resistance above the psychological $2,500 degree.

- On the final hour of 18:00 to 18:59 UTC on June 30, ETH closed at $2,487.19 from its daytime peak of $2,499.19.

- A pointy upward motion between 18:20–18:21 noticed ETH rise 1.6% at 6,318 ETH quantity, stalling close to $2,499.

- As of 20:23 UTC on June thirtieth, ETH elevated 3.49% in 24 hours at $2,519, signaling a brand new bullish momentum for the Asian Open.

Disclaimer: A part of this text is generated with the help of AI instruments and reviewed by the editorial staff to make sure accuracy and compliance Our requirements. For extra data, please refer Coindesk's full AI coverage.