Ethereum costs rose above the $3,000 threshold after a crucial breakout previous a number of resistance zones. As of July 14th, at the moment's Ethereum Value holds practically $3,046, a 2.5% enhance within the final 24 hours. The rally is supported by each a structural bullish shift and an accelerated demand within the derivatives market.

What would be the worth of Ethereum?

ETH Value Dynamics (Supply: TradingView)

Every day charts present that Ethereum costs from a multi-month accumulation vary of $2,400 to $2,800 collapse, inflicting a clear bullish structural shift. ETH Value has now regained its $2,970-$3,000 provide block, which thwarted progress between June and early July. The present construction reveals that ETH kinds the next and better low, and is presently buying and selling past Could.

Ethereum costs additionally cleared the foremost descending pattern line, which was prolonged from November 2024, displaying a reversal in a broader pattern route. Breakouts are supported by seen quantity energy and a robust base fashioned close to the demand block between $2,680 and $2,700.

The 4-hour Bollinger Band checks for up to date volatility cycles. Value is pushed up above the higher band, holding help from the 20/50 EMA cluster between $2,945 and $2,814. So long as ETH stays above the midband ($2,972), this pattern stays bullish.

Why are Ethereum costs rising at the moment?

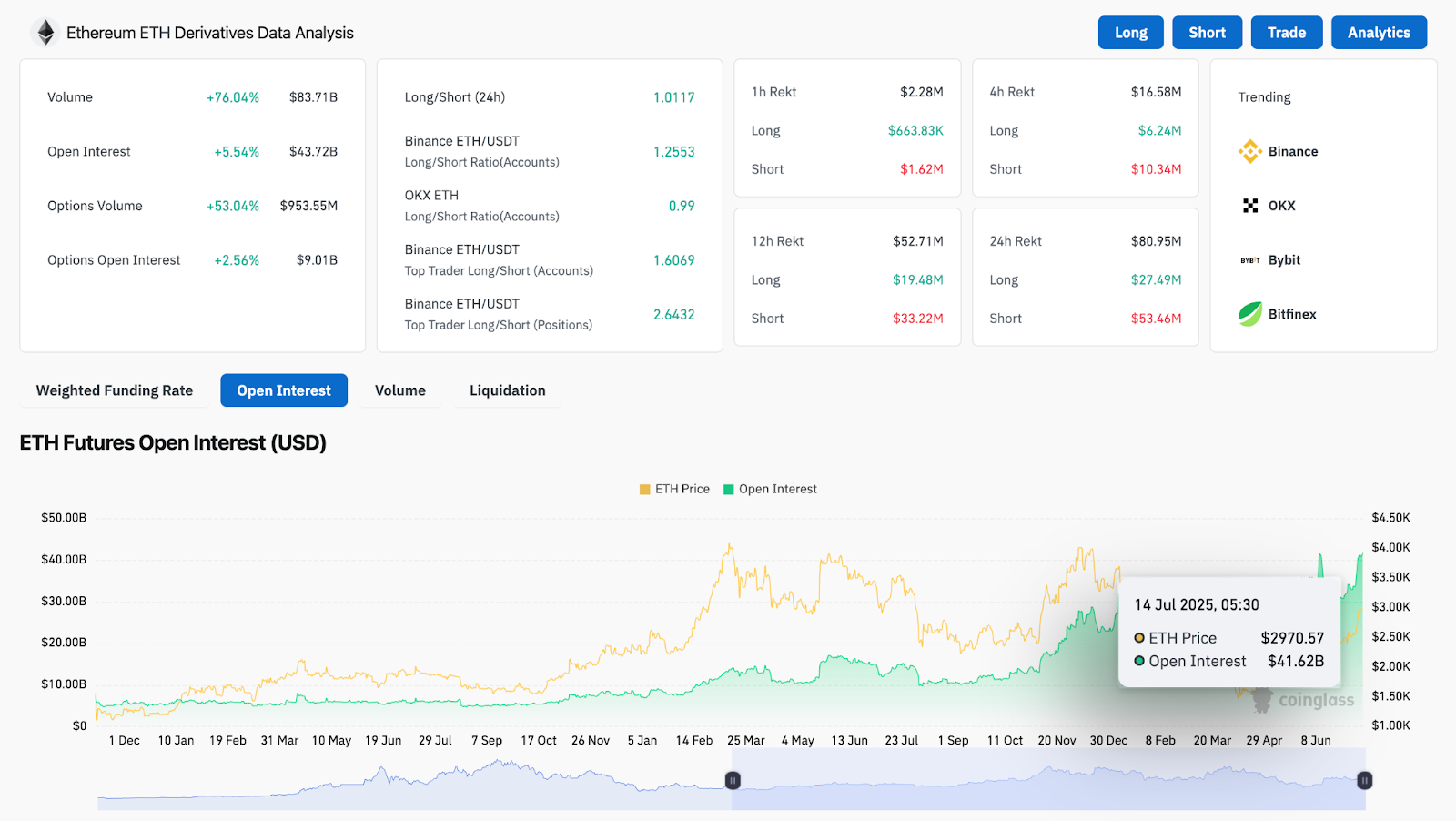

ETH by-product evaluation (supply: Coinglass)

Current rise in Ethereum costs has been pushed by sturdy derivatives actions and technical breakout indicators. Open curiosity in ETH futures has elevated by 5.54% previously 24 hours to $43.72 billion, in accordance with Coinglass information. Whole quantity elevated by 76%, and the quantity of choices exceeded 53%. Binance's lengthy ratio is 1.61 amongst high merchants, with the highest place ratio rising to 2.64, reflecting a large lengthy bias.

ETH Value Dynamics (Supply: TradingView)

From a worth motion perspective, the 30-minute chart reveals a bullish continuation after a shallow pullback to $3,030. The RSI bounces again to 65.1, leaving the impartial area. MACD additionally prints a constructive crossover when magnifying the histogram bar, indicating contemporary buy momentum.

