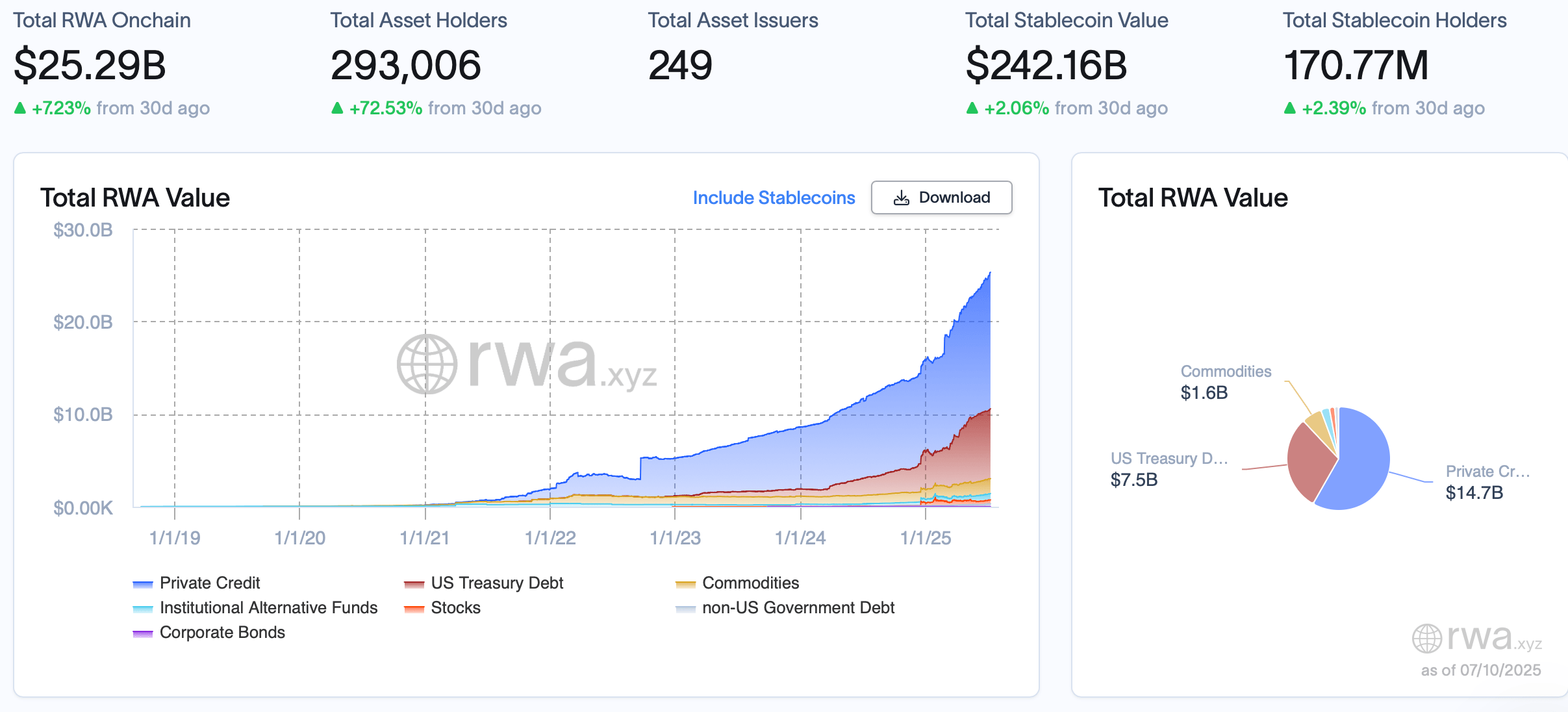

This week, the Actual World Belongings (RWA) sector crossed the $25 billion threshold, opening a recent milestone within the monetary chronicles. On prime of that, the full variety of asset homeowners has skyrocketed to 293,006, leaping over 72% in simply 30 days.

Tokenized property proceed to develop considerably

As of Thursday, July tenth, 2025, the worth of tokenized actual world property (RWAS) was over $25 billion. This has elevated by 7.23% since June tenth. At present, non-public credit score claims the highest spot for Onchain Worth.

The $14.7 billion {dollars} are parked in blockchain-verified non-public credit score choices from firms akin to Figures, Tradeables, and Maple. In response to knowledge compiled by RWA.xyz, the main figures within the pack boast $13.6 billion on cumulative on-chain loans.

Supply: rwa.xyz

The US Treasury debt or tokenized Treasury funds maintain the second spot, totaling $7.533 billion, 1.96% over the previous week. BlackRock's Buidl leads the pack with a $2.82 billion on-chain. Franklin Templeton's Benji continues at $790.44 million as of July 10, whereas Superstate's USTB is $711 million. Simply behind the treasure trove, the tokenized merchandise landed third, with a market capitalization of $1.6 billion.

Most of it comes from two heavyweight gold-backed tokens, Paxg by Paxos and Tether's Xaut. Additional down the chain are sectors with smaller on-chain footprints, akin to institutional different funds, equities, non-US debt, and company debt.

The RWA market has proven no indicators of slowing because it has practically 5 occasions within the final three years. Wanting ahead to it, I agree with one factor, though predictions from the most effective monetary establishments and consulting giants differ in scale. This market is heading in direction of trillions.

McKinsey estimates to $2 trillion, whereas Boston Consulting Group (BCG) expects to make a leap to $16 trillion by 2030.