Ethereum prolonged its upward momentum this week, gaining greater than 20% within the final seven days, pushing it above $3,600 for the primary time in months. On the time of writing, ETH traded at $3,617, displaying a 5.4% enhance throughout the final 24 hours.

The rally has attracted consideration from analysts analyzing whether or not value actions are pushed by sustainable investor demand or short-term speculative exercise.

Ethereum Futures Market is main, however spot demand is lagging

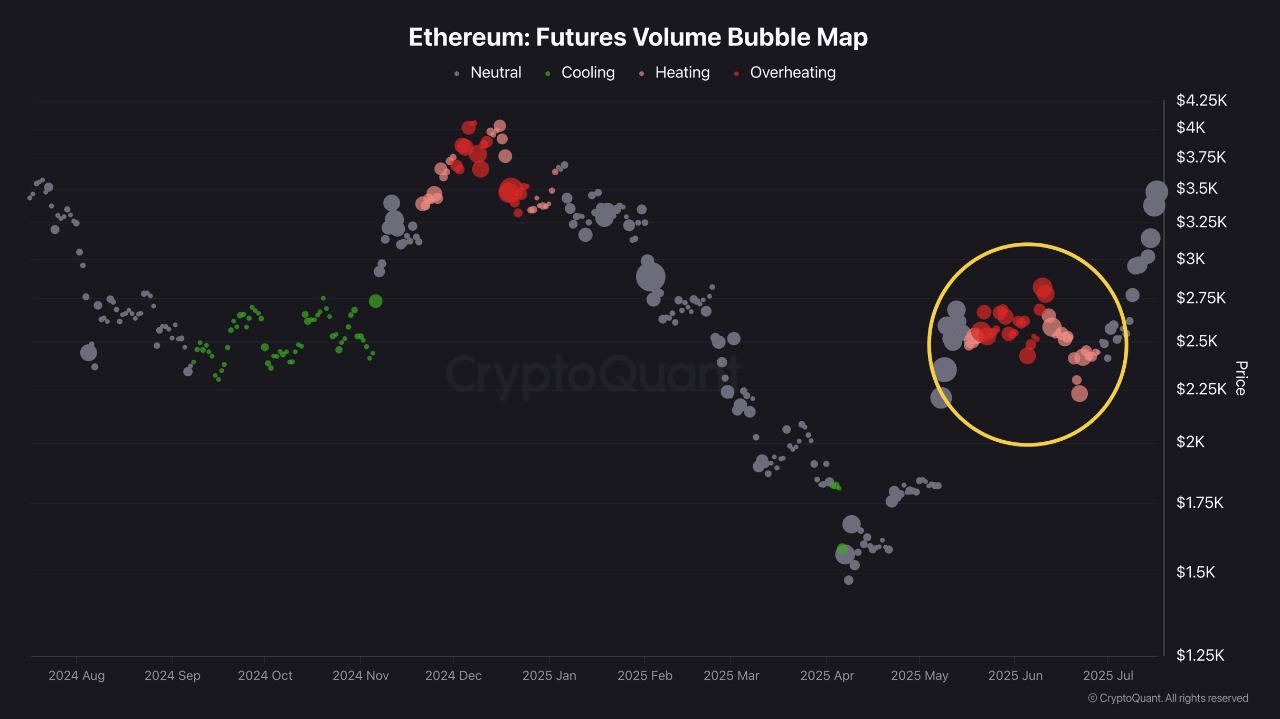

Knowledge from on-chain analytics agency Cryptoquant means that the latest uptrend in Ethereum costs is pushed primarily by the derivatives market. Contributor Avocado Onchain stated that ETH continues to maneuver increased, however the underlying supply of momentum seems to be a future place with extra leverage, slightly than shopping for within the spot market.

This distinction raises questions in regards to the sturdiness of present gatherings and whether or not follow-through demand will emerge from spot patrons. Avocado additional highlighted in his fast take evaluation entitled “Ethereum's Rally is driving the futures market – Will the demand for spots proceed?” The Ethereum Futures Quantity Bubble Map reveals overheating situations in a specific zone indicated by a quantity surge.

This enhance in futures, marked with a yellow circle on the map, is in line with the value rise of ETH, that means that leveraged positions are the primary reason behind the rise.

In distinction, spot market information reveals relative stability, with no comparable quantity spikes. This means that conventional investor strain purchases haven’t but been maintaining.

Analysts additionally identified that Ethereum's open curiosity in futures (OI) has reached a brand new historical past excessive, reinforcing the concept the present motion is inherently speculative.

In line with Avocado, the long run query is whether or not momentum from the derivatives market will in the end match demand for actual spot markets. If such demand is realized, it may contribute to the broader Altcoin market exercise, he added.

