After gathering $2,600 earlier this week, Ethereum costs at this time return to the $2,550-$2,560 zone, violating main intra-support. The refusal from the $2,610 provide zone brought on an up to date draw back because the bear compelled a breakdown beneath the rise within the short-term trendline.

ETH Worth Dynamics (Supply: TradingView)

On the time of writing, Ethereum is buying and selling practically $2,560 with gentle daytime losses as short-term indicators maintain its momentum down and volatility up.

What would be the worth of Ethereum?

ETH Worth Dynamics (Supply: TradingView)

The four-hour chart exhibits that Ethereum worth motion occurred past the multi-week consolidation vary of practically $2,520, and is rejected close to the resistance band between $2,610 and $2,620. The zone has been growing and reducing ETH 3 times since mid-June, strengthening its fundamental provide space. Help for the rising trendline from the late June low is at present being breached, turning the short-term construction bearish.

ETH Worth Dynamics (Supply: TradingView)

In the meantime, within the each day timeframe, ETH stays trapped in a big, symmetrical triangle sample, with vertices drawn. This low help for the triangle is at present coinciding with the $2,420-$2,440 zone, and if the present weak spot continues, it turns into the subsequent potential bounce space.

Why are Ethereum costs falling at this time?

ETH Worth Dynamics (Supply: TradingView)

The explanation for the worth of Ethereum at this time is probably going because of a number of bearish technical and emotional clues. On the 30-minute chart, a transparent breakdown beneath the blue help channel round $2,570 opened up house for additional losses. MACD is within the adverse territory and exhibits a decline in bullish momentum, however the RSI on the identical chart is 35.6, with a number of bear divergence alerts confirmed on July third.

ETH Worth Dynamics (Supply: TradingView)

VWAP evaluation reveals that ETH averaged beneath the session's common of $2,576, indicating a short-term worth decline. In DMI, the -DI line is dominant, however ADX is rising.

