Ethereum costs are within the consolidation stage, however present indicators of accumulation, which may result in bullish breakouts.

Ethereum (ETH) was buying and selling for round $2,500 in its final test on Saturday, July fifth, inside a slender vary that has been maintained since Could.

Third-party knowledge reveals that whales and Wall Avenue buyers have expanded their Ethereum standing prior to now few months. Sosovalue reveals that Spot ETH ETF added greater than $229 million in property this week, persevering with the pattern that started in Could. This was the eighth consecutive week of influx and an indication that these buyers have been hoping costs would rebound.

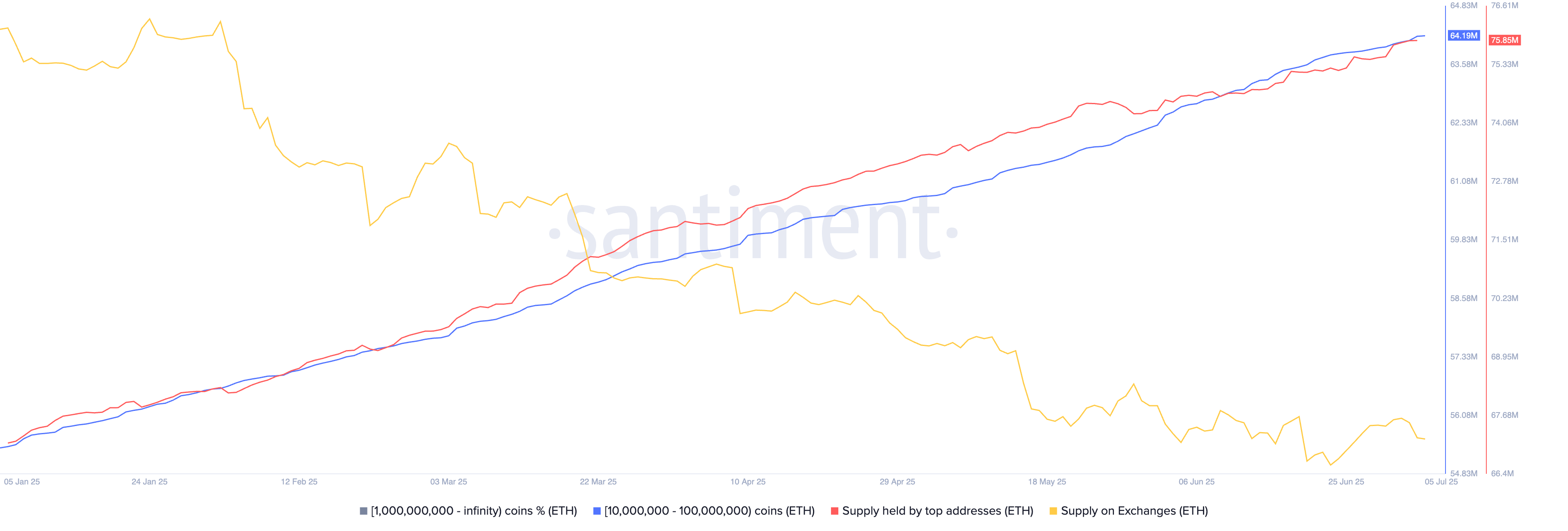

Extra knowledge reveals that whales proceed to purchase Ethereum this week, with addresses holding 10 to 10 million tokens rising their place to 64 million tokens.

Equally, as proven by the chart beneath, the availability held by the highest handle continued to be sturdy upward pattern, reaching a excessive of 75.6 million.

You may prefer it too: Humanity's tokens go towards market stoop with a surge in costs of 40%

Ethereum The stability of exchanges decreases and staking ranges enhance

At the moment, there are 7.3 million ETKENs on the trade. That is down from 1.73 million in February. The stability of trade is an indication that buyers proceed to maneuver cash to self-reliance.

ETH Whale Buy and Provide Change | Supply: Santiment

Extra buyers are staking their ETH cash. StakingRewards knowledge reveals a web enhance of two million cash, over $4 billion, in pool staking. This enhance marked staking ratios of 29.45%, bringing steaking market capitalization to just about $90 billion.

ETH spills from the trade, coupled with rising staking, point out the transition from short-term buying and selling to long-term holdings and yield era. It displays the elevated ethereum ecosystem, elevated decentralization, and elevated belief within the mature investor base.

Ethereum value expertise evaluation

ETH Value Chart | Supply: crypto.information

Each day charts present that Ethereum costs have remained in a decent vary since Could this yr. Accumulation and distribution indicators proceed to extend, and this yr we’re approaching the very best stage.

Ethereum fashioned a bullish flag sample that features vertical strains and horizontal integration. This sample usually results in a powerful bullish breakout, which corresponds to flagpole peak.

On this case, the flagpole peak is about 52%, and the goal value is $4,287, measured from the breakout level. If it rises above final yr's excessive of $4,100, the goal stage earnings are confirmed.

The bullish Ethereum value forecast will probably be invalidated for those who decrease your psychological factors to $2,000 down.

learn extra: Maple syrup costs are rebounded in order that sensible cash accumulates