The current Ethereum (ETH) rally has been reworked right into a rush of Lido Dao's withdrawal and a wrapped Steth worth slide. The protocol has seen peak ranges of unprocessed withdrawals, with WSTETH falling from its current highs.

The current Ethereum (ETH) rally has been advantageous for some Defi protocols. Within the case of Lido Dao, Eth Rally triggered a drive to drag the token out of liquid staking. After ETH exceeded $3,800 for the primary time in months, a surge in withdrawals has arrived. The ETH then sank to $3,692.72.

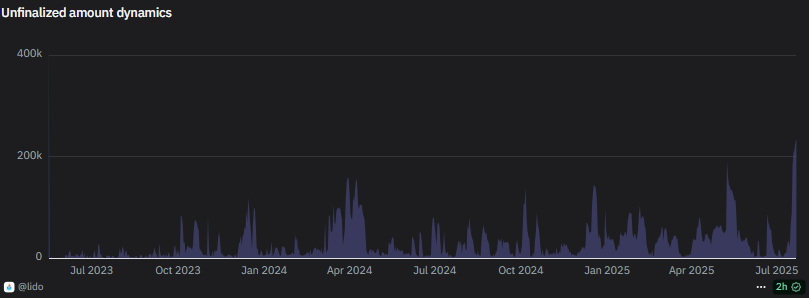

A complete of 228,992 ETHs are ready for a median 71 hour wait time, unorganized. Each ETH whales and retail batches have been attempting to depart Lido at their highest speeds for the previous two years. One cause is that the existence of ETH locked at a lower cost, looking for to unencumber belongings and understand earnings.

Lido Dao noticed peak staking requests with the very best uncooked cues of the previous two years. |Supply: Dune Analytics

Not too long ago, the worth locked in Lido has been expanded above $3.4 billionbased mostly on a conceptual ETH analysis. This protocol gives 2.8% in passive earnings per yr, along with issuing a Steth and a wrapped Stest Token for added defi exercise.

Steth slides wrapped from current peaks

As a use case for normal ETH shifts, the wrapped Steth has slipped from its current peak. The token has been habitually traded at ETH premiums and lately peaked above $4,600.

On previous days, WSTETH maintained its downward pattern, decreasing its 2.4% by $4,446.47. Current slides have additionally occurred in file volumes.

Wsteth is primarily exchanged for Steth and common ETH utilizing UnisWap distributed pairs. By way of Dex, the tokens attain a every day quantity of over $148 million, increasing exercise to a three-month peak.

WSTETH Premium implies that merchants can win extra ETH for thanks. Alternatively, you possibly can swap by a sensible contract and unlock it by a sensible contract. WSTETH is configured 1.28% Locked ETH reserves, and Exodus, could not hurt giant ecosystems. Nevertheless, this pattern could point out a change in frequent Ethereum use instances.

Lido's domination of ETH staking slides is decrease

Over the previous two years, Lido's ridiculous dominance has fallen from over 75% of the stake to round 62.8%.

The largest problem was as a consequence of Binance Staking, which has grown its share from underneath 3% to over 20% since 2023.

On the similar time, lido is bound that its Steth may very well be used establishment Each the passive earnings of ETFs and get ETH Treasury to work.

Lido has slowed over the previous yr, however the protocol nonetheless produces sturdy Income For every consumer, it stays a part of the essential Defi infrastructure. Not too long ago, Lido added Bitgo As the primary US-based custodian to supply staking infrastructure.

Comparable staking occasions have occurred earlier than, however the protocol has maintained its influence because it continues to construct a roadmap. Within the coming months, the Lido V3 is taken into account a possible staking mechanism for institutional inflows into ETH. Total, 30% of ETH stay locked in beacon chain contracts, and staking stays uncommon even in older whales.