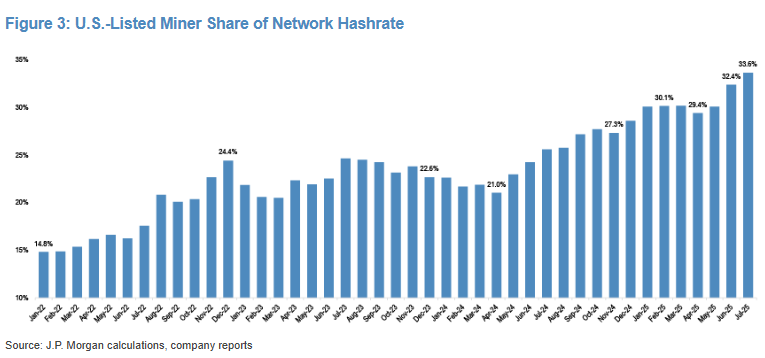

The share of Bitcoin's whole community hashrate, attributable to miners publicly listed by US miners, has skyrocketed to just about 34%, in response to current knowledge shared by analysts at Banking Large Jpmorgan.

Specifically, their hashrate benefit has greater than doubled since January 2022 (when it reached about 15%).

Nevertheless, this development was moderately uneven. The worldwide hashrate share continued to fluctuate between 20% and 23%.

They finally reached a 30% milestone by November, and this development continues steadily all through 2025.

“Entry to US capital markets is a significant differentiator for miners,” mentioned Matthew Sigel, head of digital property at Vaneck, commenting on the most recent milestones.

Final month, JPMorgan analysts revealed that publicly listed miners had received one of many highest quarters ever, incomes gross income price round $2 billion.

Mara Holdings (previously Marathon Digital) stays the main US Bitcoin miner. In final month alone, the corporate produced 950 BTC. Its whole holdings at the moment are approaching above the 50,000 BTC milestone.

US share of world hashrate

In response to Hashrate indexthe US presently accounts for a complete of 36% of the worldwide hashrate. The estimate relies on mining pool knowledge and ASIC buying and selling circulation.

China, as soon as loved absolute management within the Bitcoin mining sector at almost 75% of the world's hashrate for affordable coal and hydroelectric energy, misplaced its lead after the federal government launched a full-scale mining ban in 2021.

Regardless of the ban, China nonetheless accounts for 17% of the world's hashrate, making it third place.