Tether CEO Paolo Ardoino says the corporate may improve its USDT provide by 10 instances, probably exceeding $1 trillion.

His feedback comply with the passage of the Genius Act, a drastic stubcoin invoice signed into legislation by President Donald Trump on July 18th.

Tether Eyes $1.6 trillion after approval of the US Provide Genius Act

This legislation is the primary federal framework for ridiculous laws in the USA. The Federal Reserve permits the stablecoin writer of greenback help to be licensed and supervised.

It additionally requires full reserve backing, common audits, and cash laundering anti-money laundering (AML) compliance for all entities that present these tokens within the US.

In a press release, Ardoino stated that the readability of the regulators may unleash a brand new stage of adoption of USDT, the world's largest Stablecoin.

“Now that President Trump has embraced the US digital property, we consider we will improve it by 10 instances and solidify international domination of the greenback,” he stated.

Tether at present reviews that it distributes over $160 billion in USDT to greater than 500 million customers worldwide. A ten-fold improve will convey provide to $1.6 trillion. It is a milestone that additional cements the position of tokens within the international crypto market.

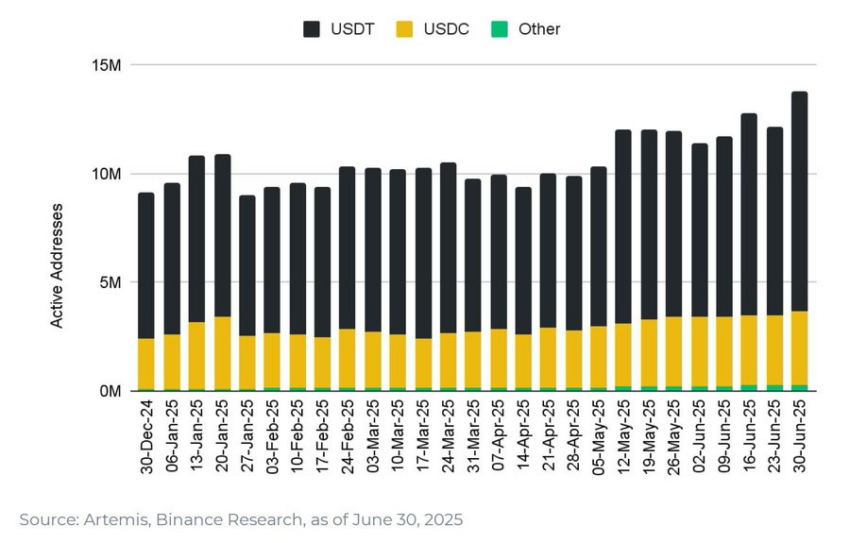

Ardoino's aim is not any shock provided that USDT is the dominant stubcoin available in the market. Digital property at present account for 73% of world Stablecoin transaction quantity, in line with out there market knowledge.

Domination of Tether Stablecoin. Supply: x/elfolded

In the meantime, regardless of optimism, genius behaviour raises a tether regulatory compliance bar considerably.

Underneath the brand new legislation, tethers working in El Salvador should meet standards for licensing, AML procedures and reservation disclosure. These necessities are important to make sure that the corporate maintains entry to the US market.

Thus far, Tether has revealed quarterly proofs of its preparation. Nevertheless, it nonetheless doesn’t provide complete and impartial audits. That is an omission that has lengthy been criticised by regulators and analysts.

Already, the corporate has dedicated to following the brand new guidelines and has reiterated its dedication to bear a full audit of its reserves.

Nevertheless, it is vital that the corporate's means to offer these guarantees – particularly with regard to backup disclosures.

It’s going to decide whether or not Tether can preserve management in an more and more regulated market that’s gaining curiosity from conventional monetary giants like Mastercard.