Bitcoin has entered a side-to-side correction section, with buyers making earnings and turning capital into the Altcoin market. As soon as BTC cools down, potential Altcoin Rally might be staged within the coming days.

Technical Evaluation

Shayan Market

Each day Charts

After going through robust resistance on the $123,000 stage, Bitcoin has entered a correction section, which is prone to be pushed by earnings and distribution amongst buyers. Traditionally, when BTC cools on the highest value ever, capital usually spins into Altcoins, inflicting rallying throughout the broader market.

A pullback to the important thing 0.5-0.618 Fibonacci retracement zone at present between $107,000 and $111,000 can seem earlier than the following main bullish impulse. Till then, a interval of integration is anticipated and will doubtlessly contain a big depth of Altcoins.

4-hour chart

Within the decrease time-frame, Bitcoin integration normally types a downward wedge sample, a construction that signifies bullish continuity. Costs are at present approaching a important assist zone between $113,000 and $1.16 million, in keeping with retracement ranges of 0.5-0.618 Fibonacci.

If this zone efficiently holds a breakout on prime of the wedge and triggers it should help you return to $123,000 resistance. Nonetheless, if assist fails, deeper fixes for the $111K stage could also be deployed.

On-Chain Evaluation

Shayan Market

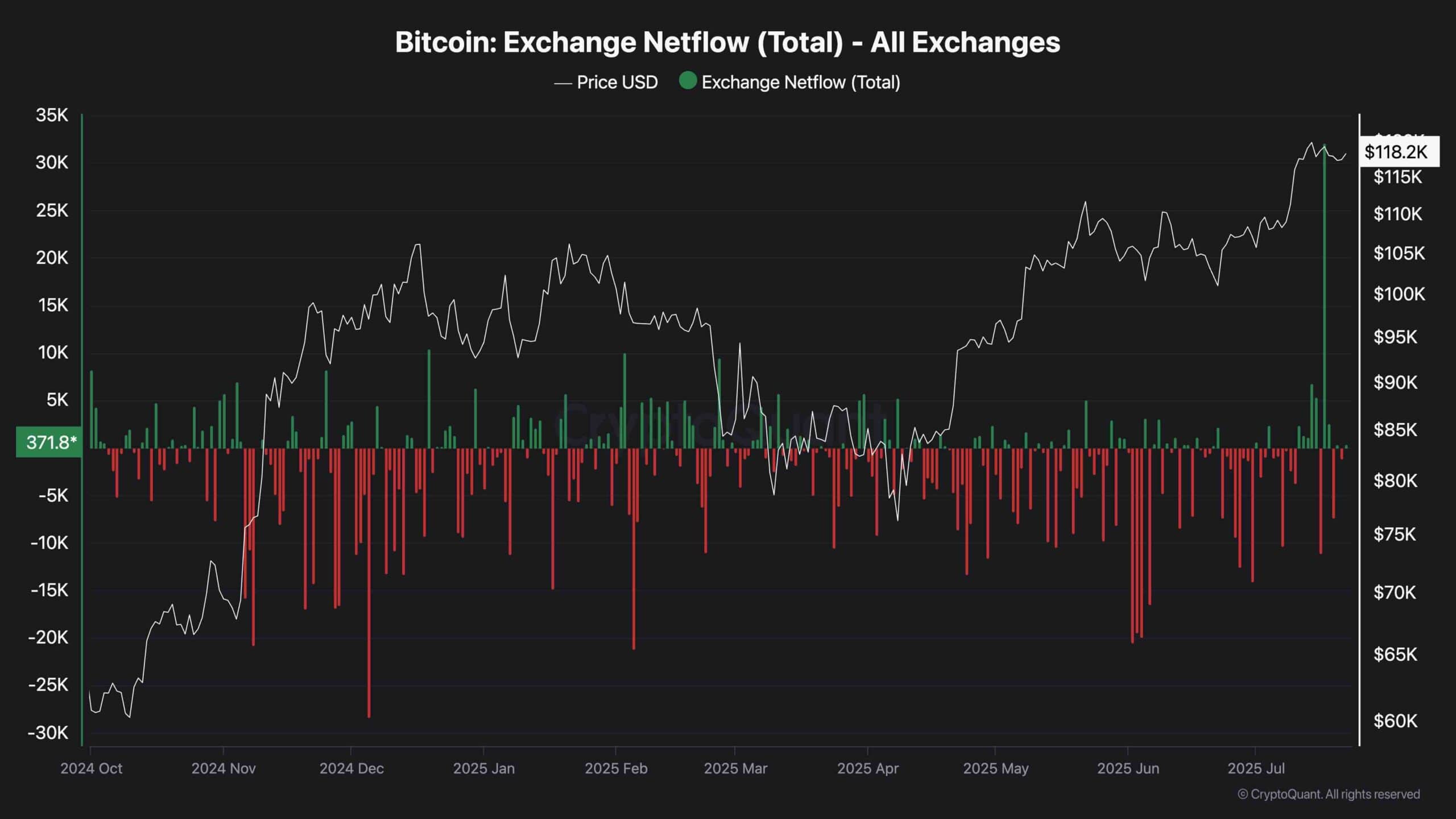

Bitcoin has seen its largest internet influx on exchanges since July 2024, indicating a big change in dynamics on the chain. Such inflows counsel a rise in distribution and earnings as extra BTC can be accessible for buying and selling.

Traditionally, related trade influx spikes usually precede deeper corrections. This week's knowledge means that key gamers, doubtlessly funds or establishments, are offloading BTC nearest all-time, managing threat exposures.

Nonetheless, this capital rotation might drive demand into various property and drive Altcoin Rally. An increase in trade provide might doubtlessly improve market volatility, particularly throughout a surge in demand. Merchants ought to take note of this indicator as they’ll foreshadow the following main transfer.