Regardless of Russia's preparations to launch the digital ruble, a few of the nation's high bankers have but to be offered underneath the thought.

As Russia approaches launching its personal digital foreign money, questions are starting to develop as as to whether the nation actually wants a central financial institution digital foreign money. And most significantly, these issues come from inside the nation's monetary system, not from abroad critics.

One in every of these questions is now being raised by certainly one of Russia's most influential bankers.

Germany's Greff, CEO of Sberbank, Russia's largest state-controlled lender, reportedly instructed reporters a couple of bystander on the Financial institution of Russia's annual monetary assembly that there was no state of affairs through which the digital ruble might result in large modifications within the financial system.

“Our funds are already fully digital. Every part the digital ruble can supply is offered by way of cashless funds. Banks are technically superior. There aren’t any new merchandise that may't be finished with a daily ruble.”

Robust German

Gref's remark is that, on condition that he not solely leads Sberbank, but in addition has solely over 100 million shoppers, or almost 69% of the nation's inhabitants, not simply what is likely to be thought of a key indicator of Russia's monetary well being, but in addition as a result of banks are anticipated to play a central function within the launch of the digital ruble.

Nevertheless, the Financial institution of Russia sees issues in a different way. The digital ruble claims that it might convey nice income over time, as money and cashless cash as a 3rd type of home foreign money.

You may prefer it too: Russian lawmakers imagine that the digital ruble will substitute the financial institution

In a current analysis report on the Digital Louvre Pilot, the central financial institution highlighted a number of potential advantages: sooner, extra clear and safer monetary transactions. Nevertheless, these advantages appear to be extra helpful to the authorities than the general public, because the digital ruble presents new instruments primarily for state-level monetary administration and increasing monetary inclusion.

Russia already has a stable digital fee setup, with a quite superior cellular banking app along with its personal model of Visa/MasterCard. So, from a person's perspective, it’s not but clear why everybody actually cares about switching to a brand new fee methodology.

Cashback is for lenders

Nonetheless, the Financial institution of Russia continues to emphasise what it considers as a long-term revenue. We plan to start large adoption of the Digital Ruble on September 1, 2026, and we hope that inside 5 to seven years the system will grow to be a daily a part of our monetary life.

To make the digital ruble much more enticing, particularly for on a regular basis customers, the central financial institution exempts all charges for particular person relocation. Firms nonetheless need to pay charges, however they’re decrease than what present fee methods and card providers cost.

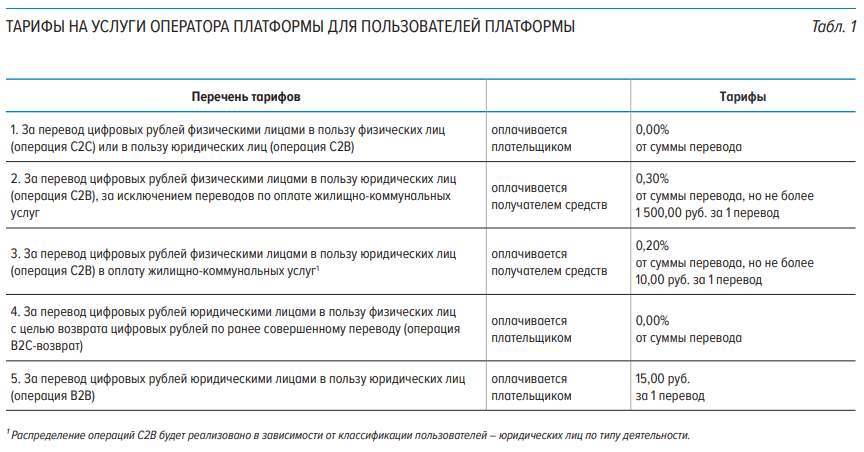

Monetary Taxes for Utilizing Russian CBDC | Supply: Financial institution of Russia

For instance, sending cash from a non-public person to a enterprise would price a most price of 1,500 rubles (about $19) or 0.3% of the switch quantity. Utility funds had been even cheaper, capped at 10 rubles or 0.2%.

The central financial institution supplies incentives to banks and different contributors who assist function the digital ruble platform. These companions obtain small charges to advertise various kinds of transactions, however the quantities are strictly regulated. Funds are made in digital rubles and processed straight by way of the platform's centralized accounting system.

Lengthy shot

The Financial institution of Russia claims that that is in regards to the future. The digital ruble is not only one other fee device, says the central financial institution emphasizes it’s a step in the direction of a extra trendy and versatile monetary system. Officers imagine the platform will make authorities funds extra environment friendly, paving the best way for brand new sorts of sensible contracts and monetary automation, in addition to new sorts of sensible contracts and monetary automation.

However Sberbank's CEO shouldn’t be at the very least certain. There’s nonetheless time for the picture to shift.

The Digital Louvre pilot part has been ongoing since August 2023, with extra options being progressively examined. Some might counsel that the true worth of the digital ruble might grow to be clear as worldwide fee methods grow to be extra fragmented and Russia is on the lookout for new instruments to keep away from sanctions and simplify commerce with chosen international companions.

In that state of affairs, the digital ruble might not change on a regular basis life for many Russians, however it might nonetheless be a great tool for the nation. In a roundabout way, the Financial institution of Russia seems to be decided to remain on track regardless of a few of the nation's strongest bankers brazenly questioning what it’s for.

learn extra: Russian ruble help stablecoin a7a5 strikes $9.3 billion in 4 months: Report