Ethereum is presently buying and selling round $2,989 after a extremely rising earlier this week, briefly tapping on the $3,082 mark. Worth motion exhibits indicators of integration just under the psychological $3,000 degree, however technical and chain information recommend that bulls are nonetheless in management for now. The broader meeting is supported by an elevated accumulation of businesses, together with BIT Digital's $67.3 million ETH Treasury growth.

Ethereum Worth Prediction Desk: July 16, 2025

What would be the worth of Ethereum?

ETH Worth Dynamics (Supply: TradingView)

Within the every day time-frame, Ethereum costs surpass the long-standing trendline stretched from the April swing, practically $1,900. A breakout above the $2,800 resistance zone has reversed the world into key structural help.

ETH Worth Dynamics (Supply: TradingView)

The candles are slightly below $3,000, with the following rapid resistance being practically $3,120, with a weekly 0.618 Fibonacci zone at $3,256.

ETH Worth Dynamics (Supply: TradingView)

The parabolic SAR is under the worth, exhibiting continued bullish pattern pressures whereas it’s now far above the $2,202-$2,459 Bull Market Assist Bluff Bluff Market Assist Band. The BBP oscillator stays constructive even within the every day time-frame, informing purchaser management.

Why are Ethereum costs rising at the moment?

At this time's surge in Ethereum costs is partly pushed by new institutional advantages. BIT Digital has introduced $67.3 million in direct inventory to increase the ETH Treasury Division. The corporate presently owns over 100,600 ETH, price roughly $303 million. This aggressive accumulation coincides with a wider improve in Crypto Markets, with Ethereum profitable 18% over the previous week.

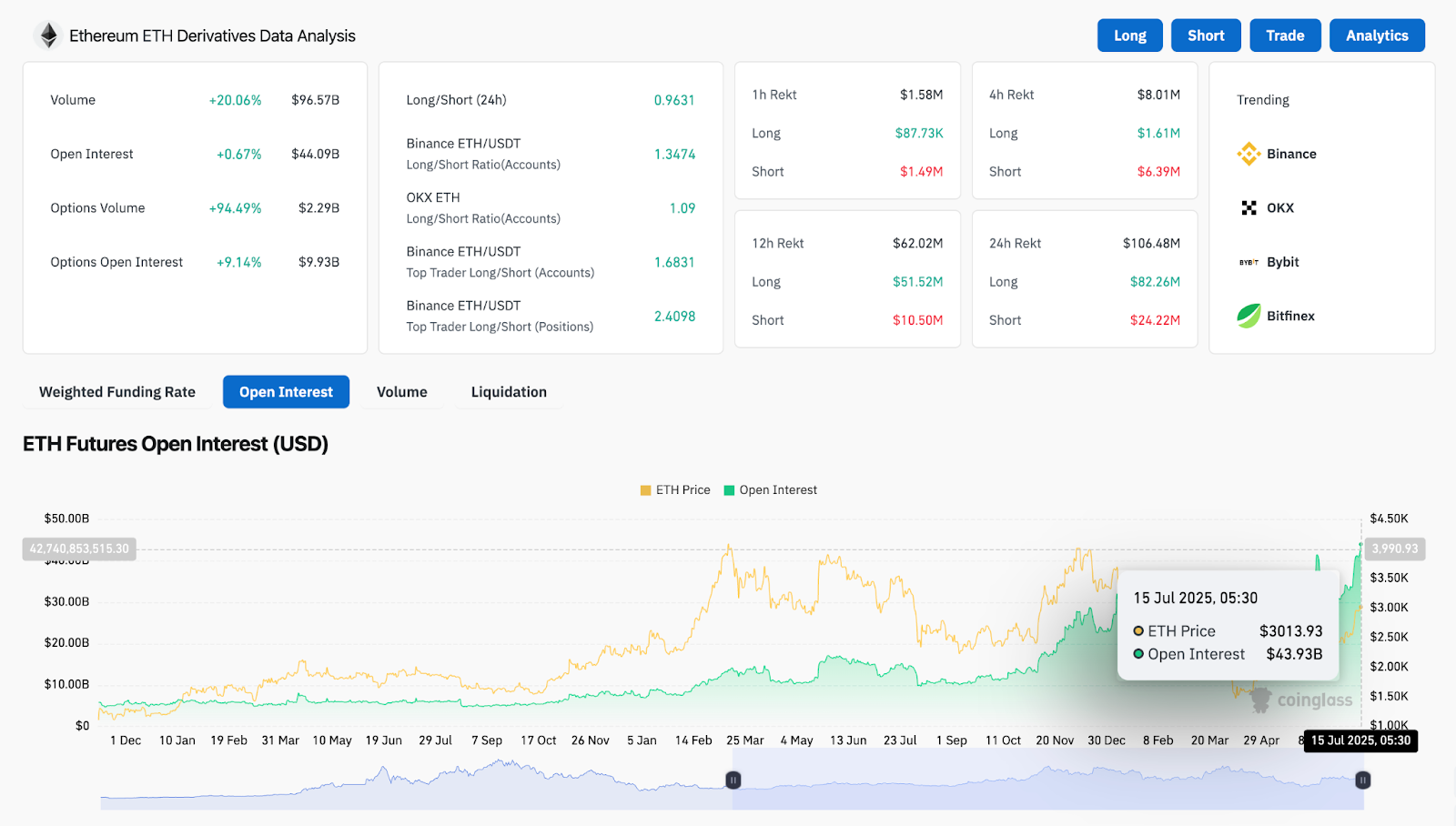

ETH by-product evaluation (supply: Coinglass)

Coinglass' on-chain by-product information confirms this bullish momentum. Choices quantity rose 94.5% to $22.9 billion, whereas choices rose to $440.9 billion. High merchants' Binance ETH/USDT lengthy/quick ratio is above 2.4, reflecting the dominant lengthy positioning. Moreover, the 24-hour whole liquidation reached $106.4 million, wiping out $82 million in shorts, strengthening bullish management.

Bollinger Band and MACD suggest short-term volatility

The four-hour chart exhibits the Ethereum Worth Motion that the property has been pulled again simply $3,082 from its current native excessive. The Bollinger Band is starting to increase following a squeeze breakout of practically $2,750, indicating recent volatility is coming into the market. Costs are presently rising close to the midzone and should check help of $2,933 earlier than surpassing one other transfer.

ETH Worth Dynamics (Supply: TradingView)

The 30-minute RSI bounced off the territory bought and is presently sitting at 50.1. 38 in the identical time-frame. It displays a impartial stance after recovering from MACD. A confirmed crossover and transfer above the $3,050 resistance is required to trigger the following leg to $3,256.

Ethereum worth forecast: Quick-term outlook (24 hours)

ETH Worth Dynamics (Supply: TradingView)

The short-term construction means that the help zone between $2,933 and $2,960 could also be retested earlier than Ethereum costs try one other breakout to $3,100. Strikes over $3,050 with quantity checks open a path in the direction of the $3,256 0.618 FIB degree. On the again, if the Bulls lose their $2,930 deal with, Ethereum might return to $2,800. Right here, the earlier breakout zone and the uptrend line intersect.

Given the help from each derivatives and on-chain metrics, the momentum of the rise stays intact. Nonetheless, merchants ought to intently monitor $3,050 as a pivotal breakout threshold.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version is just not chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.