ETH Value Dynamics (Supply: TradingView)

On the Sensible Cash Ideas (SMC) chart, ETH broke keychock ranges and performed Bos zones above $2,900. The present $3,000 push is within the low-liquid zone as much as $3,260. This might help speedy worth acceleration.

Value indicator indicators acceleration in direction of 0.618 FIB stage

ETH Value Dynamics (Supply: TradingView)

The weekly Fibonacci retrace from the highest of $4,106 to a low worth of $1,385 reveals that Ethereum costs are presently testing a major 0.618 retracement stage at $3,061. Being near the week above this mark signifies a wider pattern reversal, focusing on the subsequent upside zone of $3,524 (FIB 0.786).

ETH Value Dynamics (Supply: TradingView)

Every day RSI stays in bullish territory with out displaying excessive over-acquisition situations, and BBP (Blue Bear Energy) on the weekly chart continues to rise, indicating the energy of wholesome underlying traits.

This construction can also be in step with the long-term upward pattern line, extending from the 2022 cycle low. ETH Costs have recouped this trendline and reversed it into dynamic help, additional acknowledging the present upside breakout as a possible pattern reopening.

ETH Value Forecast: Brief-term Outlook (24 hours)

Ethereum costs could take a look at $3,061 resistance (FIB 0.618) over the subsequent 24 hours. Clear closures above this stage may ignite a run heading in direction of $3,260 and $3,524, particularly if volumes remained rising and funding charges are neutrally constructive.

ETH Value Dynamics (Supply: TradingView)

Within the quick time period, if costs fall beneath $3,000 once more, preliminary help will observe $2,972 (Bollinger Midband), adopted by $2,945 (EMA20 4H) and $2,814 (EMA50 4H). A breakdown beneath $2,814 dangers negating bullish bias, resulting in a pullback to $2,700.

Nevertheless, given the present RSI-MACD alignment, elevated open curiosity and bull market construction, Ethereum is poised to proceed to proceed above $3,061, with short-term volatility more likely to proceed rising.

Ethereum worth forecast desk: July 15, 2025

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.