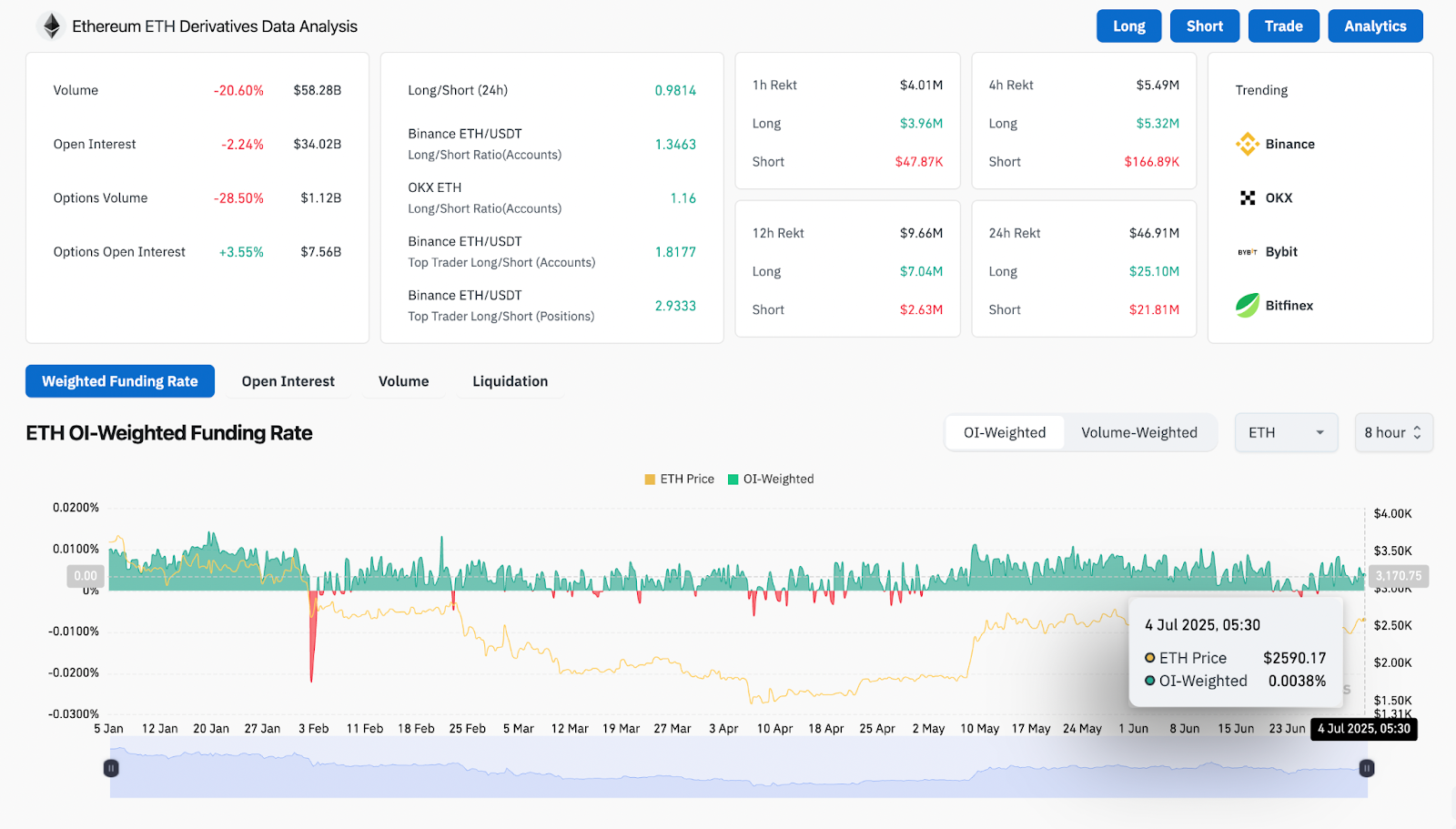

The Derivatives dashboard exhibits a 20.60% decline in quantity and a 2.24% lower in open revenue, reflecting a decline in market convictions. Most notably, quick liquidation over the previous 4 hours is minimal in comparison with lengthy liquidation, that means that the vendor remains to be in management. Fundraising charges stay barely constructive and counsel that leverage skew stays barely longer, which might result in extra downsides if sentiment will get worse.

Worth indicators, alerts, graphs, charts (24 hours)

ETH Worth Dynamics (Supply: TradingView)

Bollinger bands on the 4-hour chart are starting to develop after compression. It is a sign of elevated volatility in Ethereum costs. ETH is at present closing the four-hour candle ($2,560) beneath the midband, suggesting that downward strain might proceed in the direction of the decrease band, practically $2,515.

The EMA cluster supplies blended alerts. The ETH remains to be held simply above the 20 and 50 EMAs, that are near $2,534 and practically $2,491 respectively, however beneath the 100 EMAs ($2,482). If costs proceed to shut beneath 100 EMA, momentum might shift crucially within the bear's favor.

On-chain information stays impartial. Regardless of a constructive financing price of 0.0038% and an extended/quick ratio supporting lengthy (1.34 Binance account), a bullish lack of follow-through of $2,610 suggests merchants are cautious.

ETH Worth Forecast: Brief-term Outlook (24 hours)

If Ethereum Worth can not instantly get better $2,570, the subsequent help shall be at $2,515 (backside and horizontal help for the Bollinger Band). Underneath that, the demand zone between $2,440 and $2,460 is per the trendline and Fibonacci confluence, providing a bounce space.

The benefit is {that a} $2,580 landfill might negate the breakdown, with resistance once more at $2,610 after which $2,645. For the bull to regain management, ETH might want to regain its VWAP mid-zone and outweigh its descending resistance from its June excessive.

With RSI and MACD turning into bearish and fewer quantity, merchants want to watch gross sales strain or sudden liquidation-driven core spikes.

Ethereum worth forecast desk: July 5, 2025

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.