Bitcoin (BTC) costs enhance barely during the last 24 hours and proceed to maneuver about $ 108,000. Flagship Cryptocurrency is steadily maintained inside a variety of built-in vary between $ 100,000 and $ 110,000, reflecting the uncertainty of the market. Within the present market state, the favored buying and selling consultants in X customers' title DAAN CRYPTO have emphasised the primary fluid clusters that may play an necessary function in forming Bitcoin's brief -term value measures.

Implied Bitcoin Battle Entrance: $ 107,000 and $ 110,500

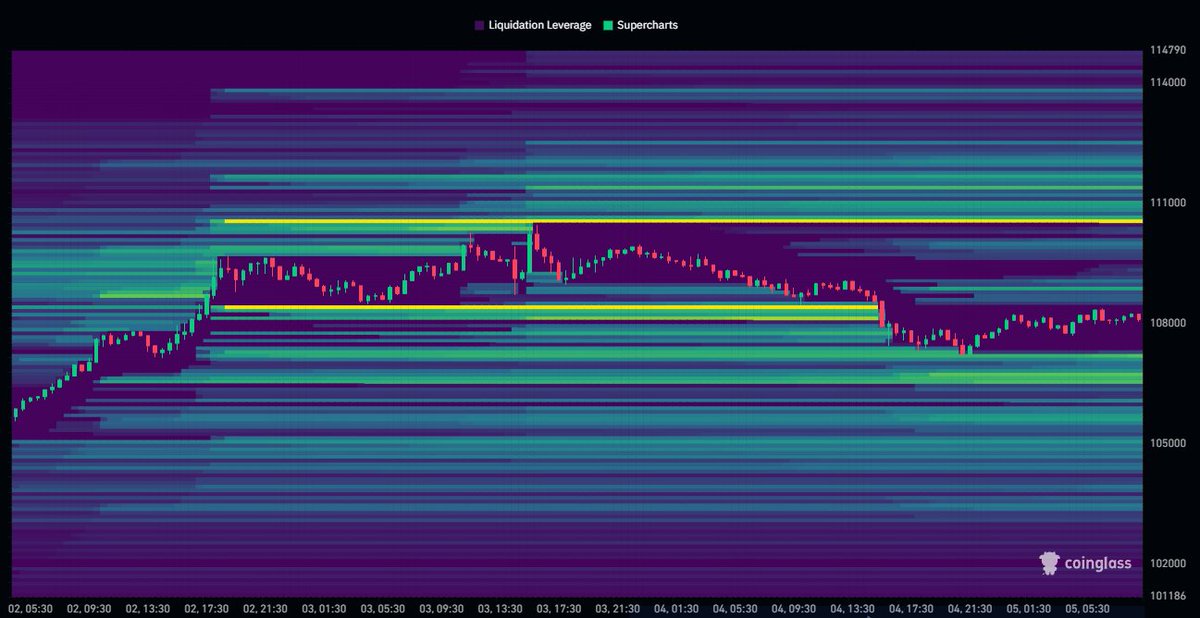

Within the X submit on July 5, DAAN CRYPTO shares necessary insights to Bitcoin's potential value measures in comparison with the liquidity stage. The info from COINGLASS explains that the well-known analysts have clearly cleared the leverage location centered on the $ 108,000 space because of the value exercise of Friday. Following this growth, buyers' curiosity is now concentrated within the new liquidity space, forming about $ 107,000 and $ 110,500.

Among the many emphasised areas, $ 107,000 seems for use as quick help, and a few merchants defend their positions which have not too long ago survived in liquidation. Subsequently, BTC is prone to expertise a brief -term rebound when testing this stage once more. Nonetheless, if the worth drops to lower than $ 107,000, the worth will likely be compelled to power the worth to $ 100,000, relying on the latest vary of bounds.

However, $ 110,500 is rising as a brief -term resistance for potential gross sales strain or brief objects to build up if Bitcoin makes an attempt one other escape. Profitable costs above this stage take away various brief positions, inflicting brief strain, permitting Bitcoin to maneuver rapidly to an unknown value of $ 111,970.

Total, the BTC market appears to be stabilizing inside $ 107,000- $ 110.5,000 zone since Friday's speedy liquidation sweep. Subsequent to this, the worth motion normally units the stage of speedy breakout or failure.

Bitcoin alternate leverage reaches the brand new finest

In different developments, encryption information exhibits that the estimated leverage ratio of all exchanges reaches as much as 0.27 per yr, and Bitcoin dealer is exhibiting excessive market urge for food. In comparison with the Alternate BTC reserves, the metrics, which monitor public curiosity, are more and more dangerous because the merchants are anticipated to alter the worth, and the borrowing capital is positioned increasingly more.

Premier cryptocurrency, in the meantime, continues to commerce about $ 108,232, reflecting 0.70percentand 6.41percentof market earnings, respectively, respectively. Bitcoin, which has a market cap of $ 2.15 trillion, maintains 64.6percentof its market dominance because the world's largest digital asset.

PEXELS's most important picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing commonplace and every web page is diligent within the high know-how consultants and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.