Institutional advantages and ETF inflows

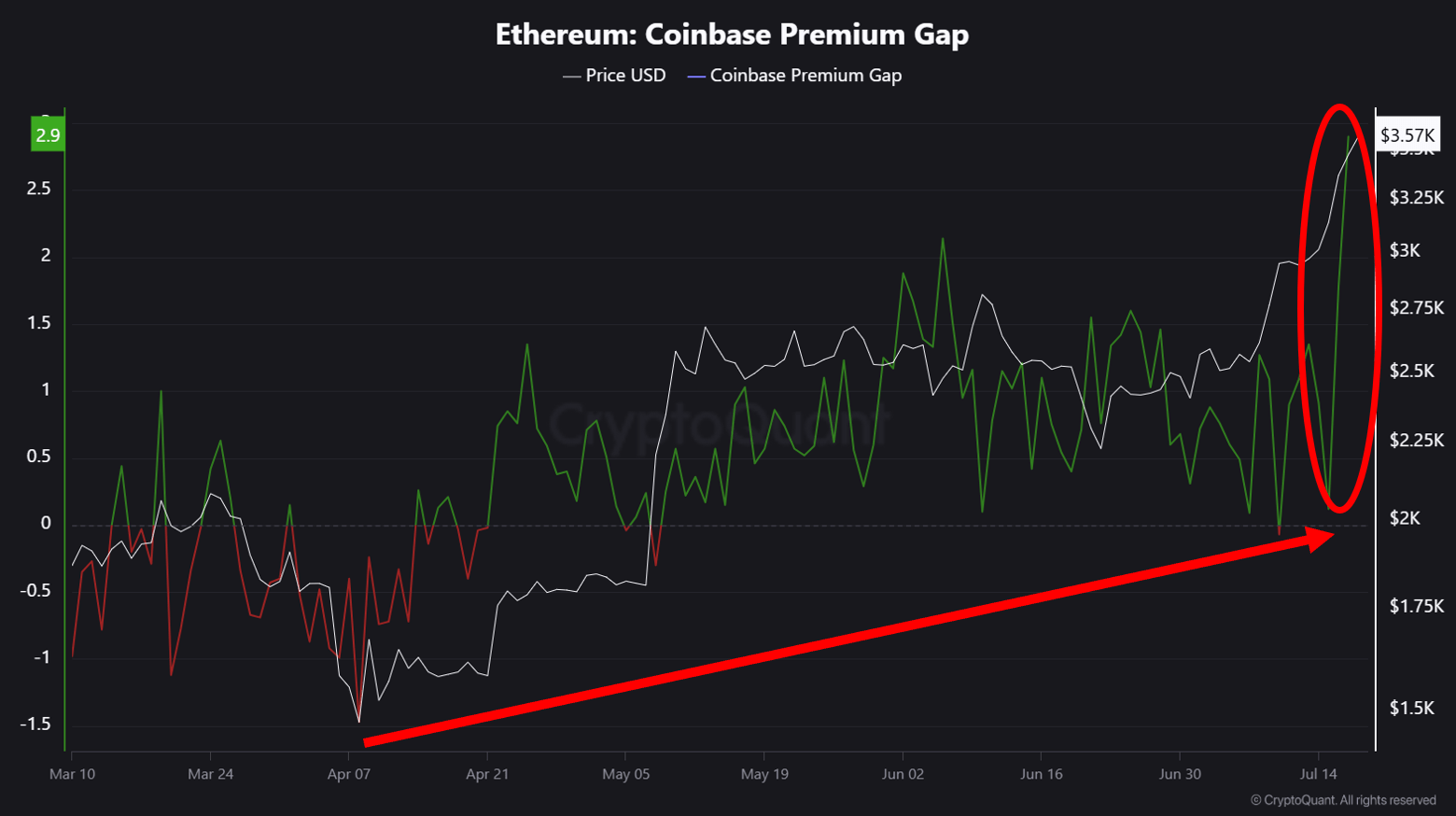

In one other perception, one other cryptographic analyst, Crypto Dan, famous a rise indication of institutional participation in Ethereum accumulation. His evaluation reveals that ETH is buying and selling on the premium of Coinbase, a platform continuously utilized by US-based establishments and huge traders, indicating a rise in purchasing from whales.

The premium, which has been described as uncommon lately, is in step with a wider development in capital inflows into Ethereum-centric spot ETFs, which have just lately reached document every day highs.

Dan stated present indicators don’t present overheating, however traders ought to acknowledge potential dangers if sturdy upward exercise happens within the second half of 2025.

For now, nonetheless, the mixture of elevated institutional demand and elevated ETF allocations may present structural assist for Ethereum, particularly when the spot market begins to strengthen futures momentum.

Particular pictures created with Dall-E, TradingView chart