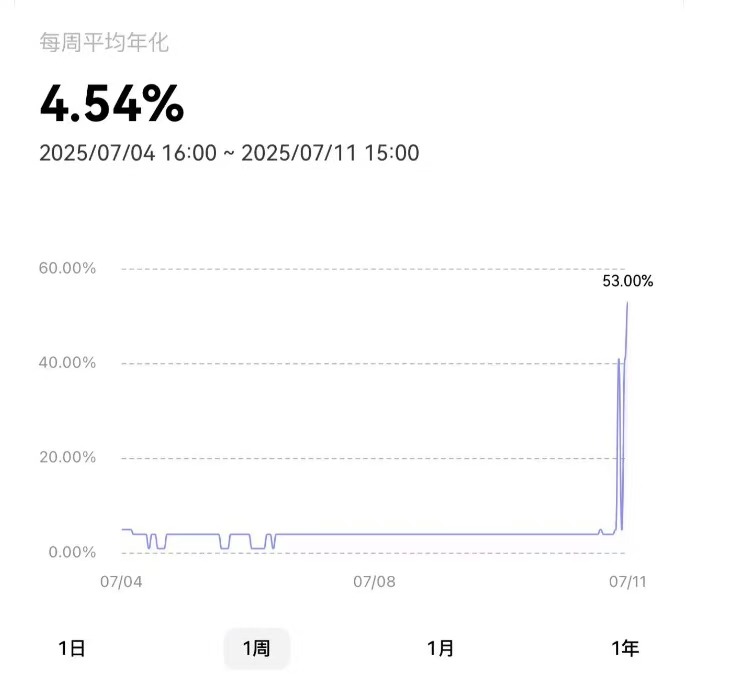

Rates of interest on OKX's USDT's “Easy Aren” versatile financial savings merchandise surged from 5% to 53% throughout noon Asian buying and selling hours on Friday as Bitcoin and Crypto Market first tasted volatility within the third quarter of 2025.

Market analysts say the spike is likely one of the short-term worth highs for merchandise that assist the crop in latest months. Traditionally, comparable jumps have coincided with the rise in Bitcoin costs.

OKX USDT Easy earns versatile charges. Supply: OKX

On November 10, 2024, Bitcoin opened at $76,677, leading to financial savings merchandise reaching 44% charges, whereas cash reached $90,000 in just some days. At present, Bitcoin buying and selling is $118,500, a rise of 6.5% within the day, making buyers appear unsure about profiting on the opportunity of persevering with market operations.

Bitcoin costs are quick sellers

Over the previous 24 hours, greater than $1.14 billion quick positions have been settled, based on Coinglass knowledge. The liquidation got here from the background, with Bitcoin rising above $118,000. The Crypto Worry & Greed Index is 67. In different phrases, the market is in an extreme state of buy.

When the most important coin of market capitalization reached $113,000 throughout buying and selling within the US market, Bitcoin rose to three,900 cash in trade.

Miners maintain cash except costs rise to a degree that justifies gross sales, primarily to cowl the prices of mining operations. They may additionally attempt to understand income by the tip of “US Crypto Week,” the place many anticipate worth changes to happen.

Cryptoquant's UTXO knowledge reveals that solely 15% of the market, which consists of holders who’ve bought Bitcoin previously month, has fallen from the earlier worth altitude of 30%. This decline signifies that the present uptrend is below the management of current homeowners relatively than contemporary capital inflows.

SOPR and trade actions present warning

Bitcoin makes use of the short-term holder's output revenue ratio (SOPR).

Knowledge from Santiment revealed that the steadiness fell 21% since June to 315,830 BTC. This pattern is deeper than ever over the previous 5 years. In the meantime, 1.88 million Bitcoins, or 61% of exchange-owned cash, have moved to impartial wallets.

Lengthy-term holders are used to putting property outdoors the trade to cut back the chance of large-scale divestitures.

When it comes to the derivatives market, Open Curiosity (OI) is as much as $4.1177 billion, up 5.67%. Greater OI means attracting extra liquidity and a focus within the futures market and dealing collectively to enhance volatility.

GlassNode: Extra Rising Market Actions

Late Thursday, GlassNode shared the X chart. This marked a $4.4 billion bounce within the Bitcoin realisation cap after the worth exceeded $113,000. It is a metric that tracks the worth of a coin based mostly on the final motion.

Not like market capitalization, the realised cap displays precise capital inflows. It solely will increase if the coin strikes at a better worth. The $4.4 billion bounce when $BTC beats a brand new ATH above $112K confirms not solely speculative markup, but in addition the true beliefs behind the transfer, not simply https://t.co/2ckvmgtmet pic.twitter.com/xtdarvgcdh.

– GlassNode (@GlassNode) July 10, 2025

In keeping with the market evaluation platform, CAP solely will increase when the coin adjustments arms at a better worth as a result of precise capital inflows relatively than speculative valuations.

The market worth to realised worth (MVRV) ratio of Bitcoin is a chart comparability of market capitalization and realised cap, which is 2.2. In earlier market tops in March and December 2024, the MVRV ratio exceeded 2.7. Wanting on the two numbers, Market Watchers imagine that the coin could not have reached its peak of execution but.

Market analyst Axel Adler Jr. defined that when the MVRV reaches 2.75, the inflection level of gross sales happens.