As capital continues to circulate strongly, the quantity of ETH that was excluded to maintain its costs down in 2025 can also be unexpectedly surged, as capital continues to circulate strongly.

What does this imply for Ethereum worth tendencies? Listed here are some skilled insights.

I'm ready for greater than 350,000 ETH to be unorganized. What does it imply?

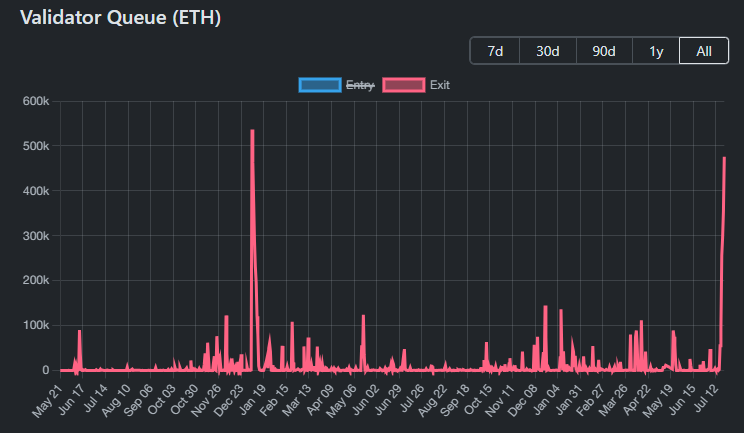

Udi Wertheimer, a widely known investor within the Crypto neighborhood, raised considerations after discovering that over 350,000 ETH (roughly $1.3 billion) are at present ready in queues that aren’t on stage.

Ethereum Validator queue. Supply: validatorqueue

“There are 350,000 ETHs being carried out in a unstable style, about $1.3 billion. Lastly, lots of these ETHs had been built-in in January 2024 after a 25% rallies at ETH/BTC in every week.

Unstaking permits customers to withdraw ETH from staking sensible contracts and return them to freely obtainable belongings.

A giant wave with out staking can point out potential gross sales stress. That is very true if buyers are attempting to generate profits after 160% of ETH's rally because the April low.

In early 2024, greater than 500,000 ETH was unraveled and later returned to $2,100 earlier than ETH surged from $2,100 to greater than $4,000.

The place will this detached ETH go?

Coinbase's OG protocol specialist Viktor Bunin instructed that the ETH might transfer to the Inner Treasury Ministry. These funds might be helpful for monetary methods comparable to long-term investments and portfolio diversification.

If that’s the case, this isn’t an indication of panic gross sales. What's extra doubtless is the type of asset administration. This really helps to stabilize the market in the long run.

In the meantime, a LookonChain report exhibits that knowledge on the chain exhibits that round 23 whales or establishments have collected 681,103 ETH (valued by $2.57 billion) since July 1st.

And the buildup has not stopped. Within the fourth week of July, extra establishments continued so as to add billions of {dollars} price of ETH.

“The brand new ETH Treasury Division (ether machine) introduced a $1.5 billion ETH this morning, which was nonetheless the most important. However final week, Tom Lee of Fundstrat Capital stated he was planning to purchase a $20 billion ETH, Sean Adams stated.

How about ETH being staked?

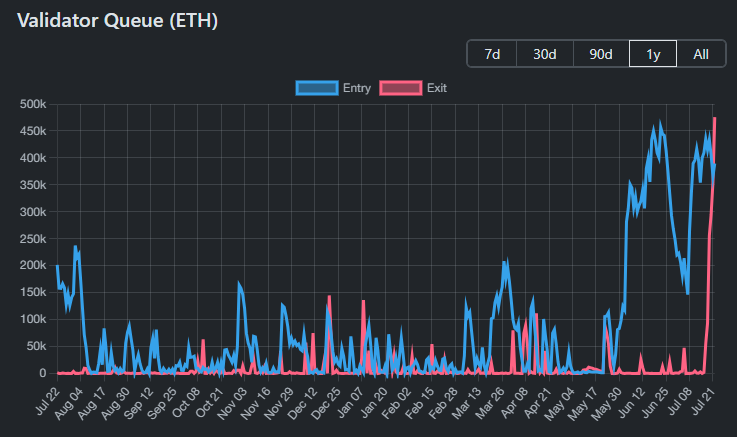

Udi Wertheimer's considerations could sound shocking, particularly when in comparison with historic patterns. However it lacks an vital perspective: the quantity of ETH at present ready to stake.

Ethereum Validator queue. Supply: validatorqueue

BalidatorQueue knowledge exhibits that ETH queued for staking is definitely way over the quantity queued for staking. The queue has been surged since June, ready for greater than 450,000 ETH to be wagered on a given day.

This displays the continued curiosity of buyers in collaborating within the Ethereum community by staking.

“And at this level, we’ve a wholesome quantity of es to eat,” Wertheimer added.

Knowledge from BeaConcha.in exhibits that over 35.7 million ETH are at present coated throughout a wide range of protocols. This accounts for 29.5% of the circulation provide.

Finally, the steadiness of ETH, which breaks in and leaves the staking protocols, is a key issue. It helps you identify whether or not the market is going through actual gross sales pressures or just witnessing strategic reallocation by establishments and particular person buyers.